Are you struggling to keep up with your property taxes? If so, you’re not alone. Many people find it difficult to manage their tax bills, especially when they’re facing financial hardship. Fortunately, there is a way to make paying your property taxes easier: by paying online.

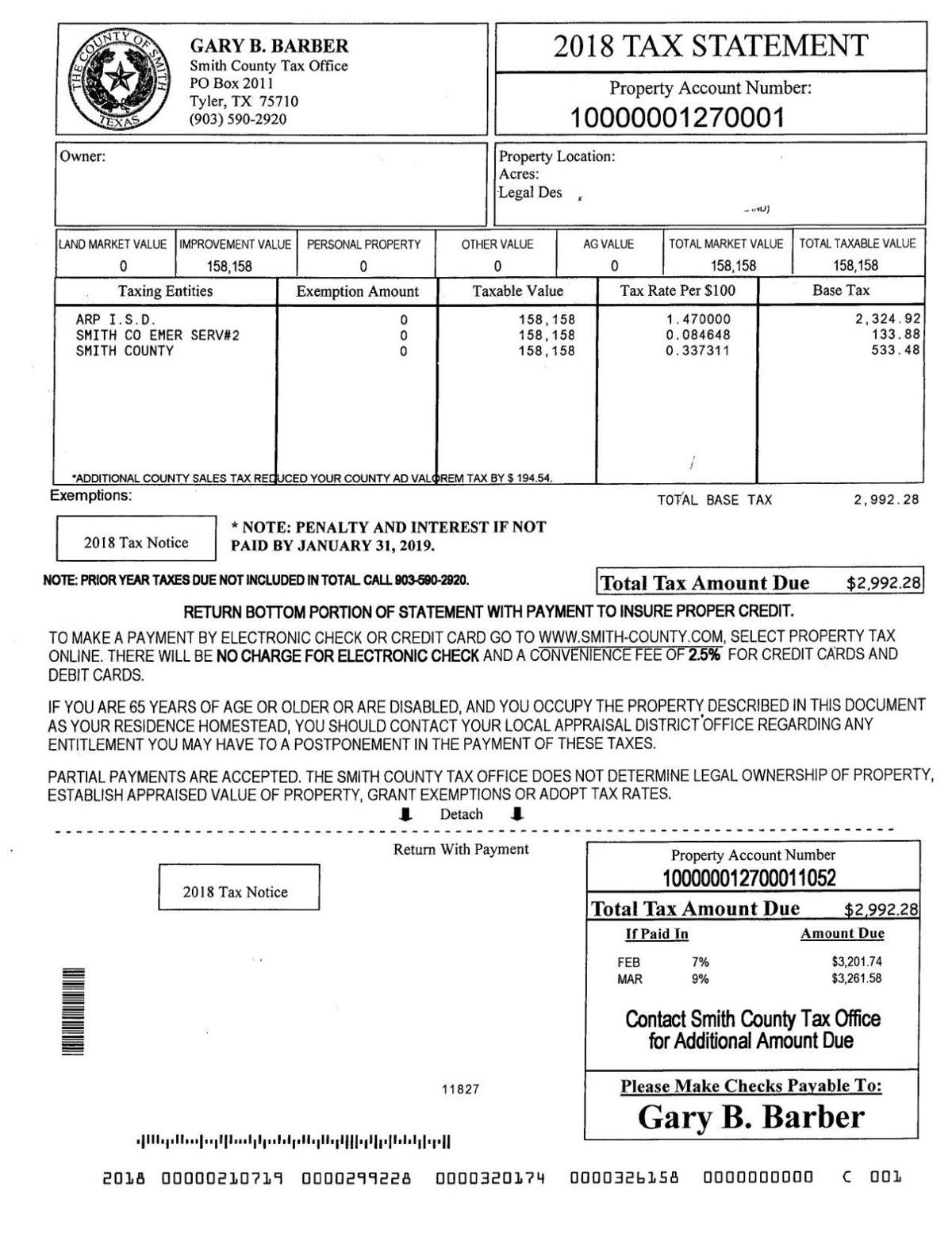

How To Read Your Property Tax Bill Property Walls – vrogue.co – Source www.vrogue.co

Paying your property taxes online can save you time and money. You can avoid the hassle of going to the tax office and waiting in line. You can also avoid paying late fees if you forget to mail your payment on time.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/shawmedia/KCZI4SAKRRC37BVESZACRJLNQE.png)

Gwen Henry: 2022 candidate for DuPage County Treasurer – Shaw Local – Source www.shawlocal.com

The DuPage County Treasurer’s office offers a convenient online payment system. You can pay your property taxes using a credit card, debit card, or electronic check. The system is secure and easy to use.

Property tax bill examples – Source www.tax.state.ny.us

To pay your property taxes online, you will need your property index number. You can find your property index number on your tax bill. Once you have your property index number, you can visit the DuPage County Treasurer’s website and click on the “Pay Property Taxes” link.

