The clock is ticking for Cook County homeowners as property taxes are set to increase significantly in 2023. This is a concerning prospect, given the already burdensome property taxes that many are struggling to pay. With the increase, it’s essential to understand how it will impact homeowners and what measures can be taken to mitigate its financial burden.

Consequences of Cook County Property Tax Hike

Map of Cook County Illinois | Curtis Wright Maps – Source curtiswrightmaps.com

The rise in property taxes will undoubtedly strain the financial well-being of many Cook County homeowners. The additional tax burden will cut into disposable income, making it challenging to cover other essential expenses such as groceries, healthcare, and transportation. Those on fixed incomes, including seniors and retirees, will be particularly vulnerable to this increase.

Targets of Cook County Property Tax Hike

Cook County’s property tax increase will primarily target residential properties and businesses. Homeowners will bear the brunt of the additional tax burden, with commercial properties also seeing an increase in their tax bills.

Breakdown of Cook County Property Tax Increase

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F24202004%2Fmerlin_106730316.jpg)

Cook County property tax bills finally posted online after monthslong – Source chicago.suntimes.com

The increase in property taxes is primarily attributed to rising property values and inflationary pressures. The combination of these factors has resulted in a reassessment of property values, leading to higher tax bills. Additionally, local governments are facing increased spending demands, including infrastructure improvements and social programs, which are contributing to the tax hike.

Personal Experience and Insight into Cook County Property Tax Hike

States With The Lowest Property Taxes In 2023 – Source www.biggerpockets.com

As a resident of Cook County, I have witnessed firsthand the impact of rising property taxes. My property tax bill has increased steadily over the years, placing a significant strain on my household budget. The upcoming increase will only compound this financial challenge, making it imperative to explore options to minimize its impact.

