Property taxes are a major expense for homeowners in Chicago. If you’re not sure how much you owe, this article can help you estimate your annual property tax liability.

Factors that affect your property tax liability

The amount of property taxes you owe is based on several factors, including the:

- Equalized Assessed Value (EAV) of your property

- Tax rate for your property

- Exemptions and deductions you qualify for

Property Tax Notice (Statement) – Mackenzie Gartside & Associates – Source comoxmortgages.com

How to estimate your property tax liability

To estimate your property tax liability, you can use the following formula:

You can find your EAV on your property tax bill or by contacting your local assessor’s office. The tax rate for your property is set by your local government.

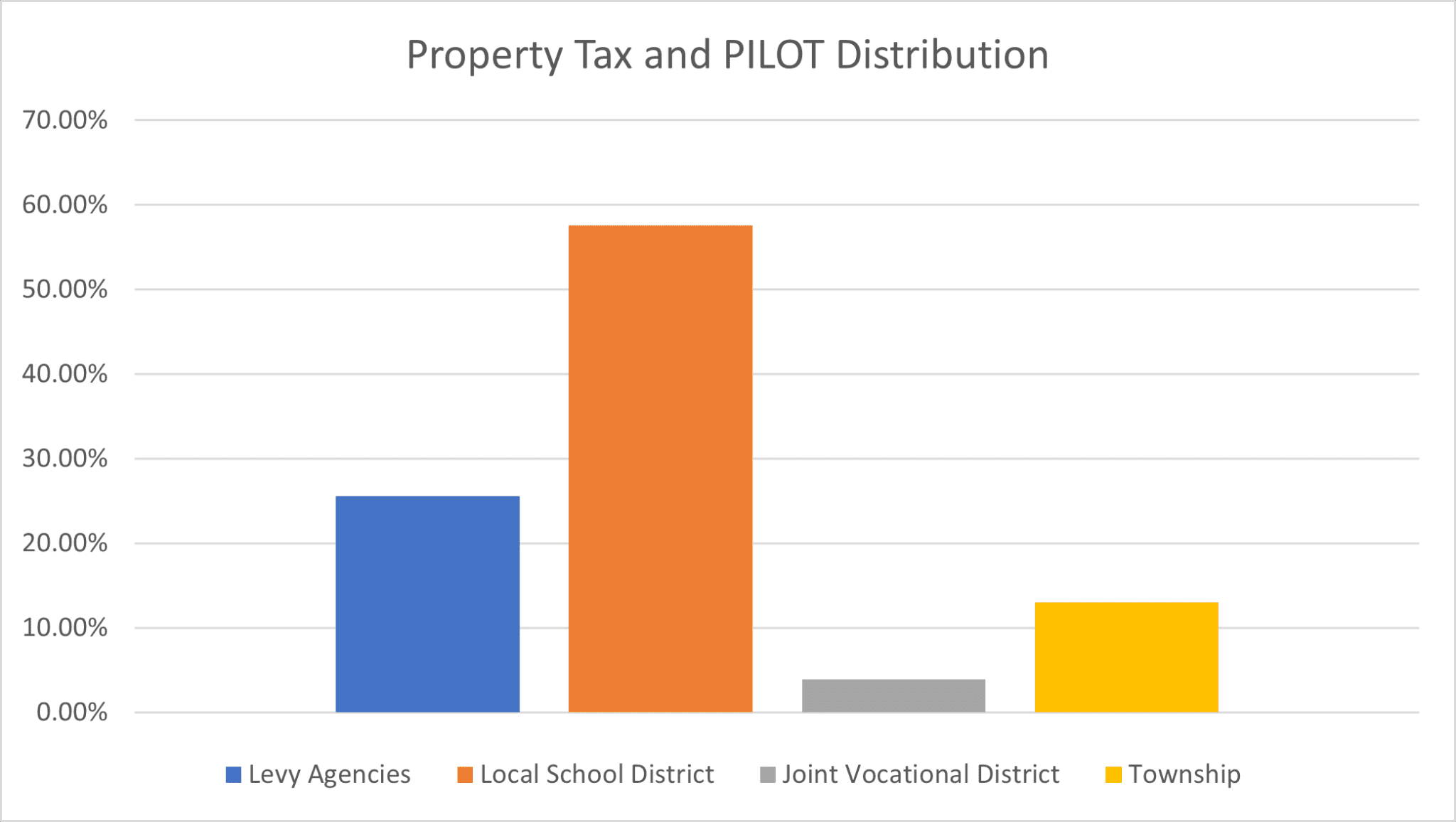

Ohio Streamlines Property Tax Appraisal Process – The Montrose Group LLC – Source montrosegroupllc.com

Conclusion

Estimating your annual property tax liability is a simple process that can help you budget for this major expense. By understanding the factors that affect your property tax liability, you can make sure that you’re paying the correct amount of taxes.

