Dealing with property taxes can be overwhelming, especially when it comes to understanding due dates and payment options. This article will provide a comprehensive guide to help you navigate the complexities of property tax payments, empowering you with the knowledge and strategies to manage this financial responsibility.

Missing property tax deadlines or struggling with payments can lead to penalties, interest charges, and even the risk of losing your property. It is crucial to stay informed about the specific due dates and payment options available in your jurisdiction to avoid these consequences.

Property tax due dates vary by state, county, and municipality. Some common due dates include April 1st, May 1st, and October 1st. It is essential to check with your local tax assessor’s office or visit their website to determine the exact due dates applicable to your property.

There are various payment options available for property taxes. Most jurisdictions accept payments by mail, online, or in person at the tax collector’s office. Some counties also offer extended payment plans or installment options to make paying property taxes more manageable. Exploring these options can help you avoid late fees and penalties.

Property Tax Due Dates And Payment Options: Personal Experience

When I first purchased my home, I was overwhelmed by the unfamiliar property tax system. I had never owned property before, and the due dates and payment options seemed confusing.

To ensure I met the deadlines, I reached out to the county tax assessor’s office. They provided me with a clear explanation of the due dates and payment options available. I opted for online payments, which were convenient and allowed me to schedule automatic payments on the due dates. This hassle-free process gave me peace of mind, knowing that my property taxes were paid on time.

Top 14 la county property tax payment inquiry 2022 – Source cumeu.com

Property Tax Due Dates And Payment Options: Historical and Mythological Association

Property taxes have a long and storied history. The concept of taxing property owners dates back to ancient civilizations, where rulers levied taxes on land and other assets.

In the United States, property taxes have been a primary source of revenue for local governments since the 18th century. These taxes fund essential services such as schools, roads, and libraries.

Nj Property Tax Due Dates 2018 – Property Walls – Source propertywalls.blogspot.com

Property Tax Due Dates And Payment Options: Hidden Secrets Unraveled

There are often hidden benefits and strategies associated with property tax due dates and payment options that taxpayers may not be aware of.

For example, some jurisdictions offer discounts for early payments or penalties for late payments. Understanding these incentives can save you money and avoid unnecessary charges.

Goa Property Tax 2023: Online Payment, Rates, Calculation, Exemptions – Source www.magicbricks.com

Property Tax Due Dates And Payment Options: Expert Recommendations

When it comes to property tax due dates and payment options, experts recommend that taxpayers:

- Stay informed about the specific due dates and payment options in their jurisdiction.

- Explore available payment plans or installment options to make payments more manageable.

- Consider online or automatic payments for convenience and timely processing.

Property Taxes Due This Week – Source kggfradio.com

Property Tax Due Dates And Payment Options: The Bigger Picture

Understanding property tax due dates and payment options is essential for responsible property ownership. By staying informed about the specific requirements in your area, you can avoid penalties, protect your property, and contribute to the essential services that benefit your community.

Property Tax Due Dates And Payment Options: Tips and Tricks

Here are some tips and tricks to make property tax payments less daunting:

- Set up a reminder system to track due dates and avoid late payments.

- Keep records of your property tax payments for future reference.

- Contact the tax assessor’s office if you have any questions or need assistance.

