Are you facing the impending deadline for the Cook County Property Tax Second Installment payment? Don’t let it slip your mind!

Property taxes in Cook County can be a burden, squeezing your finances and leaving you wondering if you’ll have enough to cover the upcoming due date. But fear not, understanding the details can empower you to navigate this obligation efficiently.

What is Cook County Property Taxes: Second Installment Due?

Cook County property taxes are imposed by local governments to fund essential services like education, infrastructure, and public assistance. The second installment of these taxes must be paid by the end of August to avoid penalties and potential legal consequences.

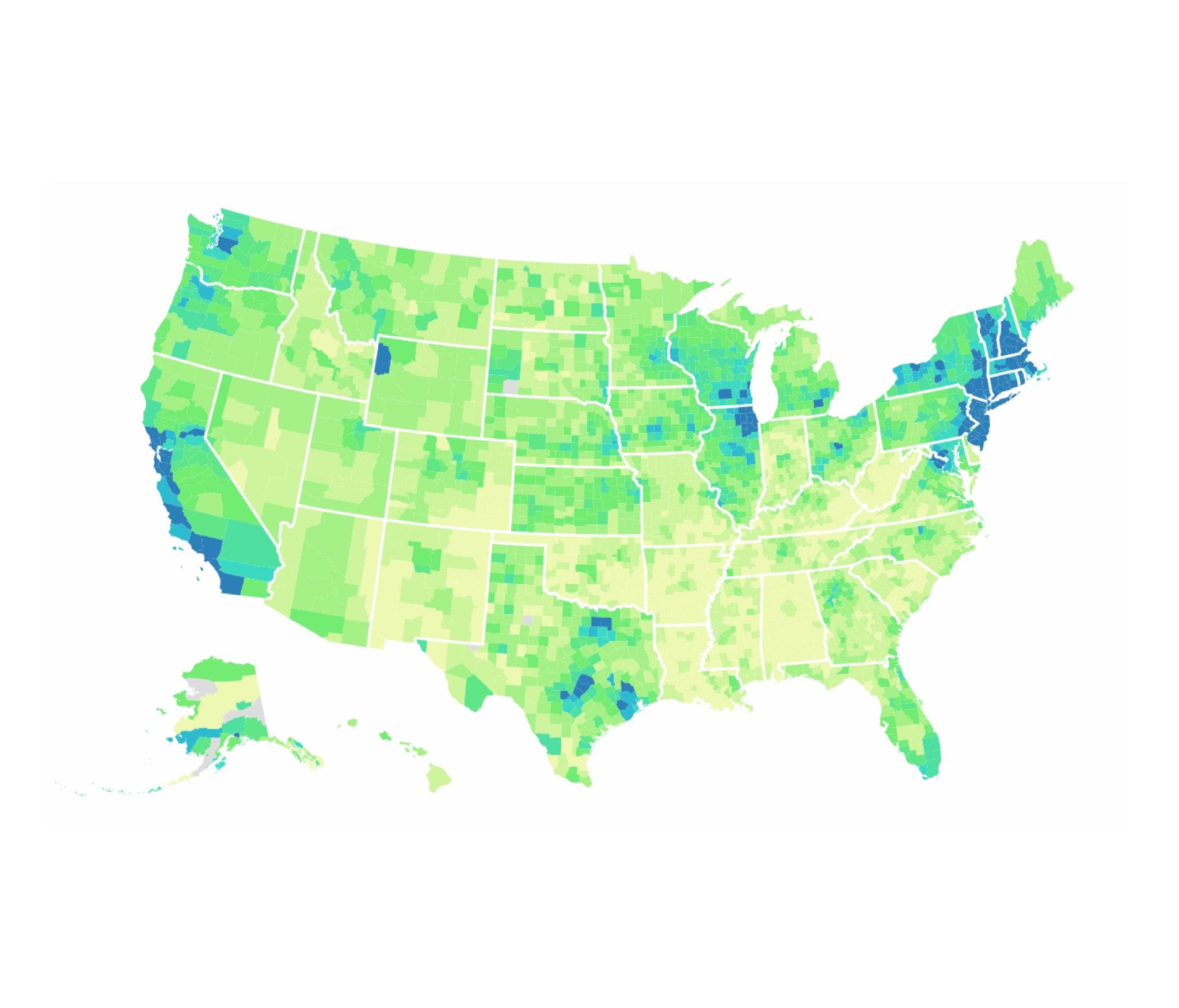

Map of Cook County Illinois | Curtis Wright Maps – Source curtiswrightmaps.com

Target Audience

All Cook County property owners are responsible for paying these taxes, regardless of their residency status or primary residence location. Whether you’re a homeowner, landlord, or business owner, you need to be aware of this impending deadline.

