Are you tired of paying exorbitant property taxes? If so, it’s time to unlock the secrets of finding the Chicago suburbs with the lowest property taxes.

Understanding the Burden of High Property Taxes

Property taxes can be a significant financial burden, especially for homeowners on a tight budget. High property taxes can eat into your income and make it difficult to save for the future. In Chicago and its surrounding suburbs, property taxes can vary widely depending on the location. Finding a suburb with low property taxes can make a substantial difference in your monthly expenses.

Unlocking the Chicago Suburbs with the Lowest Property Taxes

The key to unlocking the Chicago suburbs with the lowest property taxes lies in understanding the factors that influence property tax rates. These factors include the local tax rate, the assessed value of your property, and any exemptions or deductions you may qualify for. By researching these factors and comparing them across different suburbs, you can identify the areas with the most favorable property tax rates.

The Benefits of Low Property Taxes

Lower property taxes can provide numerous financial benefits for homeowners:

Look out, wealthy Boston suburbs: Here comes the GOP tax bill – Source www.boston.com

- Increased savings: With lower property taxes, you can save more money each month, which can help you reach your financial goals faster.

- Improved cash flow: Lower property taxes can free up cash flow, allowing you to allocate more funds towards other expenses, such as retirement savings or home improvements.

- Increased home equity: Over time, lower property taxes can contribute to increased home equity, as you will be paying less in taxes and more towards the principal of your mortgage.

A Personal Journey of Unlocking Savings

I personally experienced the financial benefits of finding a Chicago suburb with low property taxes. After years of struggling to make ends meet in a suburb with high property taxes, I decided to research and compare property tax rates in different suburbs. To my surprise, I discovered that there were several suburbs just a short drive away that had significantly lower property taxes. I decided to move to one of these suburbs and immediately noticed a reduction in my monthly property tax bill. The savings I realized allowed me to allocate more money towards paying off my mortgage and other financial goals.

Understanding Unlocking Savings: Chicago Suburbs with the Lowest Property Taxes

Unlocking savings through Chicago suburbs with the lowest property taxes involves a comprehensive approach that considers the following factors:

- Location: Property tax rates vary from suburb to suburb, so it’s crucial to research and identify the suburbs with the most favorable rates.

- Property Value: The assessed value of your property determines the amount of property taxes you will owe. It’s important to ensure that your property is assessed fairly and accurately.

- Exemptions and Deductions: Many suburbs offer property tax exemptions or deductions for certain types of homeowners, such as seniors, veterans, and disabled individuals. It’s essential to explore these options and apply for any applicable exemptions or deductions.

The Hidden Secrets of Unlocking Savings

Beyond the obvious factors, there are often hidden secrets to unlocking even lower property taxes:

