Let’s Dive into the Realm of Lasalle County Property Tax Information

Property taxes can be a burden, especially when homeowners are caught off guard by unexpected bills.

Understanding Lasalle County property tax information is crucial for homeowners to manage their finances and avoid potential tax-related issues.

LaSalle warns residential property tax increase likely coming : r – Source www.reddit.com

Understanding Lasalle County Property Tax Information

Lasalle County property tax information is a valuable resource that helps homeowners understand their property taxes. It includes details such as the assessed value of the property, the tax rate, and the amount of property tax owed. This information can be used to estimate property tax bills and plan for future tax payments.

Homeowners can access property tax information through the Lasalle County Treasurer’s Office or online property tax portals. These sources provide detailed information about each property, including the tax history, exemptions, and payment options.

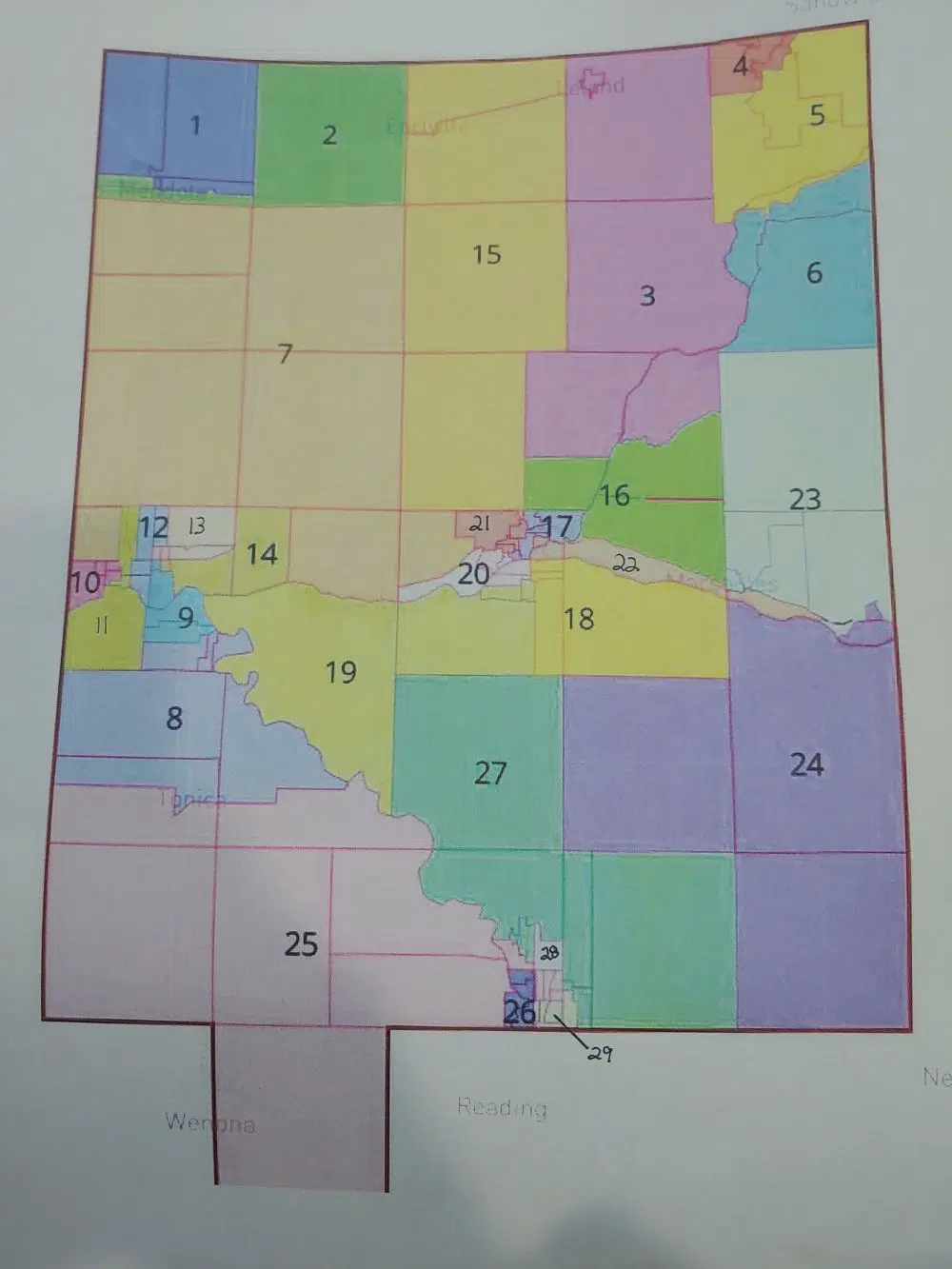

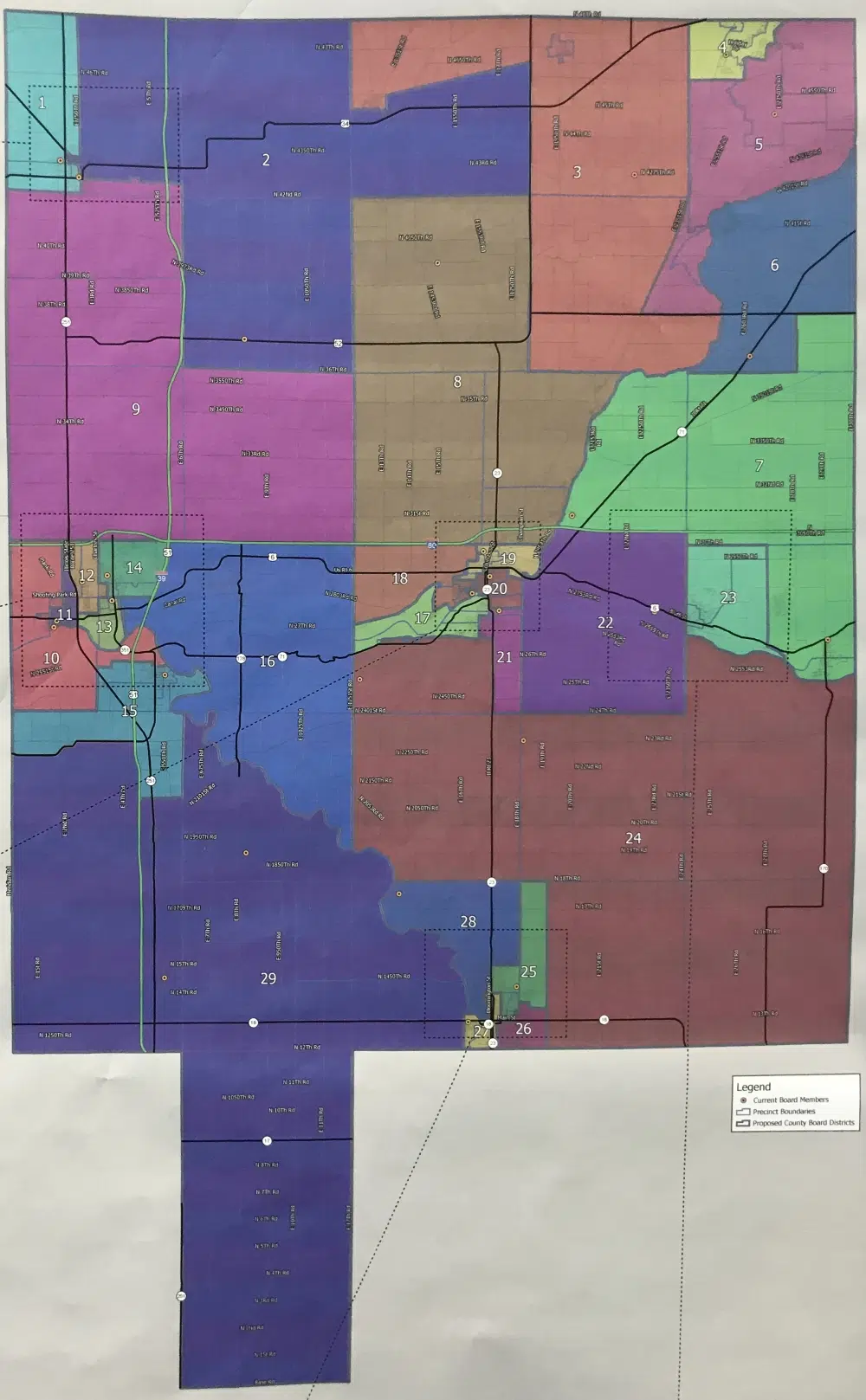

LaSalle County Board tables resolution for new redistricting map | The – Source 1430wcmy.com

Importance of Lasalle County Property Tax Information

Accurate property tax information is essential for several reasons:

- Ensures correct property tax bills

- Facilitates timely property tax payments

- Identifies potential tax savings through exemptions

- Supports property tax disputes and appeals

By having access to accurate property tax information, homeowners can make informed decisions about their property taxes and avoid any unpleasant surprises.

Marseilles, LaSalle County, IL Recreational Property, Timberland – Source www.landwatch.com

History of Lasalle County Property Tax Information

The history of Lasalle County property tax information dates back to the establishment of the county in 1831. Over the years, the methods of property assessment and tax collection have evolved to keep pace with technological advancements and changing real estate market conditions.

In the past, property assessments were largely based on manual inspections by county assessors. However, today, sophisticated software and aerial photography are utilized to accurately determine the value of properties.

LaSalle County Board approves new district map with some dissent | The – Source 1430wcmy.com

The Hidden Secrets of Lasalle County Property Tax Information

Beyond the basic details, Lasalle County property tax information holds some hidden secrets that can be beneficial to homeowners:

- Online Property Tax Calculator: The Lasalle County Treasurer’s Office provides an online property tax calculator that allows homeowners to estimate their property tax bills based on the assessed value of their property.

- Tax Exemptions: Lasalle County offers various property tax exemptions for eligible homeowners, such as the homestead exemption and the senior exemption. Homeowners should explore these exemptions to reduce their property tax burden.