Understanding Cook County Property Tax Hike History and Myths

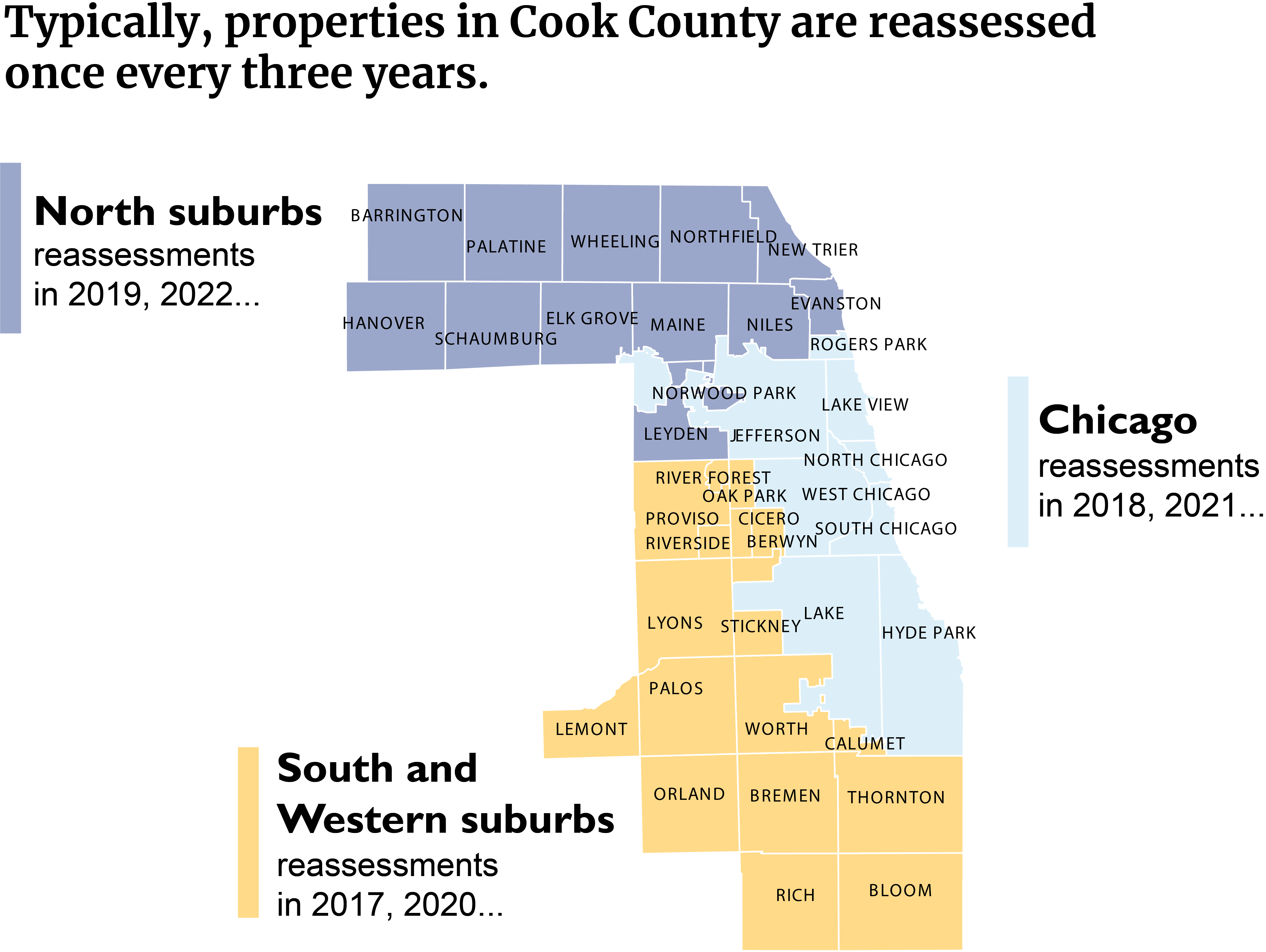

Changes to Assessments and Appeals Due to COVID-19 | Cook County – Source prod.cookcountyassessor.com

Cook County has a long history of property tax increases, fueled by factors such as rising property values and government spending. It’s crucial to dispel myths surrounding the property tax system. For instance, it’s not true that property taxes will always go up, as they can fluctuate based on economic conditions and government policies.

Unveiling the Hidden Secrets of Cook County Property Tax Hike

There are hidden elements within the Cook County property tax system that can affect homeowners. One such element is the assessment process, which determines the taxable value of a property. Homeowners should be aware of the factors that influence assessments and how to challenge inaccurate valuations.

Recommendations for Dealing with Cook County Property Tax Hike

Why Thousands of Cook County Residents Pay Zero in Property Taxes – Source news.wttw.com

To mitigate the impact of the Cook County property tax hike, homeowners can consider various strategies. Exploring property tax exemptions, seeking tax breaks for seniors or veterans, and considering refinancing mortgages with lower interest rates can all help reduce the tax burden.

Cook County Property Taxes: Exploring the Topic in Detail

Cook County property taxes are a complex system with multiple components and nuances. Understanding the assessment process, exemptions, and potential challenges can empower homeowners to navigate the system effectively.

Tips for Managing Cook County Property Tax Increase

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F24435572%2FCarCaravan.jpeg)

Cook County property taxes lead to protests, workshops to homeowners – Source chicago.suntimes.com

Managing the Cook County property tax increase requires careful planning and informed decision-making. Researching available relief programs, budgeting effectively, and considering property tax appeals can help homeowners offset the financial impact.

Cook County Property Taxes: Frequently Asked Questions

How to Protest Your Dallas County Property Taxes – Source jillcarpenterhomes.cbintouch.com

To address common concerns, here are some frequently asked questions about Cook County property taxes:

– How can I challenge my property assessment?

– What exemptions are available to reduce my property taxes?

– How do I apply for a property tax refund?

– Where can I find information about property tax appeals?

Fun Facts about Cook County Property Taxes

Cook County property taxes rise more than 9M for 2022 tax year | WLS – Source www.wlsam.com

Beyond the practical aspects, here are some interesting facts about Cook County property taxes:

– Cook County is one of the highest-taxed counties in the United States.

– Property taxes in Cook County are used to fund essential services such as education, infrastructure, and public safety.

