Heading

Struggling to keep up with your property taxes? You’re not alone. Many homeowners find themselves in a bind when the second installment property tax due date approaches. But don’t panic! There are options available to help you get caught up.

Second Installment Property Tax Due Date: What You Need to Know

City of Berwyn – 2020 Second Installment Property Tax… – Source www.facebook.com

The second installment property tax due date is the date by which you must pay the second half of your annual property taxes. This date varies from state to state, but it typically falls in late summer or early fall. If you miss the due date, you may be charged late fees and interest.

Here’s a summary of the key points about second installment property tax due dates:

When Is 2nd Installment For Cook County 2024 – Faina Jasmina – Source eadaqloraine.pages.dev

- The second installment property tax due date is the date by which you must pay the second half of your annual property taxes.

- This date varies from state to state, but it typically falls in late summer or early fall.

- If you miss the due date, you may be charged late fees and interest.

Second Installment Property Tax Due Date: Personal Experience

First-half property taxes due Friday – WJER Radio 100.9FM & 1450AM – Source www.wjer.com

I’ve been through the stress of missing a second installment property tax due date before. I was new to homeownership and didn’t realize the importance of staying on top of my tax payments. As a result, I ended up paying a hefty late fee.

Since then, I’ve learned my lesson and made sure to pay my property taxes on time. I’ve also set up a reminder system to help me stay organized.

Second Installment Property Tax Due Date: History and Myths

When Are Cook County Property Taxes Due 2024 – Edie Agnesse – Source gwenethwlesli.pages.dev

The history of property taxes dates back to ancient times. In the United States, the first property tax was levied in the Massachusetts Bay Colony in 1634.

There are a number of myths about property taxes. One common myth is that property taxes are only paid by homeowners. In reality, all property owners, including businesses and rental property owners, are responsible for paying property taxes.

Second Installment Property Tax Due Date: Hidden Secrets

PERSONAL PROPERTY TAX DUE WED OCT 5 – Source www.fairfaxunderground.com

There are a few hidden secrets about second installment property tax due dates that you may not know.

- In some states, you can get a discount if you pay your property taxes early.

