Do you know that you could potentially be owed a refund on your Cook County property taxes? Many homeowners are unaware of this little-known program, which can put hundreds or even thousands of dollars back in your pocket. Read on to learn more about Cook County property tax refunds and how you can claim yours.

Filing your taxes can be a daunting task, and it’s easy to miss out on deductions and credits that you’re entitled to. One such deduction is the Cook County property tax refund. This refund is available to homeowners who have paid property taxes in Cook County, Illinois. The amount of the refund varies depending on your income and the amount of property taxes you paid.

Tips to get a Bigger Tax Refund this Year – Money Savvy Living – Source moneysavvyliving.com

The Cook County property tax refund is a valuable resource that can help you save money on your taxes. If you’re a homeowner in Cook County, be sure to file for a refund. It’s easy to do, and it could put hundreds or even thousands of dollars back in your pocket.

What is the Cook County Property Tax Refund program?

The Cook County property tax refund program is a program that provides refunds to homeowners who have paid property taxes in Cook County, Illinois. The amount of the refund varies depending on your income and the amount of property taxes you paid. To be eligible for the refund, you must meet the following requirements:

- You must be a homeowner in Cook County, Illinois.

- You must have paid property taxes in Cook County, Illinois.

- Your income must be below a certain level.

The income limits for the Cook County property tax refund program are as follows:

- For single filers, the income limit is $50,000.

- For married couples filing jointly, the income limit is $100,000.

If you meet the eligibility requirements, you can file for a Cook County property tax refund by completing the following steps:

- Download the Cook County property tax refund application form.

- Fill out the application form and attach all required documentation.

- Mail the completed application form to the Cook County Treasurer’s Office.

History and Myths of the Cook County Property Tax Refund Program

The Cook County property tax refund program was created in 1979. The program was designed to provide relief to homeowners who were struggling to pay their property taxes. Over the years, the program has been expanded to include more homeowners.