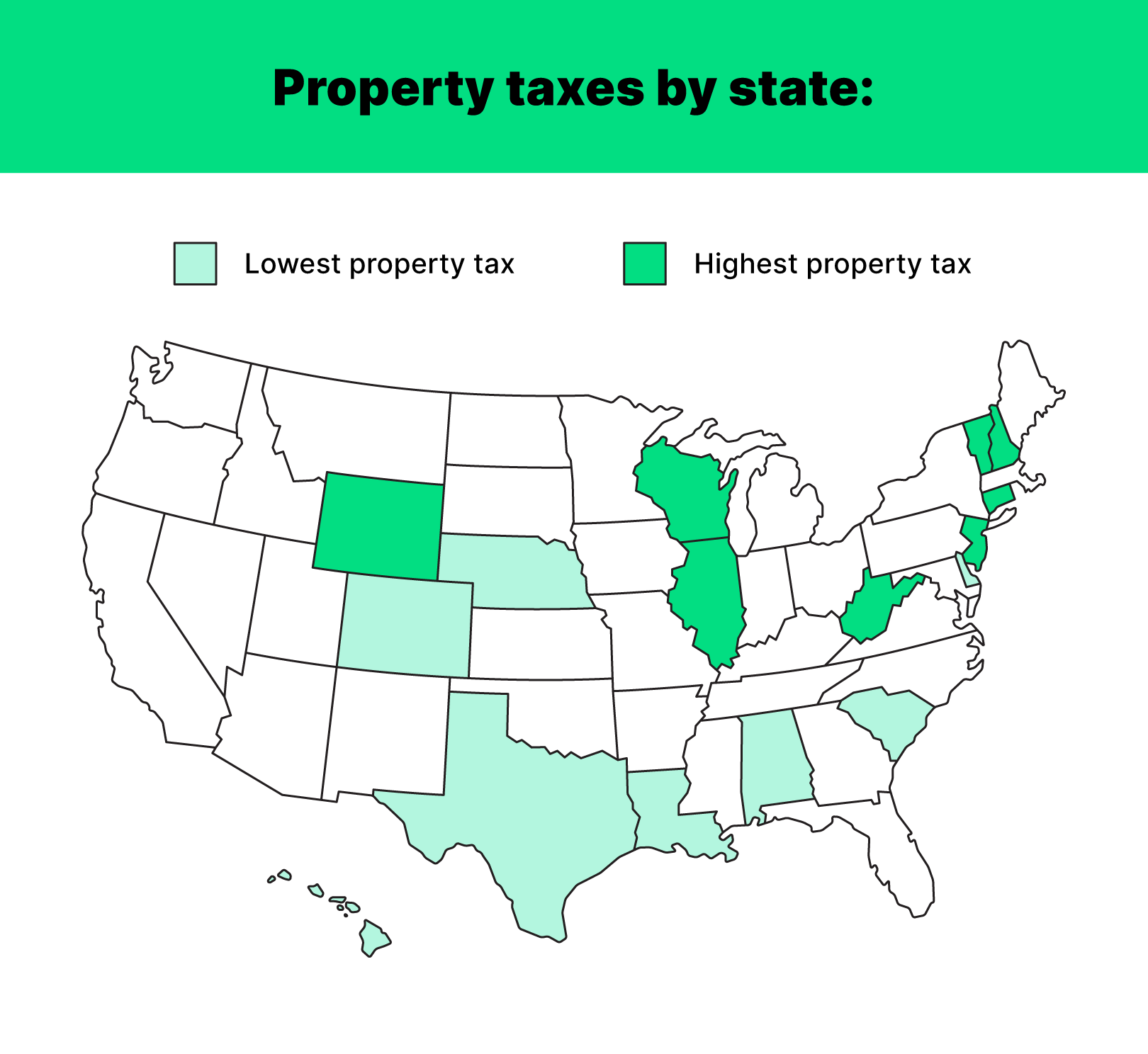

Your Guide to Property Taxes | Hippo – Source www.hippo.com

- Negotiating with the Assessor: In some cases, it may be possible to negotiate with the local property assessor to reduce your property’s assessed value, which can lead to lower property taxes.

- Property Tax Appeals: If you believe your property is overassessed, you can file a property tax appeal to challenge the assessment and potentially reduce your property taxes.

- Community Involvement: Actively participating in your community can sometimes lead to favorable property tax treatment. For example, some suburbs offer tax breaks to homeowners who volunteer for local organizations or serve on community boards.

Recommendations for Unlocking Savings

To unlock the maximum savings on your property taxes, consider the following recommendations:

- Research and compare: Take the time to research property tax rates in different Chicago suburbs and compare them against your current location.

- Get a property assessment: Obtain a professional property assessment to ensure that your property is assessed fairly and accurately.

- Explore exemptions and deductions: Investigate all available property tax exemptions and deductions that you may qualify for.

- Negotiate with the assessor: If possible, negotiate with the local property assessor to reduce your property’s assessed value.

Tips for Unlocking Savings

In addition to the recommendations above, here are some additional tips for unlocking savings:

- Consider a smaller home: A smaller home will typically have a lower assessed value, resulting in lower property taxes.

- Look for homes in unincorporated areas: Unincorporated areas often have lower property tax rates than incorporated cities and villages.

- Avoid homes with special assessments: Special assessments are additional charges assessed on top of property taxes to cover the cost of local improvements, such as new roads or sidewalks. These assessments can significantly increase your property tax bill.

Fun Facts about Unlocking Savings

Did you know that Chicago has over 200 suburbs, each with its own unique property tax rate?

States With The Lowest Property Taxes In 2023 – Source www.biggerpockets.com

The average property tax rate in Chicago suburbs is around 2%, but it can vary significantly from suburb to suburb.

How to Unlock Savings

To unlock savings through Chicago suburbs with the lowest property taxes, follow these steps:

1. Research and compare property tax rates in different suburbs.

2. Get a property assessment to ensure your property is assessed fairly.

3. Explore exemptions and deductions that you may qualify for.

4. Negotiate with the local property assessor to reduce your property’s assessed value.

5. Consider a smaller home or a home in an unincorporated area.

6. Avoid homes with special assessments.

What if You Can’t Unlock Savings?

If you are unable to unlock significant savings through the methods described above, there may be other options available to you:

- Property tax refinancing: You may be able to refinance your mortgage to a lower interest rate, which can reduce your monthly mortgage payments and free up cash flow to cover property taxes.

- Property tax assistance programs: Some local governments offer property tax assistance programs for low-income homeowners. These programs can provide financial assistance to help cover property tax bills.

Listicle of Unlocking Savings

Here is a listicle summarizing the key points for unlocking savings:

- Research and compare property tax rates in different Chicago suburbs.

- Get a property assessment to ensure your property is assessed fairly.

- Explore exemptions and deductions that you may qualify for.

- Negotiate with the local property assessor to reduce your property’s assessed value.

- Consider a smaller home or a home in an unincorporated area.

- Avoid homes with special assessments.

Questions and Answers

Q: What is the average property tax rate in Chicago suburbs?

A: The average property tax rate in Chicago suburbs is around 2%.

Q: How can I find out the property tax rate for a specific suburb?

A: You can contact the local government or visit the county assessor’s website to find out the property tax rate for a specific suburb.

Q: What are some tips for reducing my property taxes?

A: Some tips for reducing your property taxes include researching and comparing property tax rates in different suburbs, getting a property assessment to ensure your property is assessed fairly, exploring exemptions and deductions that you may qualify for, negotiating with the local property assessor to reduce your property’s assessed value, considering a smaller home or a home in an unincorporated area, and avoiding homes with special assessments.

Q: What is a property tax appeal?

A: A property tax appeal is a process by which you can challenge the assessed value of your property and potentially reduce your property taxes.

Conclusion of Unlocking Savings: Chicago Suburbs with the Lowest Property Taxes

Unlocking savings through Chicago suburbs with the lowest property taxes requires careful research, planning, and negotiation. By following the tips and strategies outlined in this article, homeowners can reduce their property tax burden and free up valuable cash flow.