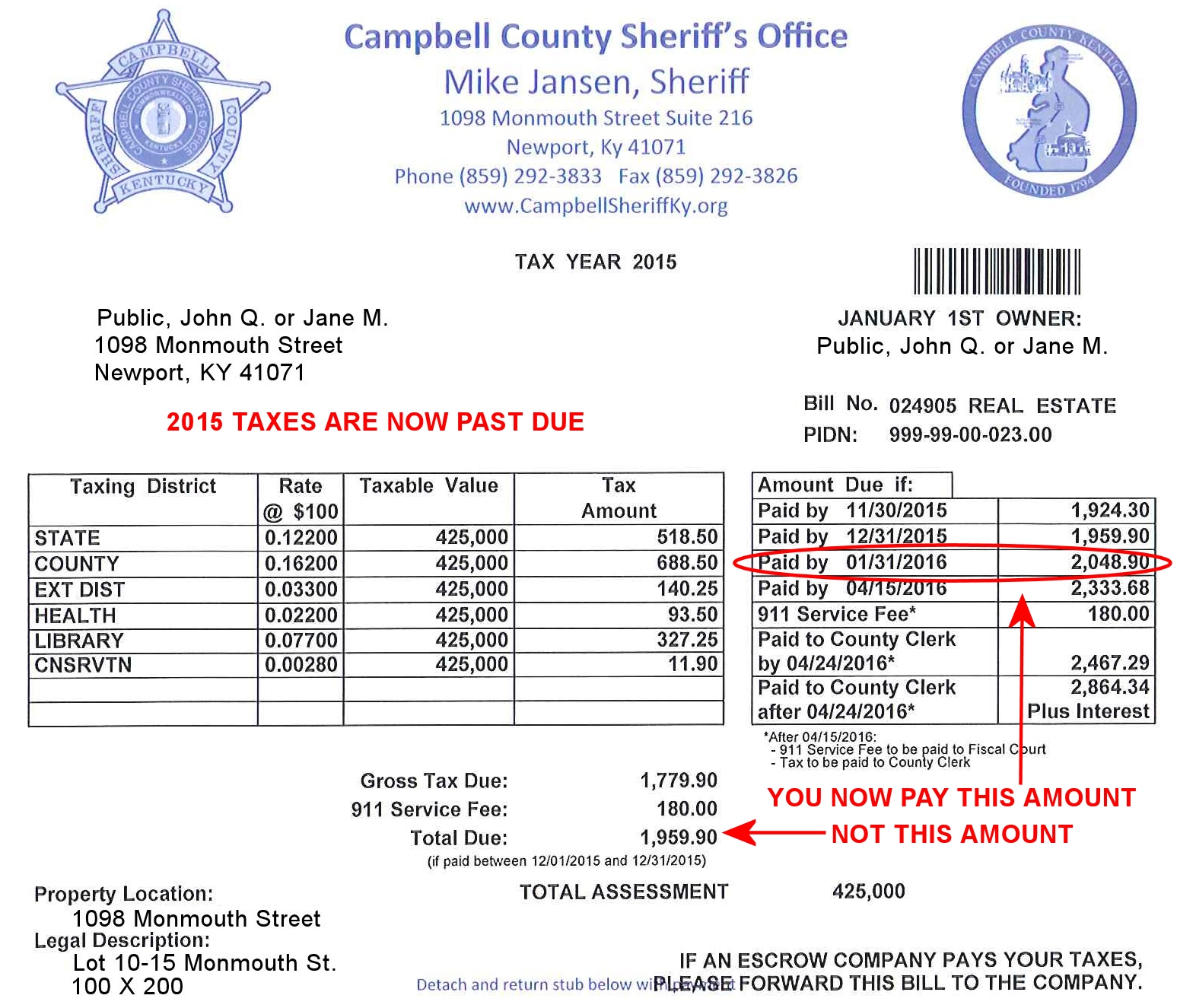

2015 Taxes are now past due. – Mike Jansen – Campbell County Sheriff’s – Source www.campbellcountysheriffky.org

DuPage County Treasurer Tax Bill: Pay Your Property Taxes Online

The DuPage County Treasurer’s office offers a convenient online payment system for property taxes. Residents can pay their taxes using a credit card, debit card, or electronic check. The system is secure and easy to use.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/shawmedia/QIZTOKUHABBADE2LKOAGH6HWXU.png)

Don Potoczny: 2022 candidate for DuPage County Treasurer – Shaw Local – Source www.shawlocal.com

Benefits of paying your property taxes online:

- Save time and money

- Avoid the hassle of going to the tax office and waiting in line

- Avoid paying late fees if you forget to mail your payment on time

How to pay your property taxes online:

- Gather your property index number, which can be found on your tax bill.

- Visit the DuPage County Treasurer’s website: https://www.dupageco.org/treasurer.

- Click on the “Pay Property Taxes” link.

- Enter your property index number and follow the instructions on the screen.

DuPage County Treasurer Tax Bill: What is it?

