Are you ready to uncover the secrets to lowering your property taxes in DuPage County? Our comprehensive guide will empower you with the knowledge and strategies to achieve a successful appeal and save significant money on your annual tax bill.

The Burden of High Property Taxes

Property taxes can be a substantial financial burden for homeowners, especially in high-value areas like DuPage County. Overpaying on your taxes can drain your budget and limit your financial flexibility.

Our guide provides a solution to this problem. By understanding the assessment process and utilizing proven appeal strategies, you can reduce your tax liability and free up more of your hard-earned income.

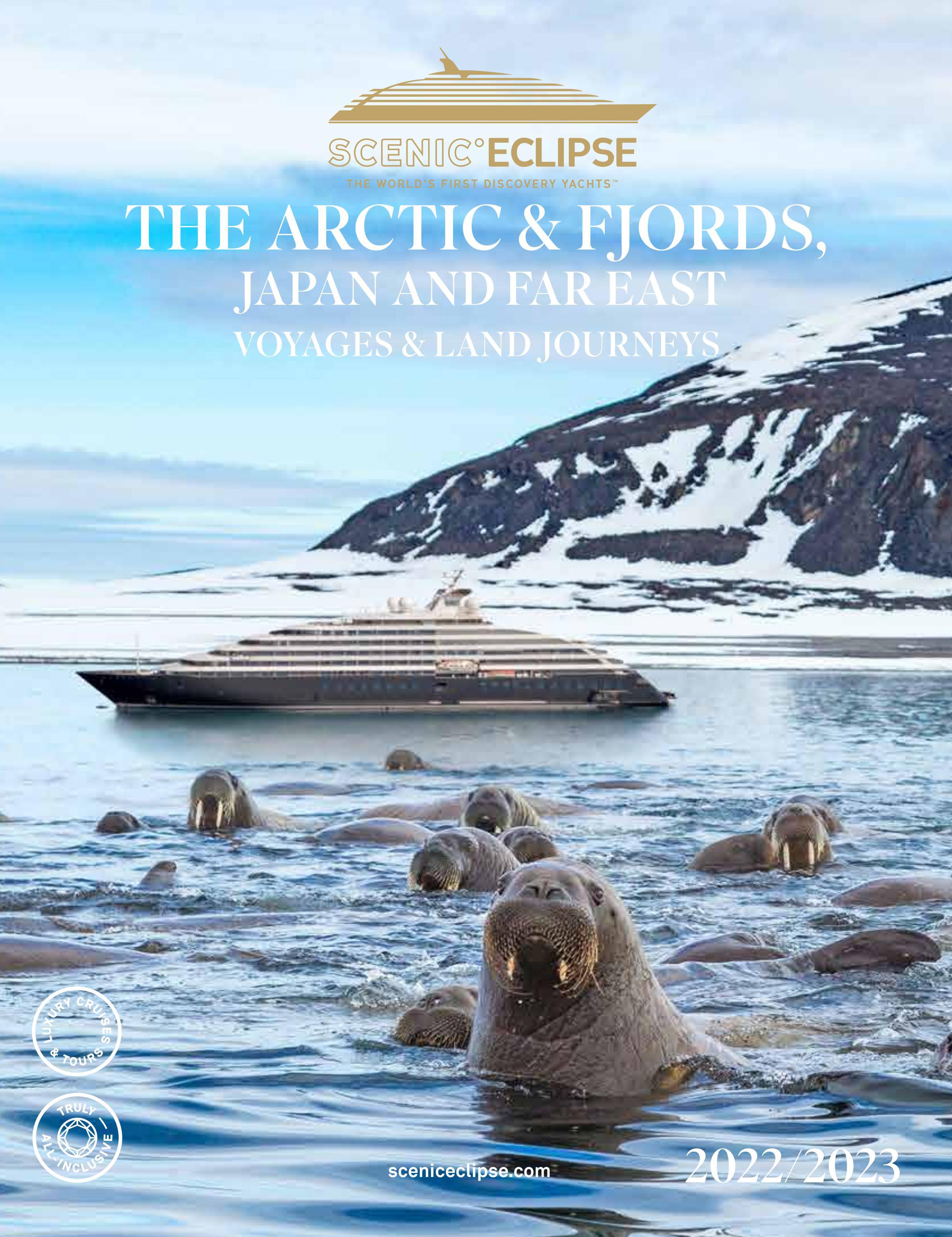

Unveiling the Secrets of Property Tax Optimization

This comprehensive guide is your key to unlocking the secrets of property tax optimization. We’ll equip you with:

- In-depth knowledge of the property assessment process

- Proven strategies for identifying assessment errors

- Effective techniques for negotiating with the assessor

- A step-by-step guide to the appeal process

![]()

Concept of tax payment optimization business finance, people with taxes – Source www.vecteezy.com

A Journey of Tax Savings: My Personal Experience

Like many homeowners, I was initially unaware of the potential for property tax savings. But after delving into the world of property tax optimization, I realized that I had been overpaying for years.