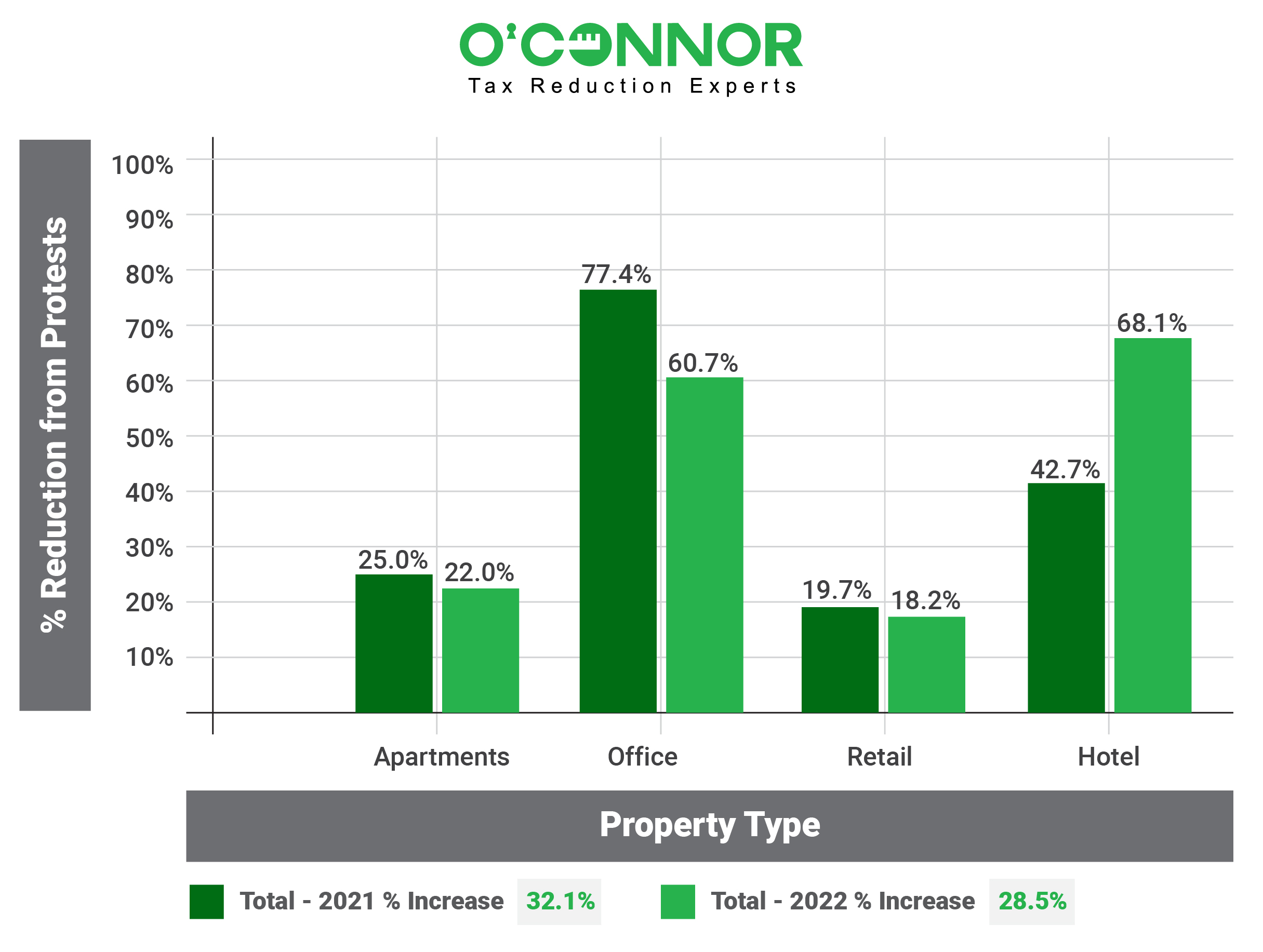

- You may be able to appeal your property assessment if you believe it is inaccurate.

- There are a number of programs available to help low-income homeowners pay their property taxes.

