If you’re a homeowner in Cook County, you’re probably dreading the arrival of your property tax bill. The second installment of 2022 property taxes is due on August 1, 2023, and it’s not going to be cheap. The average homeowner in Cook County can expect to pay around $4,000 in property taxes this year.

Homeowners Exemption Cook County Form 2023 – ExemptForm.com – Source www.exemptform.com

The Burden of Cook County Property Taxes

Property taxes are a major financial burden for many homeowners, especially those on fixed incomes. In Cook County, property taxes are the highest in the nation. The average effective property tax rate in Cook County is 2.3%, which is more than double the national average.

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F24202004%2Fmerlin_106730316.jpg)

Cook County property tax bills finally posted online after monthslong – Source chicago.suntimes.com

Who Pays Cook County Property Taxes?

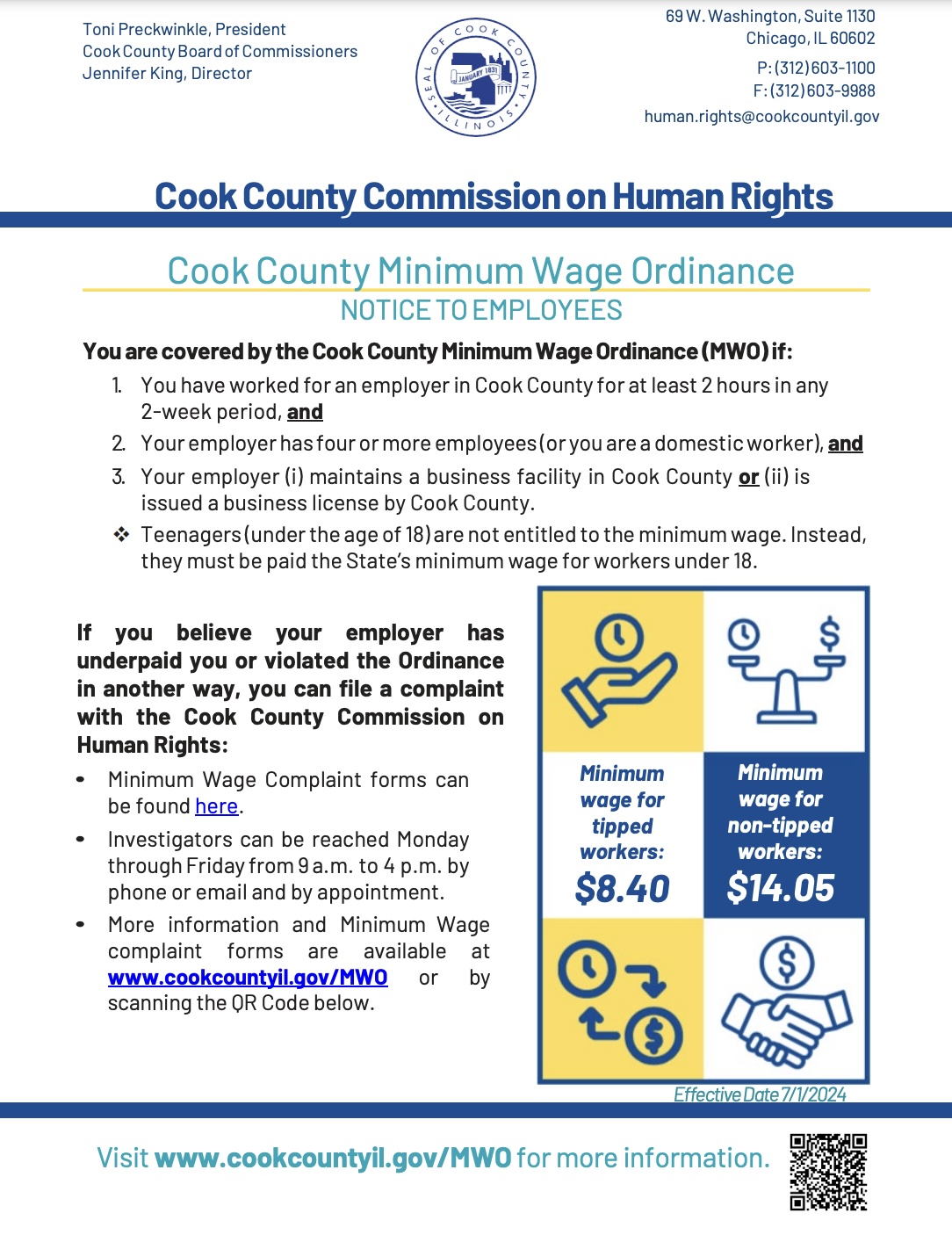

Cook County property taxes are paid by all homeowners, regardless of their income or property value. However, low-income homeowners and homeowners with disabilities may be eligible for property tax relief programs.