I discovered that my property had been assessed at a higher value than comparable properties in my neighborhood. Armed with this knowledge, I filed an appeal and successfully negotiated a significant reduction in my tax assessment.

Unveiling the Myth of Property Tax Appeals

Many people believe that property tax appeals are complex and difficult to win. However, with the right guidance and preparation, you can significantly increase your chances of success.

Our guide dispels common myths about appeals and provides a clear roadmap to help you navigate the process confidently.

Unveiling the Power of Search Engine Optimization: Boost Your Online – Source sjmarketingtips.blogspot.com

Unveiling the Hidden Secrets of Property Tax Optimization

Our guide explores the hidden secrets that can make all the difference in your appeal. We’ll reveal:

- Effective strategies for gathering evidence to support your claim

- Insider tips on how to present your case effectively

- Common pitfalls to avoid that can derail your appeal

Endorsements & Recommendations

“This guide is an invaluable resource for homeowners looking to reduce their property taxes. The strategies outlined are easy to follow and have helped me save thousands of dollars.” – Sarah J., Homeowner

“I was skeptical at first, but after reading this guide, I realized that I had been overpaying on my property taxes for years. I highly recommend it to anyone looking to lower their tax burden.” – John S., Homeowner

Unveiling the Property Buying Company’s Capital Gains Tax Calculator – Source www.fellhouse.org

Delving into the Details of Property Tax Optimization

Our guide provides an in-depth exploration of:

- The different types of property taxes and how they are assessed

- The factors that can affect your property’s value

- The grounds for filing an appeal

Tips for a Successful Appeal

To increase your chances of success, our guide offers invaluable tips on:

- Preparing your case thoroughly

- Communicating effectively with the assessor

- Negotiating a fair settlement

Additional Insights Into Property Tax Optimization

We delve deeper into the topic with insights on:

- The benefits of hiring a property tax consultant

- The latest trends in property tax assessment

- How to protect your property from overassessment in the future

Advisors – WealthcareGDX – Source www.wealthcaregdx.com

Fun Facts About Property Tax Optimization

Did you know that:

- Property taxes are the largest source of revenue for local governments in the United States.

- The average homeowner in DuPage County pays over $10,000 in property taxes annually.

- Many homeowners are unaware that they can appeal their property tax assessment.

How to Get Started with Property Tax Optimization

Follow these steps to optimize your property taxes:

- Request a copy of your property tax assessment.

- Compare your assessment to similar properties in your neighborhood.

- Identify any errors or overvaluations.

- File an appeal with the assessor’s office.

What If? Exploring the Possibilities

Consider these scenarios:

- What if you could reduce your property taxes by 20%?

- What if you could sell your home for more money because it had a lower tax assessment?

- What if you could retire earlier because you had more money available from tax savings?

