DuPage County Property Tax Appeals: Guide To Lowering Your Tax Bill

Are you a homeowner in DuPage County struggling to keep up with your property taxes? You’re not alone. Property taxes in DuPage County are among the highest in the country, and they can be a major financial burden for many families.

Unsecured Property Tax Los Angeles County – Property Tax Portal – Source propertytax.lacounty.gov

Burdensome Property Taxes

High property taxes can make it difficult to afford a home, save for retirement, and plan for the future. If you’re struggling to pay your property taxes, you may be eligible for a property tax appeal. A successful appeal can lower your property tax bill, freeing up money for other expenses.

Understanding your Property Tax Bill – Township of Cavan Monaghan – Source www.cavanmonaghan.net

Lowering Your Tax Bill

DuPage County offers a number of programs and services to help homeowners lower their property taxes. One of the most effective ways to reduce your tax bill is to file a property tax appeal. An appeal is a formal request to the DuPage County Board of Review to lower your property’s assessed value.

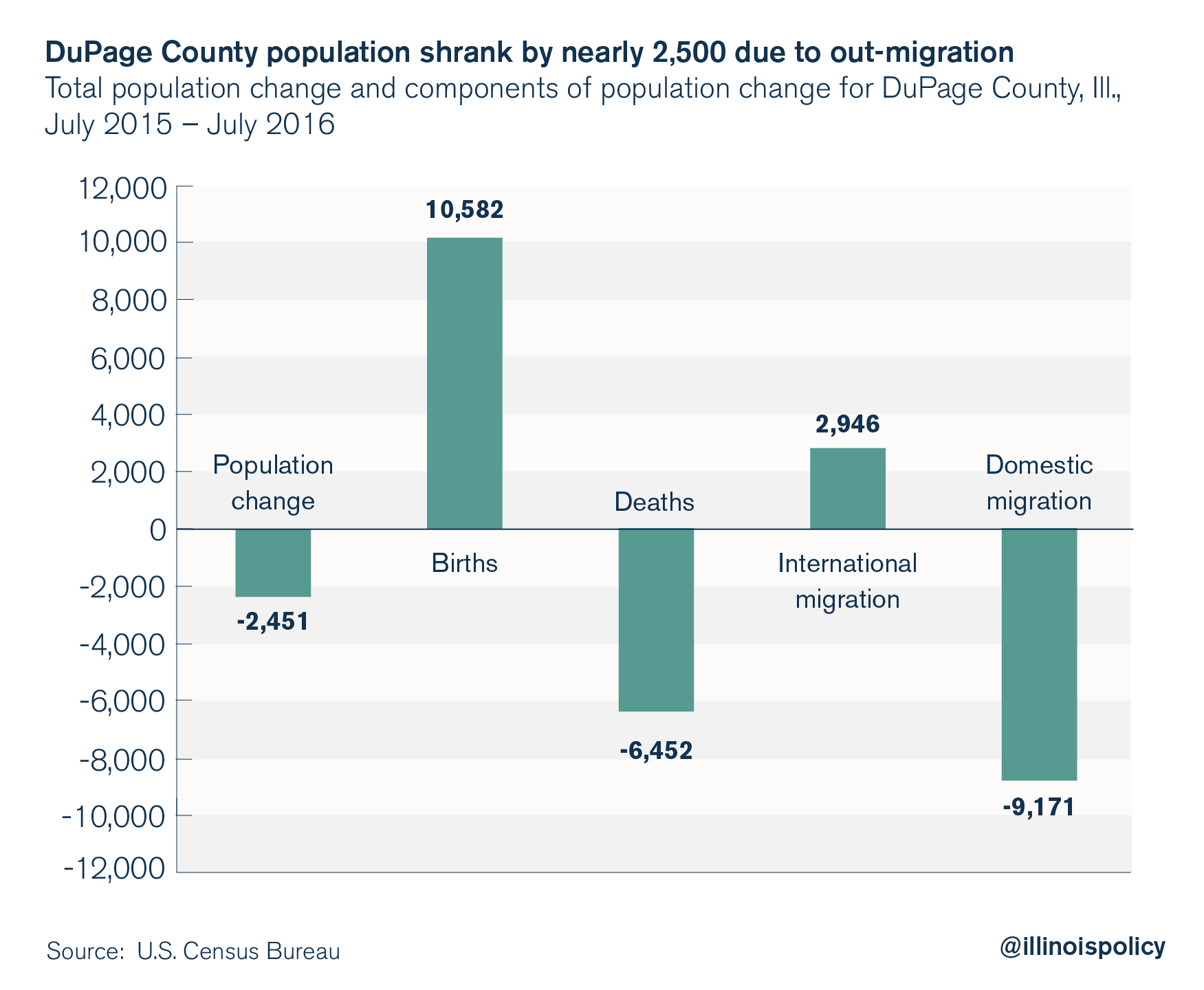

DuPage County population shrank by nearly 2,500 from 2015-2016 – Source www.illinoispolicy.org

Summary

If you’re a homeowner in DuPage County, you may be able to lower your property taxes by filing an appeal. The process is relatively simple, and it can save you money on your tax bill.

Nassau County Property Tax –

How to File an Appeal

To file an appeal, you’ll need to gather some basic information about your property, including its assessed value, its market value, and any recent improvements you’ve made. You’ll also need to provide evidence to support your claim that your property is overassessed.

What is an Assessed Value?

Your property’s assessed value is the value that the county uses to calculate your property taxes. This value is typically based on a recent appraisal of your property. However, it’s important to note that the assessed value is not always the same as the market value of your property.

History and Myths

The history of property tax appeals in DuPage County is long and complex. There are many myths and misconceptions about the process. One common myth is that only wealthy homeowners can successfully appeal their property taxes. This is not true. Homeowners of all income levels can file an appeal.

Hidden Secrets

There are a number of hidden secrets to successfully appealing your property taxes in DuPage County. One of the most important secrets is to get started early. The sooner you file your appeal, the more time you’ll have to gather evidence and prepare your case.