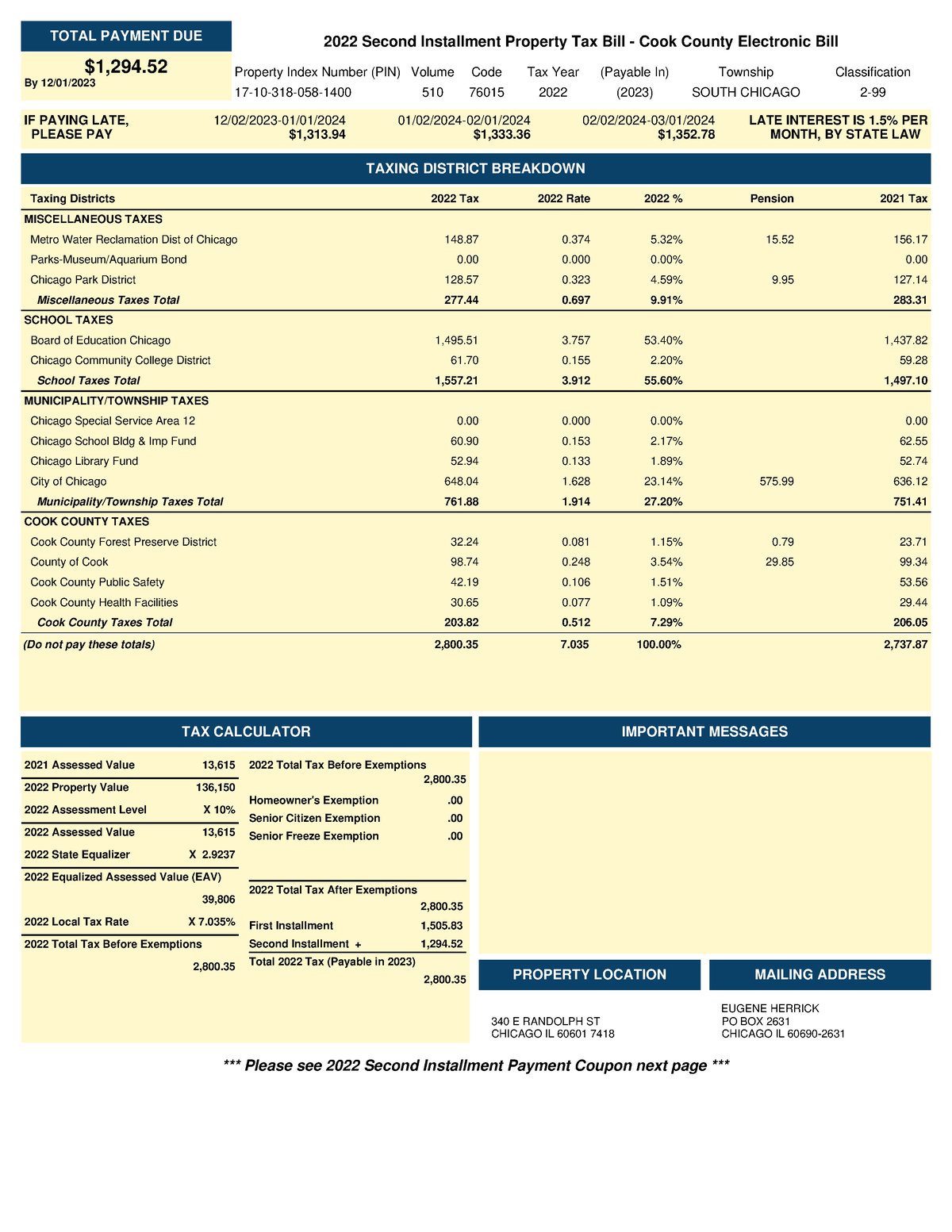

Cook County Property Tax Bill 2022Second Installment – IF PAYING LATE – Source www.studocu.com

Consequences of Late Payments

Missing the second installment deadline can result in late payment fees and interest charges. These additional costs can add up quickly, straining your budget even further. Furthermore, prolonged non-payment could lead to a tax sale of your property, a situation you want to avoid at all costs.