Estimate Your Annual Property Tax Liability In Chicago

If you’re a homeowner in Chicago, you’re required to pay property taxes. The amount of property taxes you owe is based on the value of your property, as determined by the Cook County Assessor’s Office. The tax rate is set by the city of Chicago.

You can estimate your annual property tax liability by using the following formula:

Your EAV is the Equalized Assessed Value of your property. You can find your EAV on your property tax bill or by contacting the Cook County Assessor’s Office.

Top 14 la county property tax payment inquiry 2022 – Source cumeu.com

Estimate Your Annual Property Tax Liability In Chicago

The tax rate for Chicago is 6.19%. For example, if your EAV is $200,000, your annual property tax liability would be $12,380.

You may be eligible for certain exemptions and deductions that can reduce your property tax liability. For more information, please contact the Cook County Assessor’s Office.

9 States With the Lowest Property Tax Rates – Source www.moneytalksnews.com

Estimate Your Annual Property Tax Liability In Chicago

Property taxes are a major expense for homeowners in Chicago. The amount of property taxes you owe is based on the value of your property, as determined by the Cook County Assessor’s Office. The tax rate is set by the city of Chicago.

The history of property taxes in Chicago dates back to the early 19th century. The first property tax was levied in 1833, and the tax rate has been increasing ever since.

Annual Property Tax Changes – Montana Department of Revenue – Source mtrevenue.gov

Estimate Your Annual Property Tax Liability In Chicago

There are a number of myths about property taxes in Chicago. One myth is that property taxes are always going up. While it is true that the tax rate has been increasing over time, it is not always going up. In fact, the tax rate has decreased in some years.

Another myth is that property taxes are only paid by homeowners. While it is true that homeowners pay the majority of property taxes, businesses and other property owners also pay property taxes.