How to Prepare for Cook County Property Tax Hike

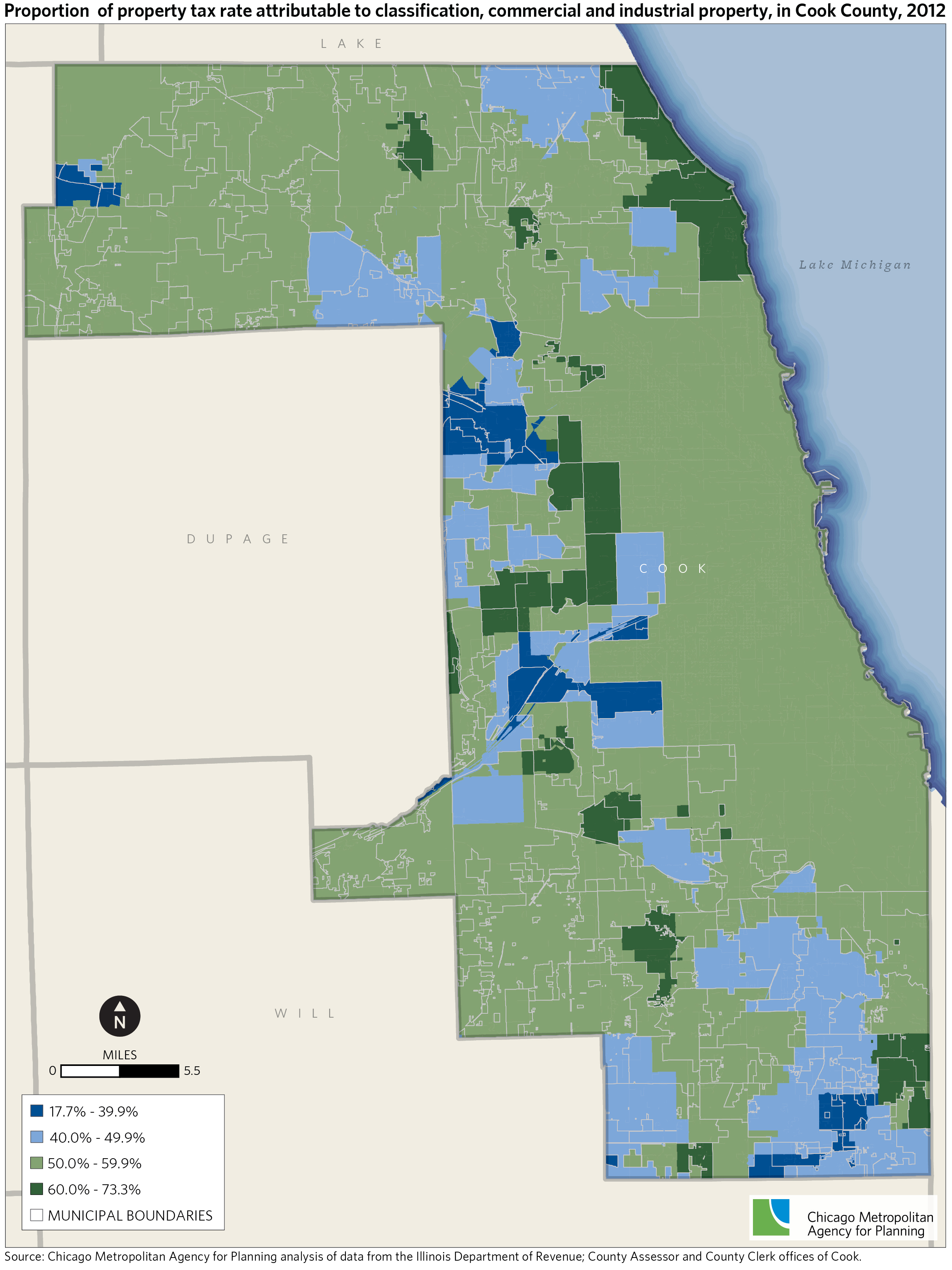

Cook County property tax classification effects on property tax burden – Source www.cmap.illinois.gov

Preparing for the Cook County property tax hike involves taking proactive steps to minimize its impact. Creating a financial plan, exploring tax breaks, and seeking professional advice can help homeowners manage the increased tax burden.

Listicle of Cook County Property Tax Mitigation Strategies

– Apply for property tax exemptions.

– Seek a property tax assessment reduction.

– Refinance your mortgage to a lower interest rate.

– Consider a property tax deferral program.

– Explore payment plans to spread out tax payments.

Conclusion of Cook County Property Taxes Set To Increase Significantly In 2023

Cook County Property Tax Portal | Property tax, Property, Cook county – Source www.pinterest.com

The upcoming property tax hike in Cook County poses a significant challenge for homeowners. By understanding the targets, history, and hidden secrets of the property tax system, homeowners can take proactive measures to mitigate its impact. Exploring various strategies, seeking professional advice, and staying informed about available relief programs can help homeowners navigate the increasing tax burden effectively.