By uncovering these hidden secrets, homeowners can maximize their savings and avoid overpaying their property taxes.

Lasalle County Illinois 1895 Old Wall Map Reprint With – Etsy in 2022 – Source www.pinterest.com

Recommendations for Lasalle County Property Tax Information

To effectively manage Lasalle County property tax information, homeowners are advised to:

- Stay Informed: Regularly check the Lasalle County Treasurer’s Office website for updates and changes to property tax information.

- Review Property Tax Bills: Carefully review property tax bills and contact the Treasurer’s Office if there are any errors or discrepancies.

- Explore Exemptions: Investigate and apply for any applicable property tax exemptions to lower your tax bill.

By following these recommendations, homeowners can ensure they have accurate and up-to-date property tax information and take advantage of any available tax savings.

5 acres in LaSalle County, Illinois – Source www.land.com

Lasalle County Property Tax Information and Homeowners

Understanding Lasalle County property tax information is crucial for homeowners because it directly impacts their financial well-being. By accessing and analyzing this information, homeowners can:

- Plan for upcoming property tax payments

- Identify potential tax savings through exemptions

- Make informed decisions about property ownership

Homeowners are encouraged to take an active role in managing their property tax information to ensure they are not overpaying taxes and are taking advantage of all available tax breaks.

Potential Sales Tax Increase Discussed at LaSalle County Board – Source www.wsplradio.com

Tips for Lasalle County Property Tax Information

Here are some tips for navigating Lasalle County property tax information:

- Use Online Resources: The Lasalle County Treasurer’s Office provides a wealth of information online, including property tax calculators and exemption forms.

- Attend Public Meetings: Attend public meetings held by the County Treasurer to stay informed about property tax changes and ask questions.

- Consult with Professionals: Consider consulting with a tax professional or real estate agent for personalized advice on property tax matters.

By following these tips, homeowners can effectively manage their property tax information and ensure they are fulfilling their tax obligations accurately and efficiently.

USGenWeb Archives Digital Map Library – Illinois Maps – Source www.usgwarchives.us

Lasalle County Property Tax Information and Assessments

Lasalle County property tax assessments are conducted periodically to determine the value of properties for tax purposes. These assessments are used to calculate property tax bills.

Homeowners who believe their property has been assessed incorrectly can file an appeal with the Lasalle County Board of Review. The Board of Review will review the assessment and make a determination on whether it should be adjusted.

Lasalle County Courthouse, 707 E Etna Rd, Ottawa, IL, Government – MapQuest – Source www.mapquest.com

Fun Facts about Lasalle County Property Tax Information

Here are some fun facts about Lasalle County property tax information:

- The highest property tax rate in Lasalle County is 3.8%.

- The average property tax bill in Lasalle County is around $1,500.

- Lasalle County offers a homestead exemption of up to $5,000 for primary residences.

These fun facts can help homeowners better understand the property tax landscape in Lasalle County.

Jury Commission | LaSalle County, IL – Source lasallecountyil.gov

How to Read Lasalle County Property Tax Information

Understanding how to read Lasalle County property tax information is essential for homeowners. Property tax bills typically include the following information:

- Property address

- Assessed value

- Tax rate

- Amount of property tax owed

- Payment due date

By understanding how to read property tax bills, homeowners can easily track their property tax payments and ensure they are up to date.

What if You Can’t Pay Your Lasalle County Property Taxes?

If you are unable to pay your Lasalle County property taxes, there are a few options available to you:

- Contact the County Treasurer: Reach out to the County Treasurer’s Office to discuss payment arrangements.

- Apply for a Hardship Exemption: Homeowners who are facing financial hardship may be eligible for a hardship exemption.

- Sell Your Property: As a last resort, you may consider selling your property to avoid foreclosure.

It is important to act promptly if you are having difficulty paying your property taxes to avoid penalties and potential foreclosure.

Listicle of Lasalle County Property Tax Information

- Lasalle County property tax bills are typically mailed out in November.

- The due date for property tax payments is March 1st.

- There are several property tax exemptions available in Lasalle County, including the homestead exemption and the senior exemption.

- Homeowners who believe their property has been assessed incorrectly can file an appeal with the Lasalle County Board of Review.

- Lasalle County offers a variety of payment options for property taxes, including online payments, mail payments, and in-person payments.

This listicle provides a quick overview of key Lasalle County property tax information.

Questions and Answers about Lasalle County Property Tax Information

- Q: What is the property tax rate in Lasalle County?

A: The property tax rate varies depending on the municipality in Lasalle County. You can find the specific rate for your property on your property tax bill or by contacting the County Treasurer’s Office. - Q: When are property tax bills mailed out?

A: Property tax bills are typically mailed out in November. - Q: What are the payment options for property taxes?

A: Lasalle County offers a variety of payment options for property taxes, including online payments, mail payments, and in-person payments. - Q: What happens if I can’t pay my property taxes?

A: If you are unable to pay your property taxes, you should contact the County Treasurer’s Office to discuss payment arrangements.

Conclusion of Lasalle County Property Tax Information

Understanding Lasalle County property tax