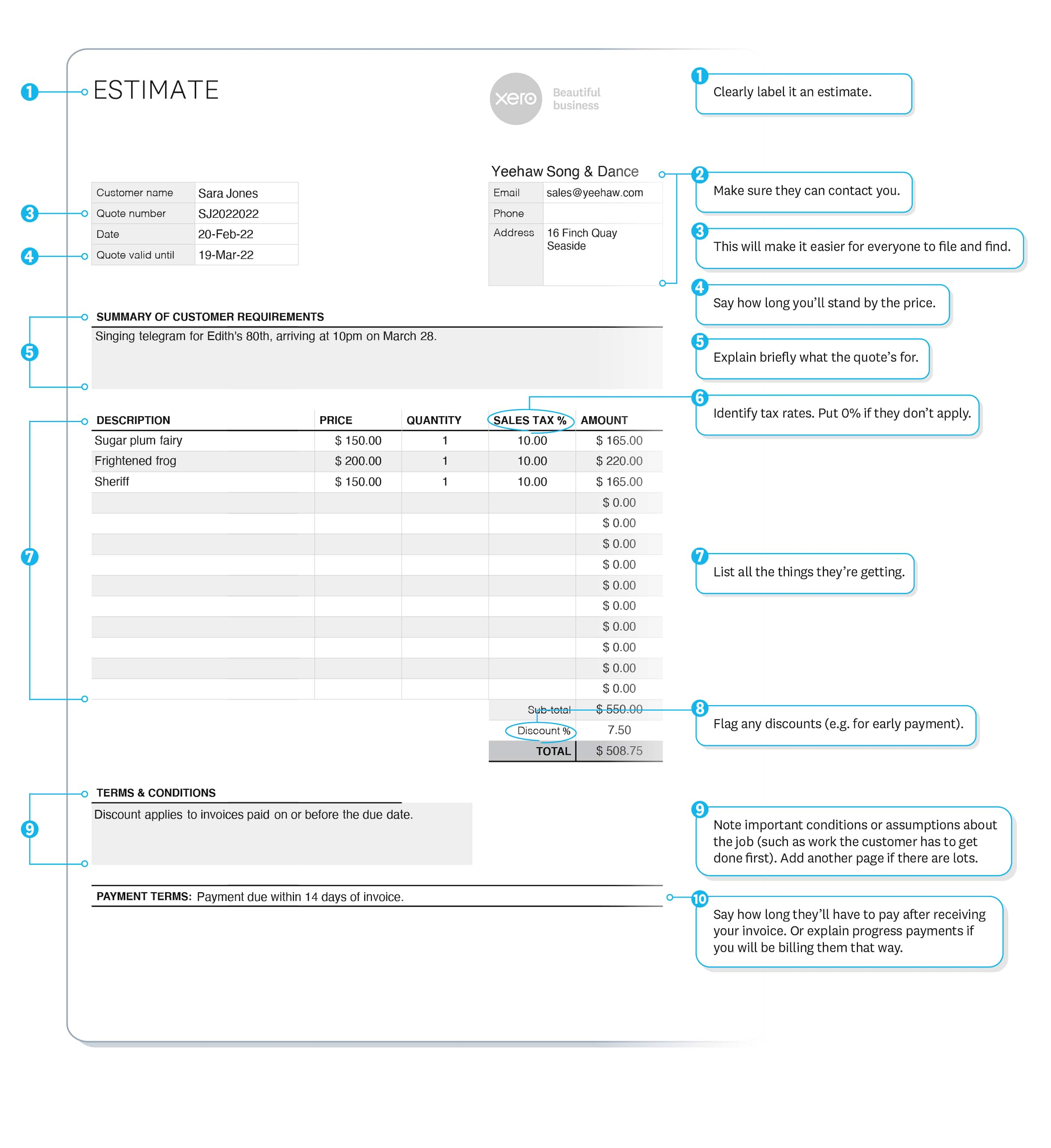

Estimate Example And Formatting Tips | Xero PH – Source www.xero.com

Estimate Your Annual Property Tax Liability In Chicago

There are a number of hidden secrets about property taxes in Chicago. One secret is that there are a number of ways to reduce your property tax liability. For example, you may be eligible for certain exemptions and deductions.

Another secret is that you can appeal your property tax assessment. If you believe that your property is assessed at too high a value, you can file an appeal with the Cook County Assessor’s Office.

Legal Strategies For Mitigating Property Tax Assessments In CRE – Source jeremyeveland.com

Estimate Your Annual Property Tax Liability In Chicago

If you’re a homeowner in Chicago, it’s important to understand how property taxes work. By understanding the factors that affect your property tax liability, you can make sure that you’re paying the correct amount of taxes.

Here are some recommendations for estimating your annual property tax liability in Chicago:

- Contact the Cook County Assessor’s Office to get your EAV.

- Multiply your EAV by the tax rate for Chicago (6.19%).

- Subtract any exemptions and deductions that you qualify for.