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F24012869%2Fmerlin_107822168.jpg)

Cook County must fix the problem of unpaid leasehold taxes – Chicago – Source chicago.suntimes.com

Strategies for Managing Payments

To prevent the consequences of late payment, consider implementing a financial plan that prioritizes property tax payments. You can set up automatic payments or pay in advance to ensure timely delivery. Additionally, explore available programs that offer property tax relief or assistance for low-income homeowners.

When Is 2nd Installment For Cook County 2024 – Faina Jasmina – Source eadaqloraine.pages.dev

Cook County Property Taxes: A Closer Look

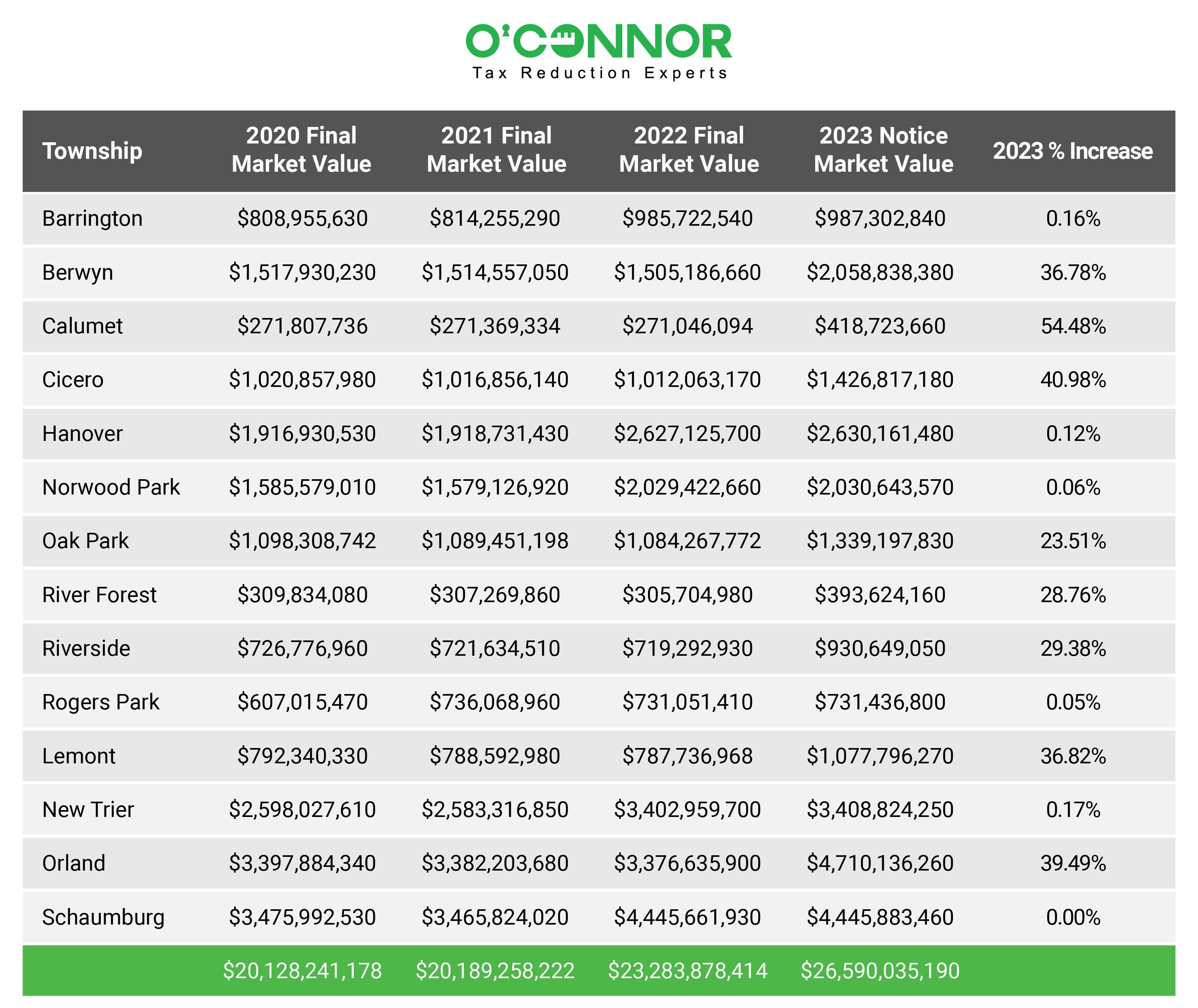

Cook County property taxes are calculated based on the assessed value of your property, determined by the Cook County Assessor’s Office. This value is derived from various factors, including the property’s size, location, and improvements. The tax rate applied to this assessed value is determined by the local taxing bodies, such as the county, municipality, and school district.

