Navigating the intricacies of property taxes can be a daunting task, especially in metropolitan areas like Cook County. Understanding the factors that determine your property tax bill is crucial for effective budgeting and ensuring you’re paying the correct amount.

Pain Points of Property Tax Calculations

Determining property taxes can be a complex process, leading to confusion and potential overpayments. The lack of transparency in the assessment process, the impact of exemptions and deductions, and the varying rates and multipliers used can add to the challenges faced by homeowners.

[Solved] calculating property tax. The assessed value of a property is – Source www.coursehero.com

Decoding Property Tax Calculations

Property taxes are calculated by multiplying the property’s assessed value by the tax rate. The assessed value represents the estimated market value of your property, while the tax rate is determined by the local taxing bodies. It’s essential to note that the assessed value may differ from the purchase price or market value.

Cook County Property Tax Assessment – Source www.cutmytaxes.com

Simplifying the Process

To ensure accuracy and understanding, it’s recommended to follow a step-by-step approach to calculating your property taxes. Begin by obtaining your property’s assessed value from the Cook County Assessor’s Office. Then, research the tax rate for your taxing district, which can be found on the Cook County Treasurer’s website. Multiply the assessed value by the tax rate to determine your base property tax liability.

Cook County judge to decide next week on challenge to Donald Trump’s – Source www.msn.com

Additional Considerations

In addition to the base tax amount, there may be additional charges or exemptions to consider. These adjustments can include exemptions for homesteads, seniors, and veterans. It’s important to investigate these options to reduce your tax liability.

Cook County State’s Attorney vacates 7 murder convictions tied to ex-cop – Source www.chicagojournal.com

Step-by-Step Guide to Calculating Property Taxes in Cook County

### Step 1: Determine Assessed Value

Visit the Cook County Assessor’s Office website or contact their office to obtain your property’s assessed value. This value is typically based on recent home sales in your area and may differ from the purchase price or market value.