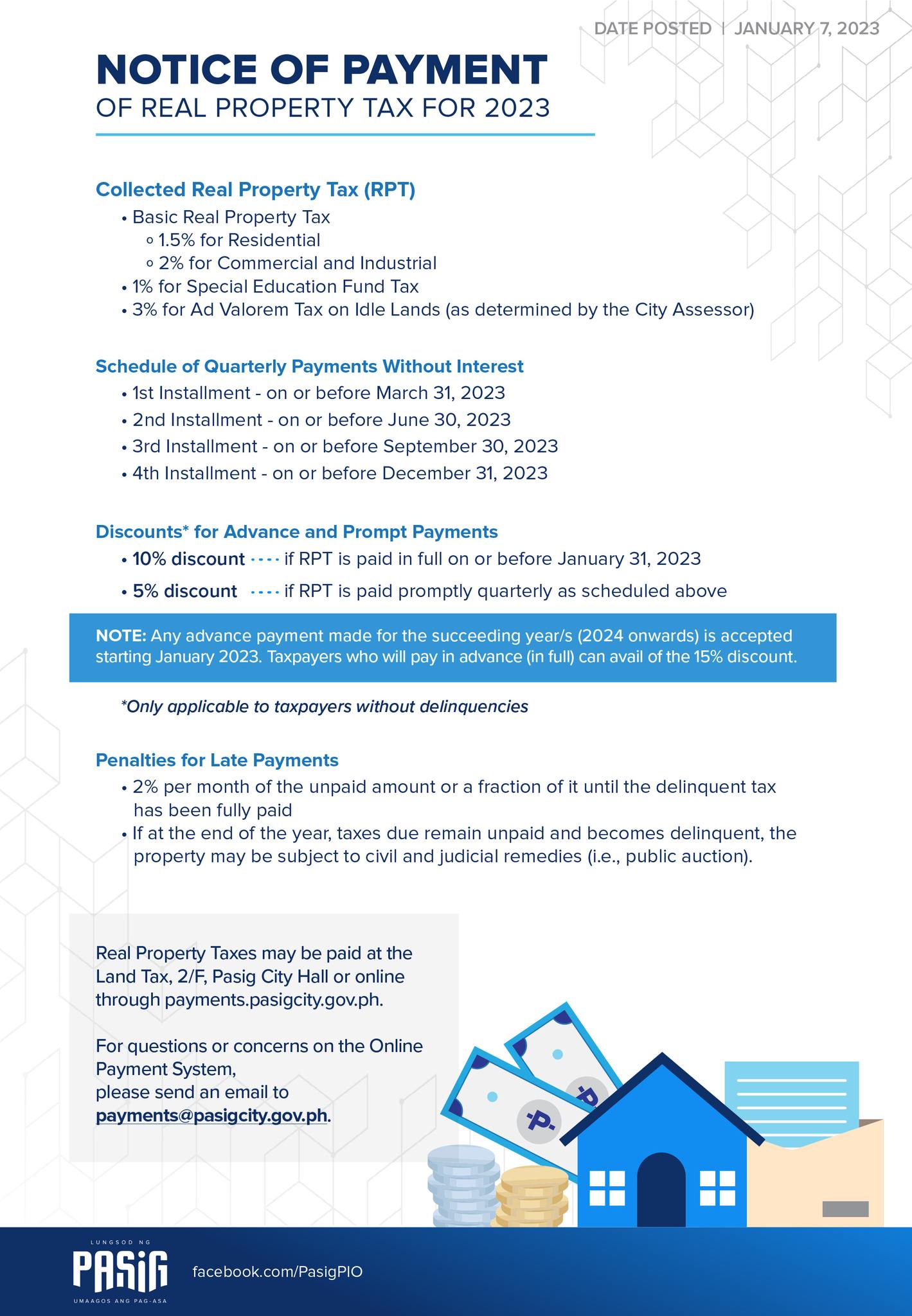

News and Releases | Pasig City – Source www.pasigcity.gov.ph

Property Tax Due Dates And Payment Options: A Deeper Dive

For a more in-depth understanding of property tax due dates and payment options, consider consulting with a tax professional or researching online resources provided by government agencies and reputable financial institutions.

Property Tax Due Dates And Payment Options: Fun Facts

Here are some fun facts about property taxes:

- The first property tax in the United States was levied in 1634 in the Massachusetts Bay Colony.

- Property taxes are the largest source of revenue for local governments in the United States.

- Some states, such as Alaska and Wyoming, do not have property taxes.

2023 Property Tax Notifications arriving now – Douglas County – Source www.douglas.co.us

Property Tax Due Dates And Payment Options: Step-by-Step Guide

If you are unsure of how to make a property tax payment, here is a step-by-step guide:

- Determine your property tax due date and amount.

- Choose a payment method (mail, online, or in person).

- Gather necessary information, such as your property tax bill or account number.

- Complete the payment process according to the instructions provided.

- Keep a record of your payment for future reference.

Riverside County property taxes still due in April, despite federal – Source www.desertsun.com

Property Tax Due Dates And Payment Options: What If Scenarios

Here are some common “what if” scenarios related to property tax due dates and payment options:

- What if I miss a property tax payment deadline? You may be subject to penalties and interest charges.

- What if I can’t afford to pay my property taxes? You may be able to apply for a payment plan or seek assistance from government programs.

- What if I sell my property before the property taxes are due? You are responsible for paying the property taxes up to the date of the sale.

Property taxes due Thursday – Source www.jconline.com

Property Tax Due Dates And Payment Options: The Ultimate Listicle

Here is a listicle summarizing the key points related to property tax due dates and payment options:

- Property tax due dates vary by jurisdiction.

- There are various payment options available, including mail, online, and in person.

- Some jurisdictions offer payment plans or installment options.

- Understanding the due dates and payment options can help you avoid penalties and protect your property.

- Contact the tax assessor’s office if you have any questions or need assistance.

Property Tax Bills Mailed To Residents – Source www.alpharetta.ga.us

Question and Answer about Property Tax Due Dates And Payment Options

Q: How can I find out the due date for my property taxes?

A: Contact your local tax assessor’s office or visit their website.

Q: What are the different payment options available for property taxes?

A: Mail, online, and in person. Some jurisdictions also offer payment plans or installment options.

Q: Can you explain the process of making a property tax payment?

A: Determine the due date and amount, choose a payment method, gather necessary information, complete the payment process, and keep a record of your payment.

Q: What are the penalties for missing a property tax payment deadline?

A: Penalties and interest charges may apply.

Conclusion of Property Tax Due Dates And Payment Options

Property tax due dates and payment options are crucial aspects of responsible property ownership. By understanding the specific requirements in your jurisdiction and exploring available payment plans and options, you can ensure timely payments, avoid penalties, and contribute to the essential services that benefit your community. If you have further questions or need assistance, do not hesitate to contact the tax assessor’s office or seek guidance from a tax professional.

![Are Fender Eliminators Street Legal? [Definitive Guide] Are Fender Eliminators Street Legal? [Definitive Guide]](https://img-webike-370429.c.cdn77.org/catalogue/images/52410/98049.jpg)