Cook County Jail population declining, likely due to elimination of – Source www.wbez.org

The Cook County Property Tax Second Installment 2022 is due on August 1, 2023. The average homeowner in Cook County can expect to pay around $4,000 in property taxes this year. Property taxes are a major financial burden for many homeowners, especially those on fixed incomes.

When Is 2nd Installment For Cook County 2024 – Faina Jasmina – Source eadaqloraine.pages.dev

Cook County Property Tax Second Installment 2022: What You Need to Know

The Cook County Property Tax Second Installment 2022 is due on August 1, 2023. The average homeowner in Cook County can expect to pay around $4,000 in property taxes this year. If you haven’t already paid your first installment, you can expect to pay both installments on August 1st.

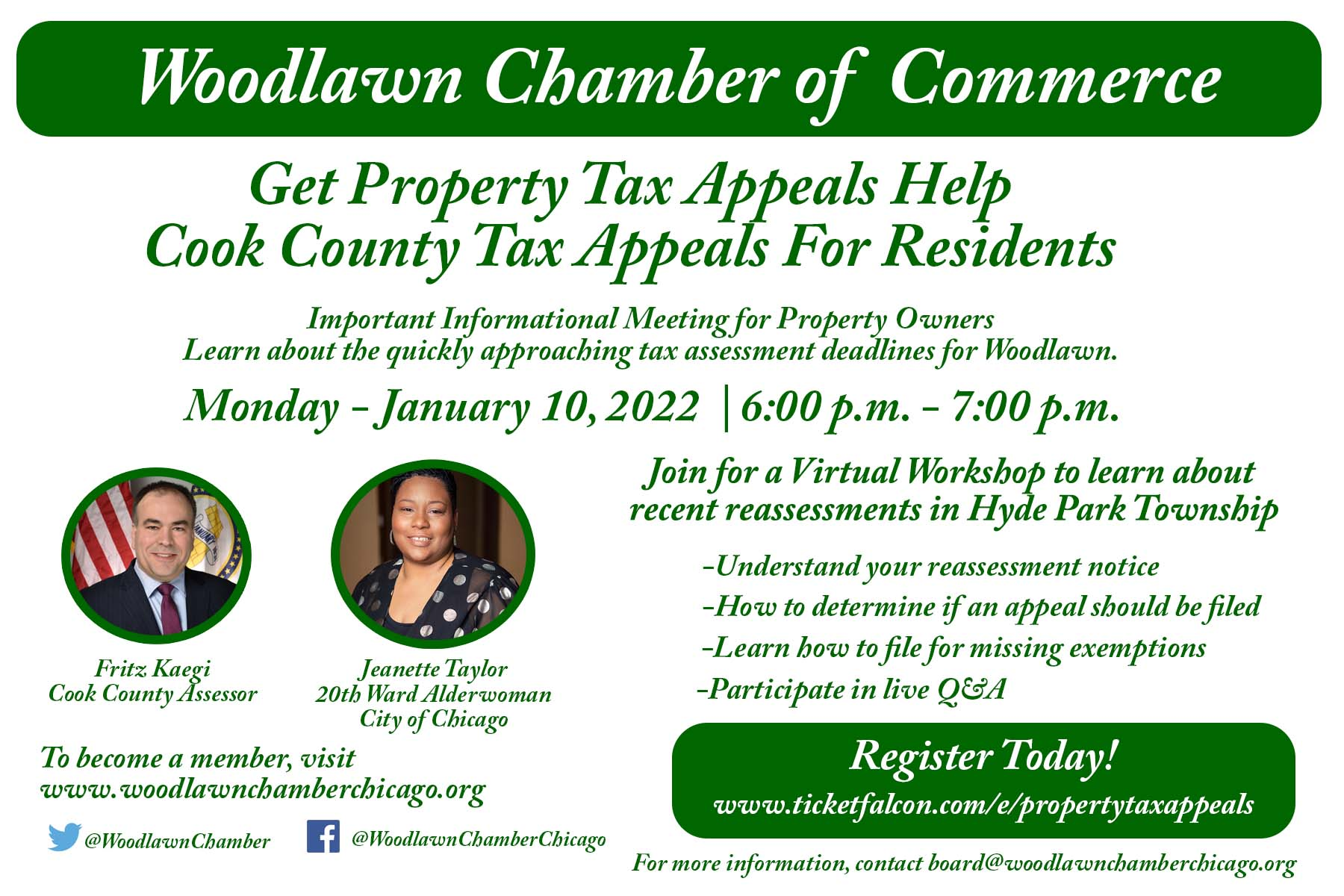

Get Cook County Property Tax Appeals Help Tickets – Powered by Ticket – Source www.ticketfalcon.com

Here’s what you need to know about the Cook County Property Tax Second Installment 2022:

- The due date is August 1, 2023.

- The average homeowner can expect to pay around $4,000.

- You can pay online, by mail, or in person.

- If you don’t pay your taxes on time, you may be charged penalties and interest.

Cook County Property Tax Second Installment 2022: A Personal Experience

I’m a homeowner in Cook County, and I know firsthand how burdensome property taxes can be. My property taxes have gone up every year since I bought my house. Last year, I paid over $5,000 in property taxes.

Cook County Tax Appeal: How do I know if my property taxes are going up – Source www.hermosachi.com

I’m concerned about how I’m going to afford my property taxes in the future. I’m on a fixed income, and my property taxes are eating up a large chunk of my budget. I’m not sure what I’m going to do if my property taxes continue to increase.

Cook County Property Tax Second Installment 2022: The History and the Myth

The history of property taxes in Cook County is a long and complicated one. The first property taxes were levied in Cook County in the early 1800s. At that time, property taxes were used to fund local governments and schools.

Cook County Property Tax Assessment – Source www.cutmytaxes.com

Over the years, property taxes in Cook County have been used to fund a variety of programs and services, including roads, parks, and libraries. Today, property taxes are the primary source of revenue for local governments in Cook County.

Cook County Property Tax Second Installment 2022: The Hidden Secrets

There are a few things that most people don’t know about property taxes in Cook County. Here are a few of the hidden secrets:

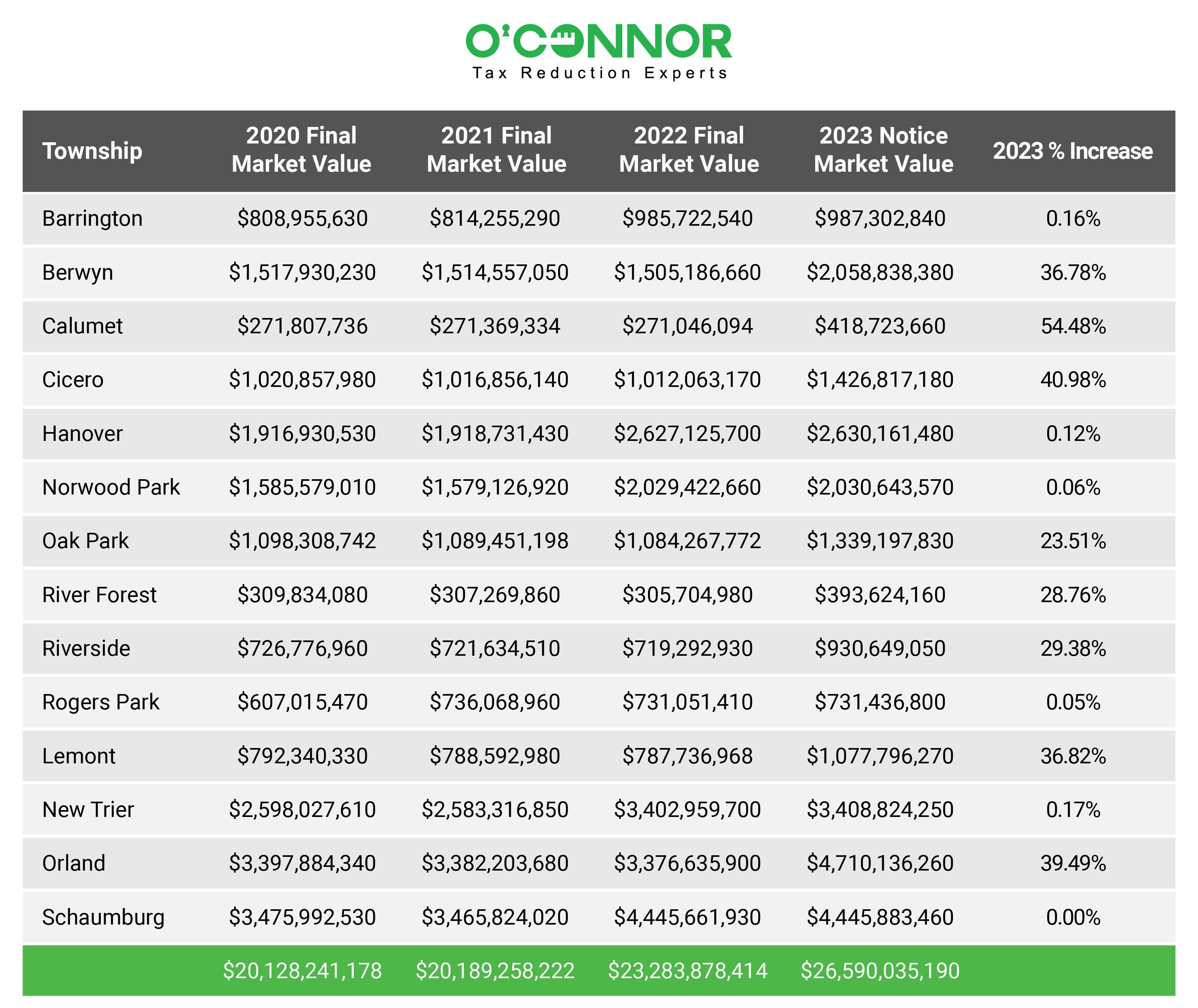

- Property taxes are based on the assessed value of your property. This means that if your property value goes up, your property taxes will go up as well.

- You can appeal your property assessment if you think it’s inaccurate.

- There are a number of property tax relief programs available for low-income homeowners and homeowners with disabilities.

Cook County Property Tax Second Installment 2022: Recommendations

If you’re struggling to pay your property taxes, there are a few things you can do:

- Contact your local government and ask about property tax relief programs.

- Appeal your property assessment if you think it’s inaccurate.

- Consider refinancing your mortgage to get a lower interest rate and monthly payment.

Cook County Property Tax Second Installment 2022: Tips

Here are a few tips for paying your property taxes on time:

- Mark the due date on your calendar.

- Set up a reminder on your phone or computer.

- Pay your taxes online or by mail at least a week before the due date.

Cook County Property Tax Second Installment 2022: Fun Facts

Here are a few fun facts about property taxes in Cook County:

- The average effective property tax rate in Cook County is 2.3%, which is more than double the national average.

- The highest property tax rate in Cook County is 3.3%, which is found in the village of Oak Park.

- The lowest property tax rate in Cook County is 1.2%, which is found in the village of Thornton.

Cook County Property Tax Second Installment 2022: How To

If you’re not sure how to pay your Cook County property taxes, here’s a step-by-step guide:

- Gather your property tax bill.

- Choose a payment method. You can pay online, by mail, or in person.

- Follow the instructions on your property tax bill to make your payment.

Cook County Property Tax Second Installment 2022: What If

What if you can’t pay your property taxes on time? If you can’t pay your property taxes on time, you may be charged penalties and interest. The penalty for late payment is 1.5% per month, and the interest rate is 10% per year.