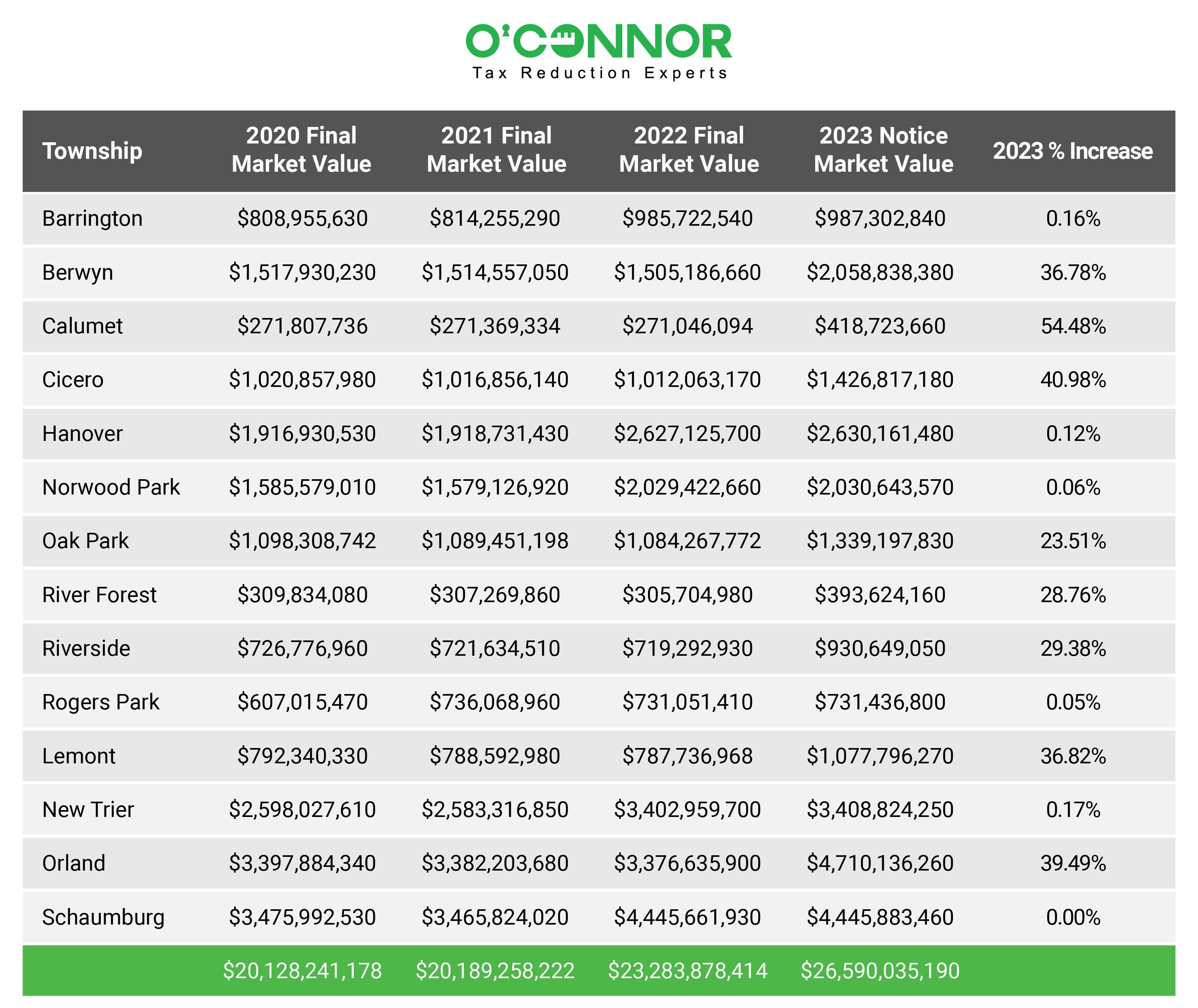

Cook County Tax Appeal: How do I know if my property taxes are going up – Source www.hermosachi.com

### Step 2: Research Tax Rate

Locate the tax rate for your taxing district on the Cook County Treasurer’s website. The tax rate is determined by the local taxing bodies, including the county, township, and municipality.