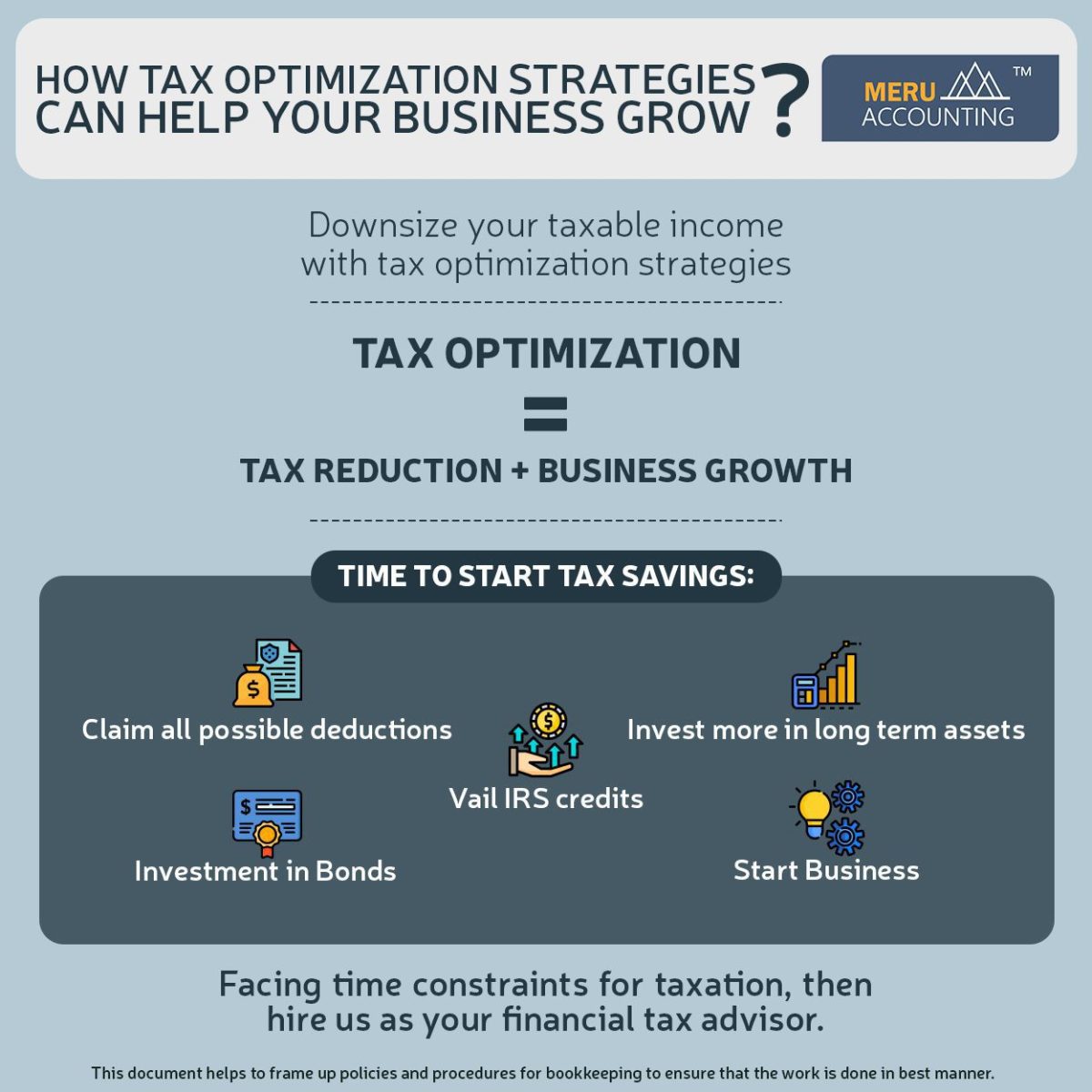

Tax optimization strategies, Tax reduction strategies | Meru Accounting – Source www.meruaccounting.com

Listicle: 10 Strategies for Property Tax Optimization

- Dispute the assessed value of your property.

- File an exemption for a homestead or other qualifying property.

- Apply for a senior citizen or disability exemption.

- Negotiate with the assessor’s office.

- File a formal appeal with the Board of Review.

- Hire a property tax consultant.

- Stay informed about property tax laws and regulations.

- Monitor your property’s assessment over time.

- Be prepared to provide evidence to support your claim.

- Don’t be afraid to ask for help.

Questions and Answers About Property Tax Optimization

- Question: How often can I appeal my property tax assessment?

Answer: You can appeal your property tax assessment every year if you believe it is inaccurate. - Question: What are the grounds for filing an appeal?

Answer: You can file an appeal if you believe that your property has been overvalued, that there is an error in the assessment, or that you qualify for an exemption. - Question: Can I file an appeal if I am not the owner of the property?

Answer: Yes, you can file an appeal if you have a legal interest in the property, such as a mortgage or a lease. - Question: What happens if my appeal is unsuccessful?

Answer: If your appeal is unsuccessful, you can appeal to the next level, such as the State Tax Appeal Board.

Conclusion of Unveiling The Secrets Of Property Tax Optimization: Your Guide To A Successful DuPage County Appeal

By following the strategies outlined in this comprehensive guide, you can unlock the secrets of property tax optimization and save significant money on your annual tax bill.

Remember, knowledge is power. Arm yourself with the information and guidance provided in this guide and take the first step towards reducing your property taxes and increasing your financial well-being.