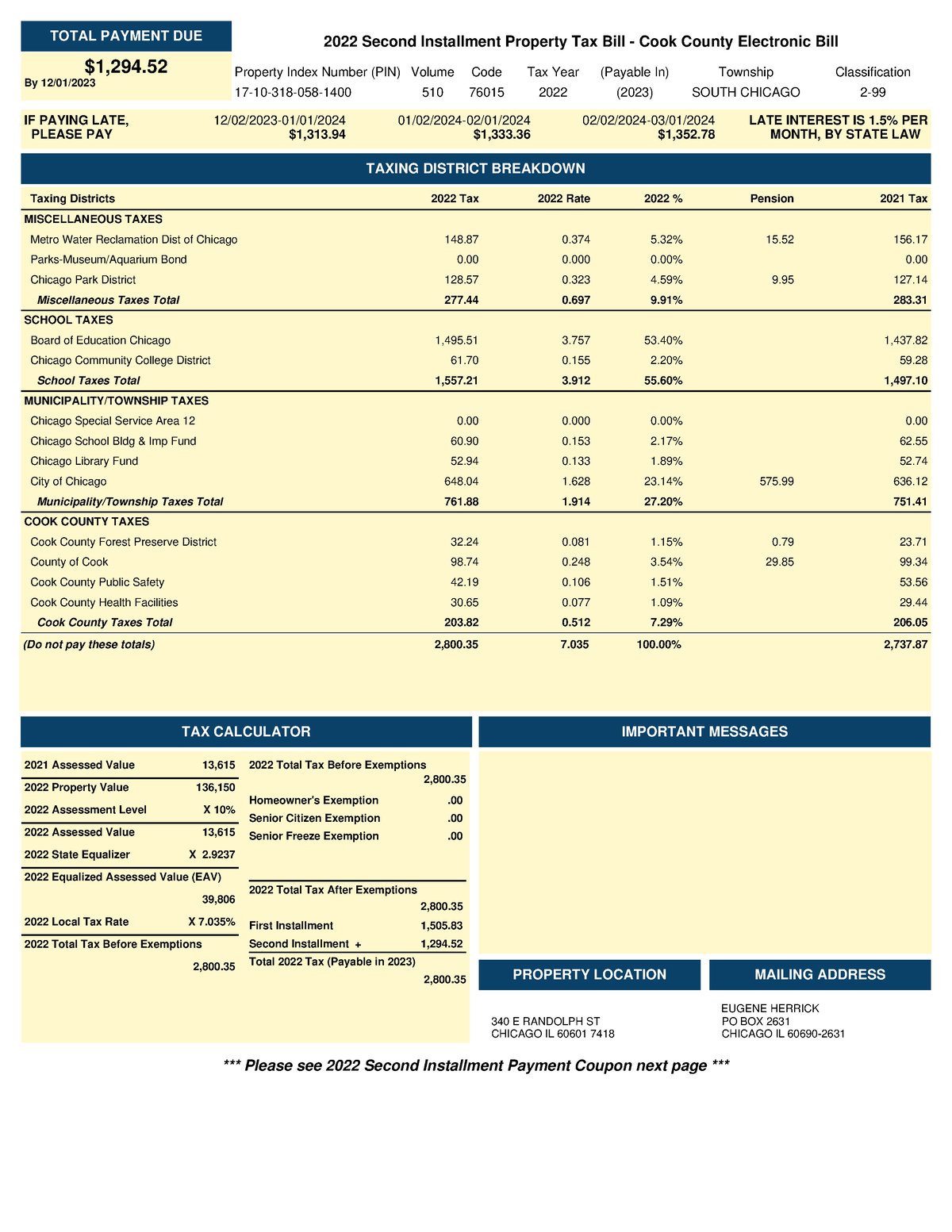

Cook County Property Tax Bill 2022Second Installment – IF PAYING LATE – Source www.studocu.com

There are a number of myths about the Cook County property tax refund program. One myth is that the program is only available to low-income homeowners. This is not true. Homeowners of all income levels can qualify for the refund.

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F24202004%2Fmerlin_106730316.jpg)

Cook County property tax bills finally posted online after monthslong – Source chicago.suntimes.com

Another myth is that the refund is only available to homeowners who have lived in Cook County for a long time. This is also not true. Homeowners who have recently moved to Cook County can also qualify for the refund.