Recommendations

If you’re thinking about filing a property tax appeal in DuPage County, there are a few things you should keep in mind. First, it’s important to do your research and understand the process. Second, you should gather as much evidence as possible to support your claim. Third, you should be prepared to present your case to the Board of Review.

Evidence and Documentation

When you file an appeal, you’ll need to provide evidence to support your claim that your property is overassessed. This evidence can include:

- A recent appraisal of your property

- Comparable sales data

- Evidence of any recent improvements you’ve made to your property

Tips for Success

Here are a few tips for successfully appealing your property taxes in DuPage County:

- File your appeal early.

- Gather as much evidence as possible.

- Be prepared to present your case to the Board of Review.

- Don’t be afraid to ask for help.

Deadlines and Timelines

The deadline to file an appeal in DuPage County is May 1 of the year following the assessment. However, it’s important to note that the earlier you file your appeal, the more time you’ll have to gather evidence and prepare your case.

Fun Facts

Here are a few fun facts about property tax appeals in DuPage County:

- The average property tax bill in DuPage County is over $10,000.

- Over 100,000 property tax appeals are filed in DuPage County each year.

- The success rate of property tax appeals in DuPage County is about 50%.

How to Get Help

If you need help filing a property tax appeal in DuPage County, there are a number of resources available to you. You can contact the DuPage County Assessor’s Office, the DuPage County Bar Association, or a private property tax consultant.

What if I Lose?

If you lose your property tax appeal, you have the right to appeal the decision to the Illinois Property Tax Appeal Board. The PTAB is an independent state agency that reviews property tax appeals.

Listicle

Here is a listicle of tips for successfully appealing your property taxes in DuPage County:

- File your appeal early.

- Gather as much evidence as possible.

- Be prepared to present your case to the Board of Review.

- Don’t be afraid to ask for help.

- Be patient.

Conclusion of DuPage County Property Tax Appeals: Guide To Lowering Your Tax Bill

Filing a property tax appeal can be a daunting task, but it’s worth it if you’re successful. By following the tips in this guide, you can increase your chances of lowering your property tax bill.