Second Installment Property Tax Due Date: Recommendations

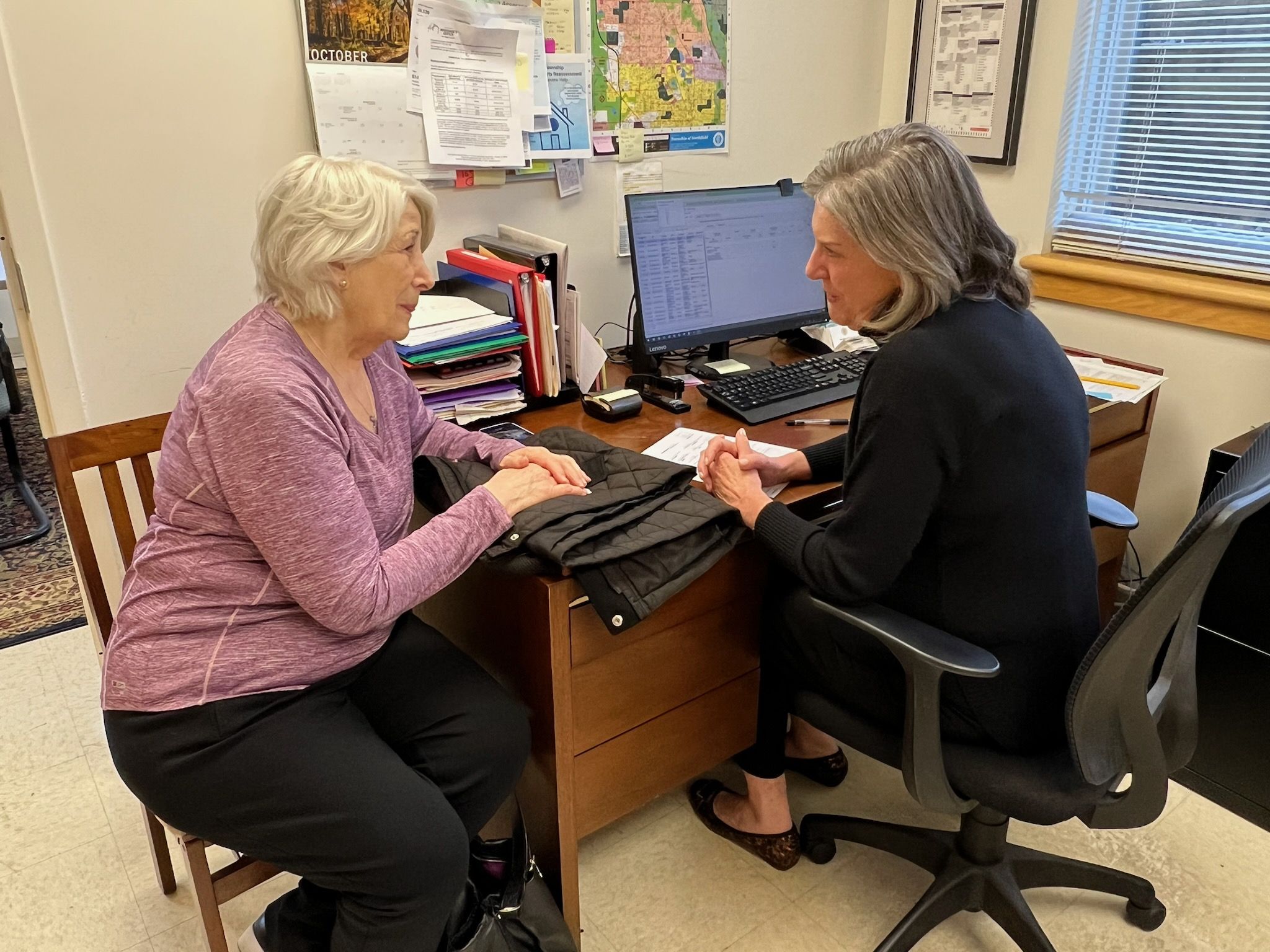

Property Tax Assistance – Northfield Township – Source northfieldtownship.com

Here are a few recommendations to help you stay on top of your second installment property tax due dates:

- Mark the due date on your calendar and set up reminders.

- Consider setting up a payment plan with your local tax assessor.

- If you’re struggling to pay your property taxes, contact your local tax assessor to see if you qualify for any assistance programs.

Second Installment Property Tax Due Date: Tips and Tricks

March Property Taxes are due by March 31, 2023 – Poweshiek County, Iowa – Source poweshiekcounty.org

Here are a few tips and tricks to help you avoid missing your second installment property tax due date:

- Keep your property tax bill in a safe place where you can easily find it.

- Set up a reminder system, such as a calendar alert or email reminder.

- Consider setting up a payment plan with your local tax assessor.

Second Installment Property Tax Due Date: Fun Facts

When Is Property Tax Due 2024 – Berna Stoddard – Source josselynwleese.pages.dev

Here are a few fun facts about second installment property tax due dates:

- The average American homeowner pays about $2,000 in property taxes each year.

- Property taxes are the largest source of revenue for local governments.

- The first property tax in the United States was levied in the Massachusetts Bay Colony in 1634.

Second Installment Property Tax Due Date: How to

Second installment property tax bills months late – Wednesday Journal – Source www.oakpark.com

Here are the steps on how to pay your second installment property taxes:

- Gather your property tax bill.

- Write a check or money order for the full amount of the bill.

- Mail your payment to the address on the bill.

Second Installment Property Tax Due Date: What If

DHA Quetta Installment Plan Payment Schedule | eProperty® – Source eproperty.pk

Here are a few things that can happen if you miss your second installment property tax due date:

- You may be charged late fees and interest.

- Your property may be subject to a tax lien.

- Your property may be sold at a tax auction.

Second Installment Property Tax Due Date: Listicle

Here is a listicle of things to remember about second installment property tax due dates:

- The due date varies from state to state.

- You may be charged late fees and interest if you miss the due date.

- There are a number of programs available to help low-income homeowners pay their property taxes.

- You can appeal your property assessment if you believe it is inaccurate.

- You can get a discount in some states if you pay your property taxes early.

Question and Answer

Here are a few questions and answers about second installment property tax due dates:

- When is the second installment property tax due date in my state?

- What happens if I miss the second installment property tax due date?

- How can I appeal my property assessment?

- Are there any programs available to help me pay my property taxes?

Conclusion of Second Installment Property Tax Due Date

Second installment property tax due dates can be a challenge, but they don’t have to be. By following the tips and recommendations in this article, you can stay on top of your property tax payments and avoid any penalties.