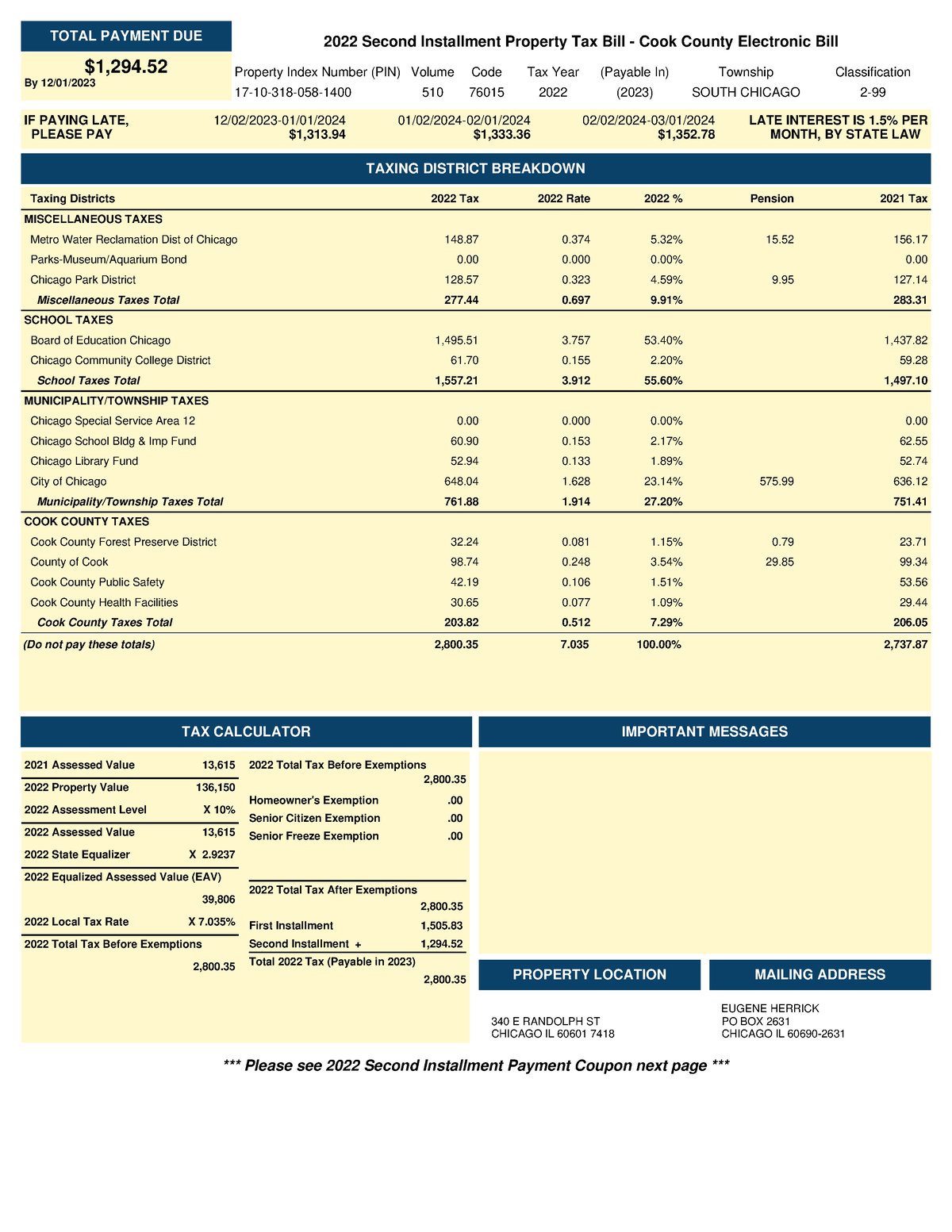

Cook County Property Tax Bill 2022Second Installment – IF PAYING LATE – Source www.studocu.com

If you’re having trouble paying your property taxes, you should contact your local government and ask about property tax relief programs. You may also be able to get a payment plan that allows you to pay your taxes over time.

Cook County Property Tax Second Installment 2022: Listicle

Here’s a listicle of the key points about the Cook County Property Tax Second Installment 2022:

- The due date is August 1, 2023.

- The average homeowner can expect to pay around $4,000.

- You can pay online, by mail, or in person.

- If you don’t pay your taxes on time, you may be charged penalties and interest.

- There are a number of property tax relief programs available for low-income homeowners and homeowners with disabilities.

Questions and Answers about Cook County Property Tax Second Installment 2022

Here are some frequently asked questions about the Cook County Property Tax Second Installment 2022:

- When is the due date for the Cook County Property Tax Second Installment 2022?

- How much can I expect to pay?

- How can I pay my taxes?

- What happens if I don’t pay my taxes on time?

The due date for the Cook County Property Tax Second Installment 2022 is August 1, 2023.

The average homeowner in Cook County can expect to pay around $4,000 in property taxes this year.

You can pay your taxes online, by mail, or in person.

If you don’t pay your taxes on time, you may be charged penalties and interest.

Conclusion of Cook County Property Tax Second Installment 2022

The Cook County Property Tax Second Installment 2022 is due on August 1, 2023. The average homeowner in Cook County can expect to pay around $4,000 in property taxes this year. If you haven’t already paid your first installment, you can expect to pay both installments on August 1st.