The DuPage County Treasurer Tax Bill is a statement that is sent to property owners each year. The bill shows the amount of property taxes that are due for the year. Property taxes are used to fund local services, such as schools, roads, and parks.

Unsecured Property Tax Los Angeles County – Property Tax Portal – Source propertytax.lacounty.gov

The DuPage County Treasurer’s office is responsible for collecting property taxes. The office also provides a variety of services to property owners, such as online payment options and tax relief programs.

Sewer Inspection Report Template | Glendale Community – Source www.glendalecommunity.ca

If you have any questions about your property tax bill, you can contact the DuPage County Treasurer’s office at (630) 407-6500.

DuPage County Treasurer Tax Bill: History and Myths

The history of property taxes in DuPage County dates back to the 19th century. The first property tax law was passed in 1872. The law required all property owners to pay taxes based on the value of their property.

Hecht Group | Paying Unsecured Property Taxes Online – Source www.hechtgroup.com

Over the years, the property tax system in DuPage County has changed several times. However, the basic principle of property taxation remains the same: property owners are required to pay taxes based on the value of their property.

There are a number of myths about property taxes in DuPage County. One myth is that property taxes are only used to fund schools. In fact, property taxes are used to fund a variety of local services, including schools, roads, and parks.

Another myth is that property taxes are always increasing. In fact, property taxes have remained relatively stable in DuPage County in recent years.

DuPage County Treasurer Tax Bill: Hidden Secrets

There are a number of hidden secrets about the DuPage County Treasurer Tax Bill. One secret is that there are a number of ways to reduce your property taxes.

One way to reduce your property taxes is to apply for a property tax exemption. There are a number of different types of property tax exemptions available, including exemptions for seniors, veterans, and disabled persons.

Another way to reduce your property taxes is to appeal your property assessment. If you believe that your property is assessed at too high a value, you can appeal your assessment to the DuPage County Board of Review.

DuPage County Treasurer Tax Bill: Recommendation

If you are a property owner in DuPage County, it is important to understand your property tax bill. The bill shows the amount of property taxes that are due for the year. Property taxes are used to fund local services, such as schools, roads, and parks.

There are a number of ways to pay your property taxes. You can pay online, by mail, or in person at the DuPage County Treasurer’s office. You can also pay your property taxes using a credit card, debit card, or electronic check.

If you have any questions about your property tax bill, you can contact the DuPage County Treasurer’s office at (630) 407-6500.

DuPage County Treasurer Tax Bill: Tips

Here are a few tips for paying your DuPage County Treasurer Tax Bill:

- Pay your property taxes on time to avoid late fees.

- If you cannot pay your property taxes in full, you can apply for a payment plan.

- If you have any questions about your property tax bill, you can contact the DuPage County Treasurer’s office at (630) 407-6500.

DuPage County Treasurer Tax Bill: Fun Facts

Here are a few fun facts about the DuPage County Treasurer Tax Bill:

- The DuPage County Treasurer’s office collects over $1 billion in property taxes each year.

- The property tax rate in DuPage County is one of the lowest in the Chicago area.

- The DuPage County Treasurer’s office offers a variety of services to property owners, including online payment options and tax relief programs.

DuPage County Treasurer Tax Bill: How to

To pay your DuPage County Treasurer Tax Bill, you will need to gather your property index number. You can find your property index number on your tax bill. Once you have your property index number, you can visit the DuPage County Treasurer’s website and click on the “Pay Property Taxes” link.

On the “Pay Property Taxes” page, you will need to enter your property index number and follow the instructions on the screen. You can pay your property taxes using a credit card, debit card, or electronic check.

If you have any questions about how to pay your property taxes, you can contact the DuPage County Treasurer’s office at (630) 407-6500.

DuPage County Treasurer Tax Bill: What if

What if you cannot pay your DuPage County Treasurer Tax Bill? If you cannot pay your property taxes in full, you can apply for a payment plan. To apply for a payment plan, you will need to contact the DuPage County Treasurer’s office at (630) 407-6500.

The DuPage County Treasurer’s office will work with you to create a payment plan that fits your budget. If you have any questions about payment plans, you can contact the DuPage County Treasurer’s office at (630) 407-6500.

DuPage County Treasurer Tax Bill: Listicle

Here is a listicle of things you need to know about the DuPage County Treasurer Tax Bill:

- The DuPage County Treasurer Tax Bill is a statement that is sent to property owners each year.

- The bill shows the amount of property taxes that are due for the year.

- Property taxes are used to fund local services, such as schools, roads, and parks.

- You can pay your property taxes online, by mail, or in person at the DuPage County Treasurer’s office.

- You can pay your property taxes using a credit card, debit card, or electronic check.

- If you cannot pay your property taxes in full, you can apply for a payment plan.

- If you have any questions about your property tax bill, you can contact the DuPage County Treasurer’s office at (630) 407-6500.

Questions and Answers about DuPage County Treasurer Tax Bill:

What is the DuPage County Treasurer Tax Bill?