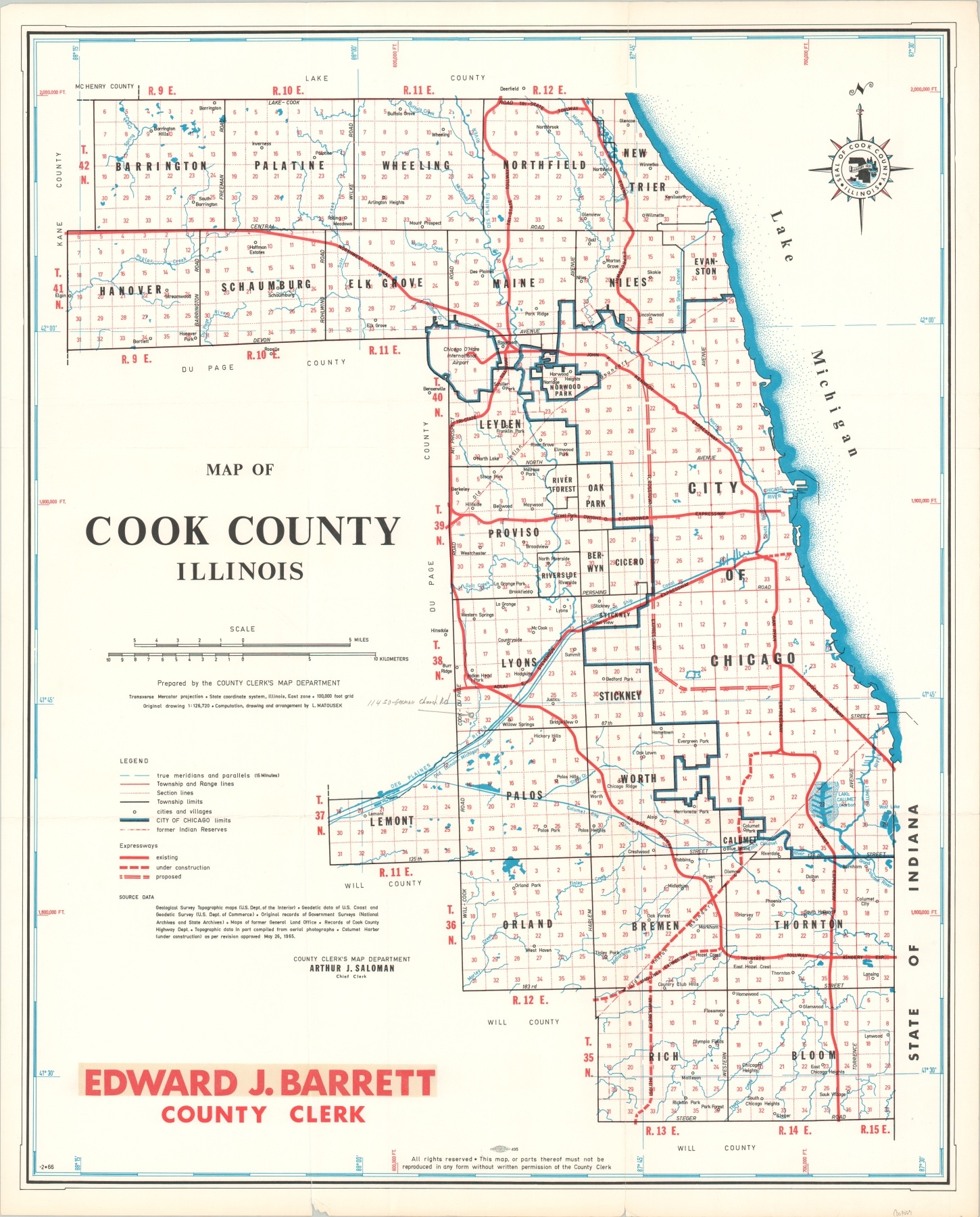

Map of Cook County Illinois | Curtis Wright Maps – Source curtiswrightmaps.com

### Step 3: Calculate Base Tax Liability

Multiply the assessed value by the tax rate to calculate your base property tax liability. This amount represents the primary component of your property tax bill.

Cook County Jail population declining, likely due to elimination of – Source www.wbez.org

History and Evolution of Property Tax Calculations

Property taxes have a long history, dating back to ancient civilizations. Originally, these taxes were levied to support public projects and infrastructure. Over time, the purpose of property taxes has evolved to include funding essential services such as education, healthcare, and public safety.

Cook County introduces game changing property tax software – Source www.audacy.com

Unveiling Hidden Secrets

In some cases, homeowners may be unaware of exemptions or deductions that can significantly reduce their property tax liability. Research available exemptions, such as homestead exemptions for primary residences, senior citizen exemptions, and veteran’s exemptions. By taking advantage of these benefits, you can potentially lower your tax bill.

Homeowners Exemption Cook County Form 2023 – ExemptForm.com – Source www.exemptform.com

Recommendations for Accurate Calculations

To ensure accurate property tax calculations, consider the following recommendations: Obtain a recent assessment notice from the Cook County Assessor’s Office to ensure you have the most up-to-date assessed value. Carefully review your property tax bill to identify any errors or discrepancies. Contact the Cook County Treasurer’s Office if you have questions or concerns regarding your property tax assessment.

Officials Search for Legislative Fixes To Cook County’s Convoluted Tax – Source illinoisanswers.org

Assessment Process and Tax Rate Determination

The assessment process involves evaluating the property’s characteristics, such as size, location, and amenities. These factors are used to determine the assessed value. The tax rate is set by local taxing bodies and can vary depending on the jurisdiction and the level of services provided.

Tips to Optimize Property Tax Calculations

Additional Resources for Homeowners

For further assistance with property tax calculations in Cook County, homeowners can refer to the following resources: Cook County Assessor’s Office website: Provides information on property assessments and exemptions. Cook County Treasurer’s Office website: Offers details on tax rates and payment options.

Fun Facts about Property Tax Calculations

Did you know that some states in the U.S. do not impose property taxes? Alaska, Delaware, and Wyoming are among these states.

How to Dispute Property Tax Calculations

If you believe your property tax assessment is inaccurate, you have the right to file an appeal. The process and deadlines for appeals vary, so it’s essential to contact the Assessor’s Office promptly.

What If Calculations Are Incorrect?

If you discover that your property tax calculations are incorrect, you should contact the Assessor’s Office or the Treasurer’s Office immediately. They can investigate the error and make the necessary adjustments to your assessment or tax bill.

Listicle of Important Considerations

Here’s a listicle of factors to keep in mind when calculating property taxes in Cook County: Assessed Value: Obtain an accurate assessed value from the Assessor’s Office. Tax Rate: Research the tax rate applicable to your taxing district. Exemptions: Explore available exemptions that can reduce your tax liability. Deadlines: Note the deadlines for property tax payments and assessment appeals.

Questions and Answers

Conclusion of Step-by-Step Guide to Calculating Property Taxes in Cook County

By following these steps and leveraging the resources provided, homeowners in Cook County can ensure accurate property tax calculations and optimize their tax liability. Remember to stay informed, review your assessments and tax bills regularly, and contact the relevant authorities if you have any questions or concerns.