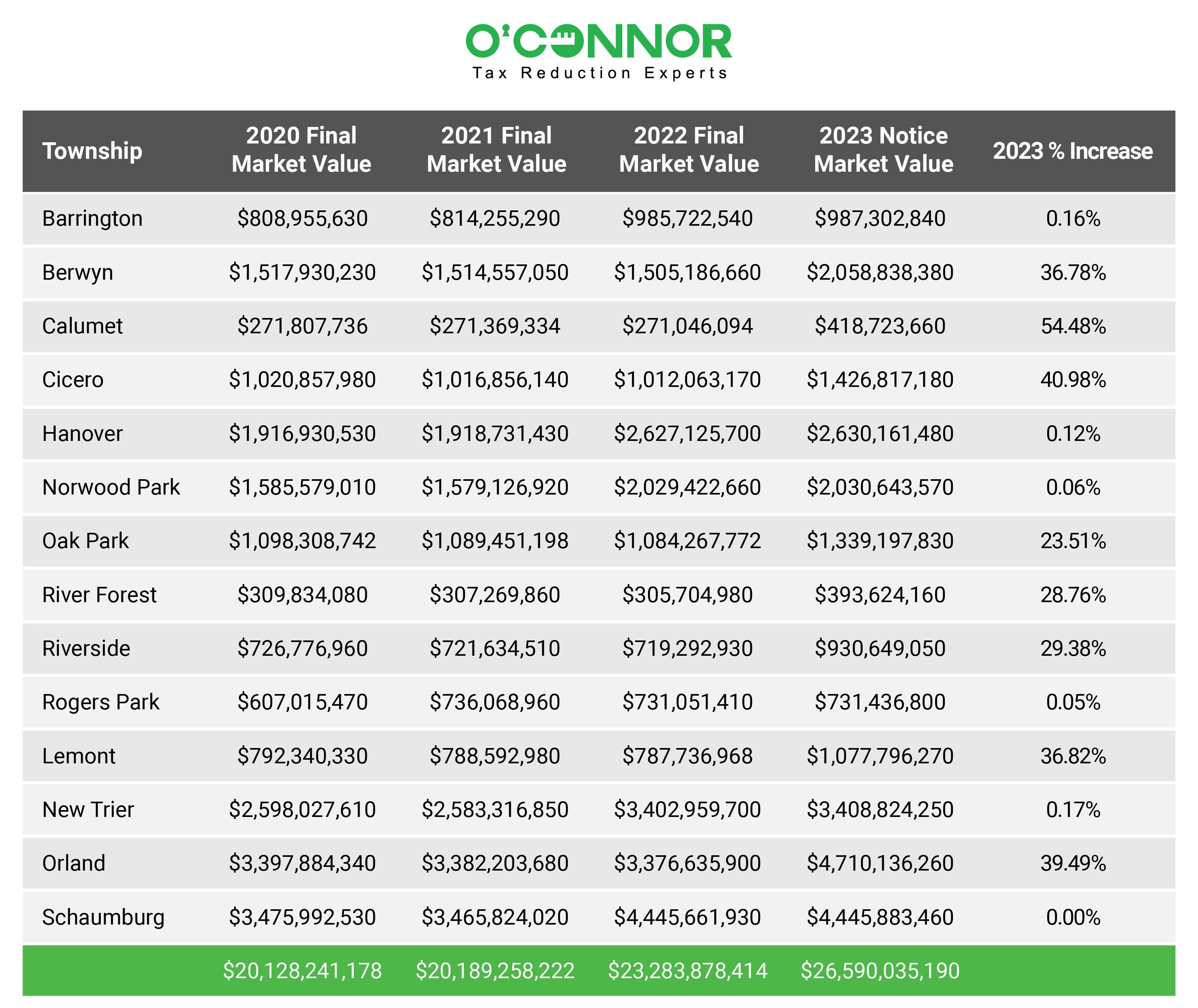

Cook County Property Tax Assessment – Source www.cutmytaxes.com

Hidden Secrets of the Cook County Property Tax Refund Program

There are a number of hidden secrets about the Cook County property tax refund program. One secret is that the program is not well-publicized. Many homeowners are unaware of the program and miss out on the opportunity to claim a refund.

Cook County Tax Appeal: How do I know if my property taxes are going up – Source www.hermosachi.com

Another secret is that the program is not difficult to apply for. The application process is simple and straightforward. Homeowners can file for a refund online or by mail.