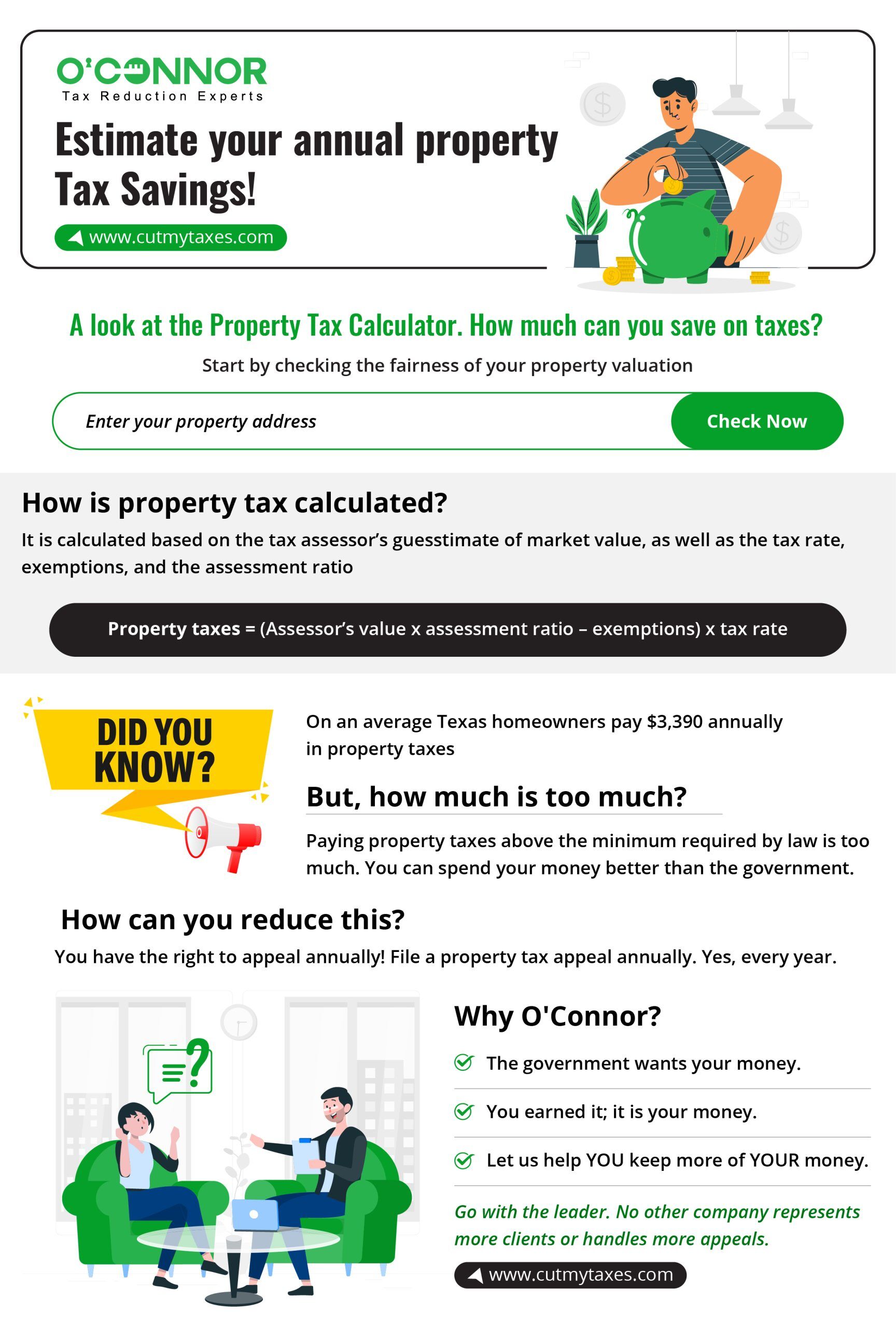

5 Steps in Filing a Protest for High Residential Property Tax – Source www.cutmytaxes.com

Estimate Your Annual Property Tax Liability In Chicago

Here are some tips for reducing your property tax liability in Chicago:

- File for a homestead exemption.

- Appeal your property tax assessment.

- Take advantage of any other exemptions and deductions that you may qualify for.