Form To Appeal Taxes In Cook County – CountyForms.com – Source www.countyforms.com

The History and Evolution of Cook County Property Taxes

Cook County property taxes have a long and intricate history. The first property tax in Illinois was levied in 1825, and the system has since undergone numerous revisions and reforms. One significant change occurred in 1931 when the Cook County Assessor’s Office was established, centralizing property assessments for the entire county.

Cook County Tax Appeal: How do I know if my property taxes are going up – Source www.hermosachi.com

Unveiling the Hidden Truths

Beyond the surface-level understanding of Cook County property taxes, there are often lesser-known aspects that can impact taxpayers. One such factor is the existence of property tax exemptions and deductions. These provisions can significantly reduce your tax liability if you qualify, so it’s essential to research and understand the eligibility criteria.

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F24202004%2Fmerlin_106730316.jpg)

Cook County property tax bills finally posted online after monthslong – Source chicago.suntimes.com

Recommendations for Savvy Taxpayers

To navigate the complexities of Cook County property taxes, consider seeking guidance from a tax professional. These experts can provide personalized advice tailored to your specific situation, ensuring you optimize your tax payments and avoid unnecessary expenses. Additionally, staying informed about changes in property tax laws and regulations can help you make informed decisions.

Cook County property taxes rise more than 9M for 2022 tax year | WLS – Source www.wlsam.com

Cook County Property Taxes: In-Depth Analysis

Cook County property taxes involve a multitude of facets, including assessment appeals, property tax protests, and tax liens. Understanding these concepts can empower you to challenge incorrect assessments, file appeals, and resolve tax-related issues effectively.

Cook County Property Tax Assessment – Source www.cutmytaxes.com

Cook County Property Taxes: Tips and Tricks

To maximize your tax savings, explore various strategies such as homestead exemptions, senior citizen exemptions, and disabled veteran exemptions. By taking advantage of these provisions, you can reduce your tax burden and save money.

Cook County Jail population declining, likely due to elimination of – Source www.wbez.org

Cook County Property Taxes: Fun Facts

Did you know that Cook County has the second-highest property taxes in the nation? Despite this, Illinois has a relatively low effective property tax rate compared to other states. These seemingly contradictory statistics highlight the intricacies of property tax systems.

How to Cook County Property Taxes

To make your property tax payments, several options are available. You can pay online, by mail, or in person at designated locations. Additionally, you can set up a payment plan if you anticipate difficulty paying the full amount on time.

What if Cook County Property Taxes

If you’re experiencing financial hardship and cannot make your property tax payments, there are programs that may provide assistance. These programs can offer payment plans, tax deferrals, and even property tax forgiveness in certain cases.

Cook County Property Taxes: A Comprehensive List

To fully grasp the complexities of Cook County property taxes, consider delving into the following topics:

- Property tax assessments

- Property tax exemptions

- Property tax appeals

- Property tax liens

- Property tax payment options

Question and Answer

Here are some frequently asked questions about Cook County property taxes:

- Q: When is the second installment due?

A: The second installment is due by the end of August. - Q: What are the consequences of late payment?

A: Late payment fees, interest charges, and potential tax sale. - Q: How can I lower my property taxes?

A: Explore property tax exemptions, deductions, and assessment appeals. - Q: What if I can’t pay my property taxes?

A: Contact the Cook County Treasurer’s Office to inquire about assistance programs.

Conclusion of Cook County Property Taxes: Second Installment Due

Navigating the complexities of Cook County property taxes can be challenging, but understanding the basics and seeking professional guidance can empower you to manage your tax obligations effectively. By paying on time, exploring tax-saving strategies, and staying informed about changes in property tax laws, you can minimize your tax burden and maintain financial stability.

![[Wauconda Memorial Day Parade Honors Fallen Heroes] [Wauconda Memorial Day Parade Honors Fallen Heroes]](https://alpost911.org/wp-content/uploads/2023/08/iD9lds0L-min-2048x1429.jpg)