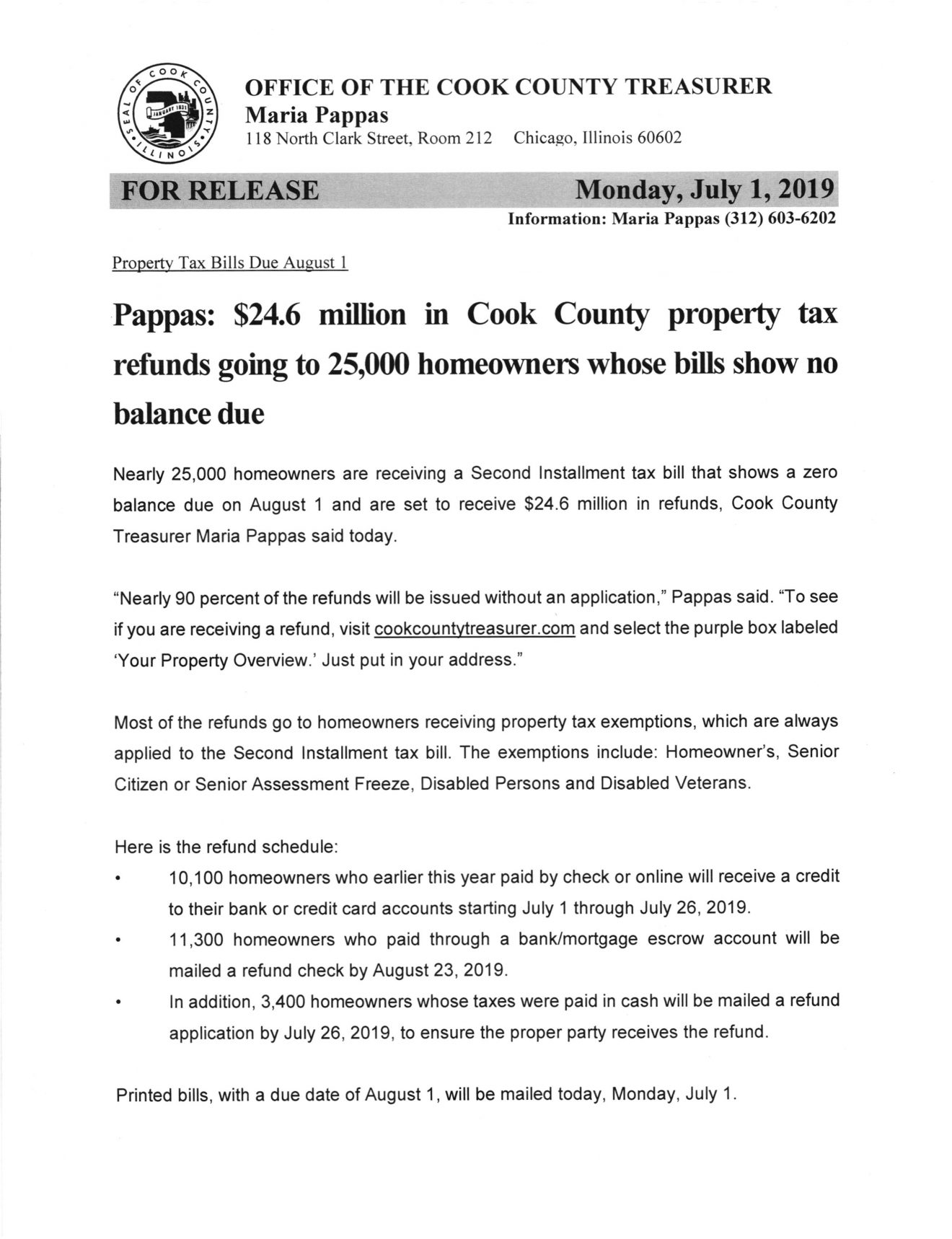

Cook County Property Tax Refunds – Village Of Alsip – Source villageofalsip.org

Recommendations for the Cook County Property Tax Refund Program

There are a number of recommendations that can be made to improve the Cook County property tax refund program. One recommendation is to increase the income limits for the program. This would allow more homeowners to qualify for the refund.

Homeowners Exemption Cook County Form 2023 – ExemptForm.com – Source www.exemptform.com

Another recommendation is to increase the amount of the refund. The current refund amount is relatively small and does not provide significant relief to homeowners.

Million Property Tax Refunds – Chicago Cook County Homeowners – Source texasbreaking.com

Tips for Filing for a Cook County Property Tax Refund

There are a number of tips that can help you file for a Cook County property tax refund. One tip is to file early. The earlier you file, the sooner you will receive your refund.