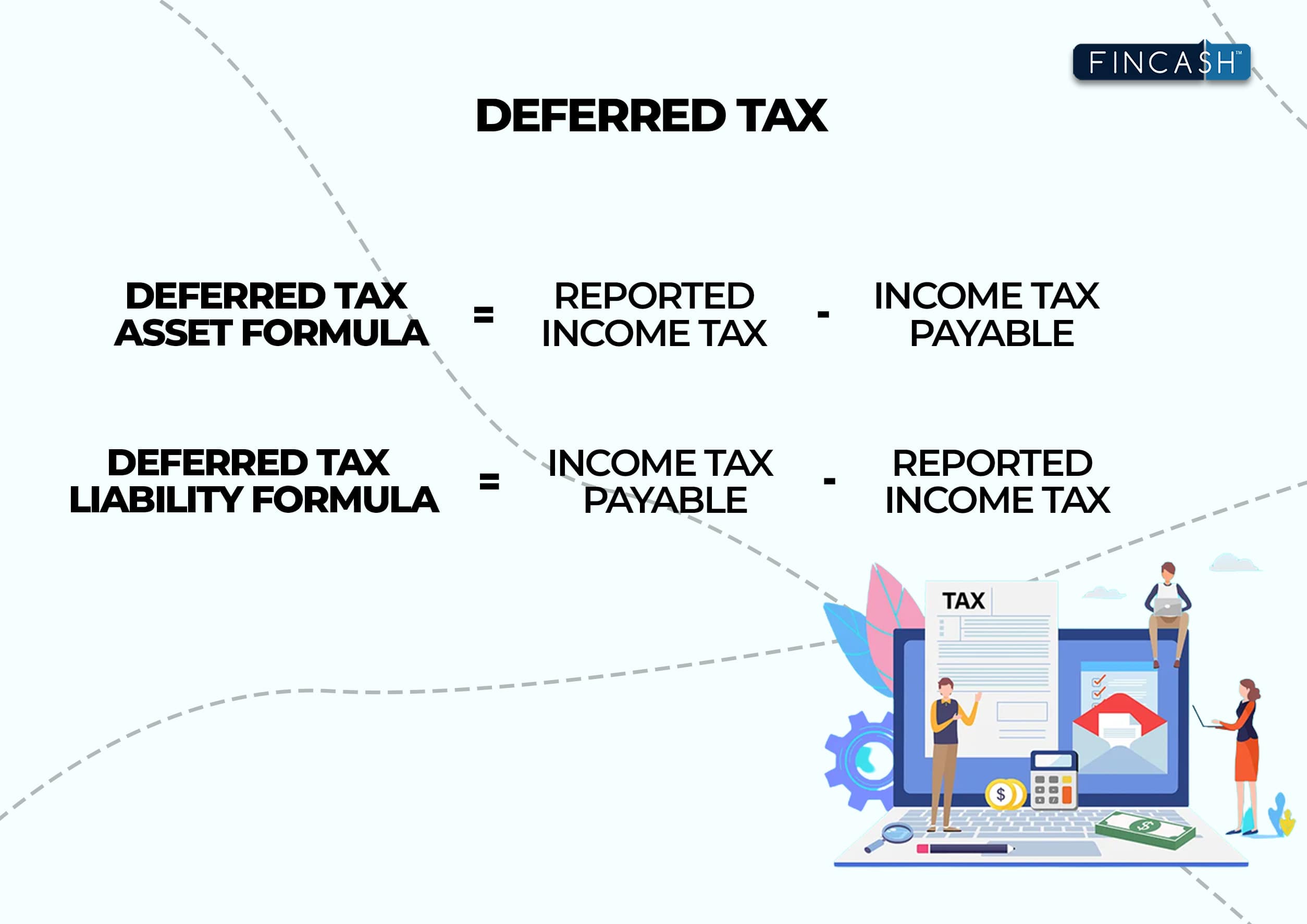

Deferred Income Tax in India – Fincash – Source www.fincash.com

Estimate Your Annual Property Tax Liability In Chicago

Here are some resources that can help you estimate your annual property tax liability in Chicago:

- Cook County Assessor’s Office: https://www.cookcountyassessor.org/

- City of Chicago Department of Revenue: https://www.cityofchicago.org/city/en/depts/revenue.html

Could Texas Really Eliminate Property Taxes? – Texas Monthly – Source www.texasmonthly.com

Fun Facts

Did you know that the tallest building in Chicago is the Willis Tower? It is 1,450 feet tall and has 110 stories. The Willis Tower is also the second tallest building in the United States.

Did you know that Chicago is home to the world’s first skyscraper? The Home Insurance Building was built in 1885 and was 10 stories tall. The Home Insurance Building was demolished in 1931.

How to

If you’re not sure how to estimate your annual property tax liability in Chicago, you can use the following steps:

- Contact the Cook County Assessor’s Office to get your EAV.

- Multiply your EAV by the tax rate for Chicago (6.19%).

- Subtract any exemptions and deductions that you qualify for.

What if

What if you can’t pay your property taxes? If you can’t pay your property taxes, you may be able to get a payment plan from the Cook County Treasurer’s Office.

You may also be able to get a property tax deferral if you are over the age of 65 or disabled. For more information, please contact the Cook County Treasurer’s Office.

Listicle

- Contact the Cook County Assessor’s Office to get your EAV.

- Multiply your EAV by the tax rate for Chicago (6.19%).

- Subtract any exemptions and deductions that you qualify for.

- File for a homestead exemption.

- Appeal your property tax assessment.

Question and Answer

A: To estimate your annual property tax liability in Chicago, you can use the following formula: Property tax liability = EAV x Tax rate – Exemptions and deductions.

A: The tax rate for Chicago is 6.19%.

A: You may qualify for a homestead exemption, a senior citizen exemption, or a disability exemption.

A: If you can’t pay your property taxes, you may be able to get a payment plan from the Cook County Treasurer’s Office. You may also be able to get a property tax deferral if you are over the age of 65 or disabled.

Conclusion

Estimating your annual property tax liability in Chicago is a simple process that can help you budget for this major expense. By understanding the factors that affect your property tax liability, you can make sure that you’re paying the correct amount of taxes.