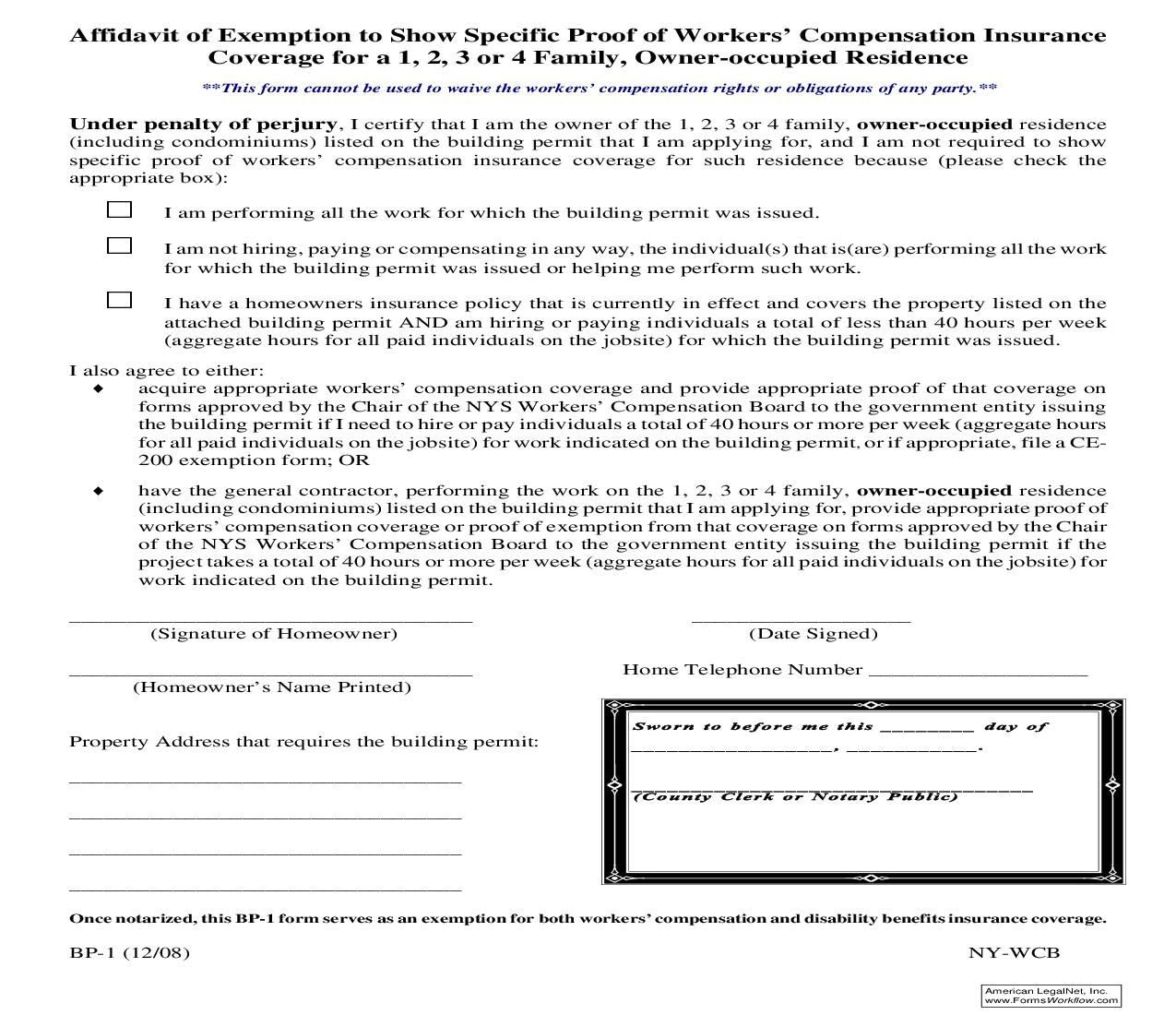

Form To Appeal Taxes In Cook County – CountyForms.com – Source www.countyforms.com

Another tip is to be organized. When you file for a refund, you will need to provide documentation to support your claim. Having all of your documentation organized will make the filing process easier.

Cook County likely to again delay property tax payment deadline | Crain – Source www.chicagobusiness.com

Fun Facts about the Cook County Property Tax Refund Program

There are a number of fun facts about the Cook County property tax refund program. One fun fact is that the program has been in existence for over 40 years.

Another fun fact is that the program has helped millions of homeowners save money on their property taxes.

How to File for a Cook County Property Tax Refund

If you are a homeowner in Cook County, Illinois, you may be eligible for a property tax refund. To file for a refund, you will need to complete the following steps:

- Download the Cook County property tax refund application form.

- Fill out the application form and attach all required documentation.

- Mail the completed application form to the Cook County Treasurer’s Office.

What if I Don’t Qualify for a Cook County Property Tax Refund?

If you do not qualify for a Cook County property tax refund, there are still a number of other ways to save money on your property taxes. One option is to appeal your property tax assessment. If your assessment is too high, you may be able to get it reduced.

Another option is to apply for a property tax exemption. There are a number of exemptions available, including exemptions for seniors, veterans, and disabled homeowners.

Listicle of Cook County Property Tax Refund Program

- The Cook County property tax refund program is available to homeowners who have paid property taxes in Cook County, Illinois.

- The amount of the refund varies depending on your income and the amount of property taxes you paid.

- To be eligible for the refund, you must meet the following requirements:

- You must be a homeowner in Cook County, Illinois.

- You must have paid property taxes in Cook County, Illinois.

- Your income must be below a certain level.

- The income limits for the Cook County property tax refund program are as follows:

- For single filers, the income limit is $50,000.

- For married couples filing jointly, the income limit is $100,000.

- If you meet the eligibility requirements, you can file for a Cook County property tax refund by completing the following steps:

- Download the Cook County property tax refund application form.

- Fill out the application form and attach all required documentation.

- Mail the completed application form to the Cook County Treasurer’s Office.

- There are a number of myths about the Cook County property tax refund program. One myth is that the program is only available to low-income homeowners. This is not true. Homeowners of all income levels can qualify for the refund.

- Another myth is that the refund is only available to homeowners who have lived in Cook County for a long time. This is also not true. Homeowners who have recently moved to Cook County can also qualify for the refund.

- There are a number of hidden secrets about the Cook County property tax refund program. One secret is that the program is not well-publicized. Many homeowners are unaware of the program and miss out on the opportunity to claim a refund.

- Another secret is that the program is not difficult to apply for. The application process is simple and straightforward. Homeowners can file for a refund online or by mail.

- There are a number of recommendations that can be made to improve the Cook County property tax refund program. One recommendation is to increase the income limits for the program. This would allow more homeowners to qualify for the refund.

- Another recommendation is to increase the amount of the refund. The current refund amount is relatively small and does not provide significant relief to homeowners.

- There are a number of tips that can help you file for a Cook County property tax refund. One tip is to file early. The earlier you file, the sooner you will receive your refund.

- Another tip is to be organized. When you file for a refund, you will need to provide documentation to support your claim. Having all of your documentation organized will make the filing process easier.

- If you are a homeowner in Cook County