Cook County property taxes are notoriously high, and many homeowners feel that their assessments are unfair. If you’re one of those homeowners, you’re not alone. There are a number of resources available to help you fight for a fair assessment, including the Cook County Property Tax Appeal Champion.

Feeling Overwhelmed by High Property Taxes?

Cook County property taxes are among the highest in the nation. For many homeowners, these taxes represent a significant financial burden. If you’re struggling to pay your property taxes, you’re not alone. There are a number of resources available to help you, including the Cook County Property Tax Appeal Champion.

Cook County Property Tax Appeal Champion: Fighting for Fair Assessments

The Cook County Property Tax Appeal Champion is a non-profit organization that helps homeowners fight for fair property tax assessments. The Champion provides free legal representation to homeowners who are appealing their assessments. The Champion has a team of experienced attorneys who are dedicated to helping homeowners get the relief they deserve.

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F24202004%2Fmerlin_106730316.jpg)

Cook County property tax bills finally posted online after monthslong – Source chicago.suntimes.com

Meet the Cook County Property Tax Appeal Champion

The Cook County Property Tax Appeal Champion is a group of dedicated individuals who are committed to helping homeowners get fair property tax assessments. The Champion is led by a team of experienced attorneys who have a proven track record of success. The Champion has helped thousands of homeowners get their property taxes reduced.

If you’re unhappy with your property tax assessment, the Cook County Property Tax Appeal Champion can help. The Champion provides free legal representation to homeowners who are appealing their assessments. Contact the Champion today to learn more about their services.

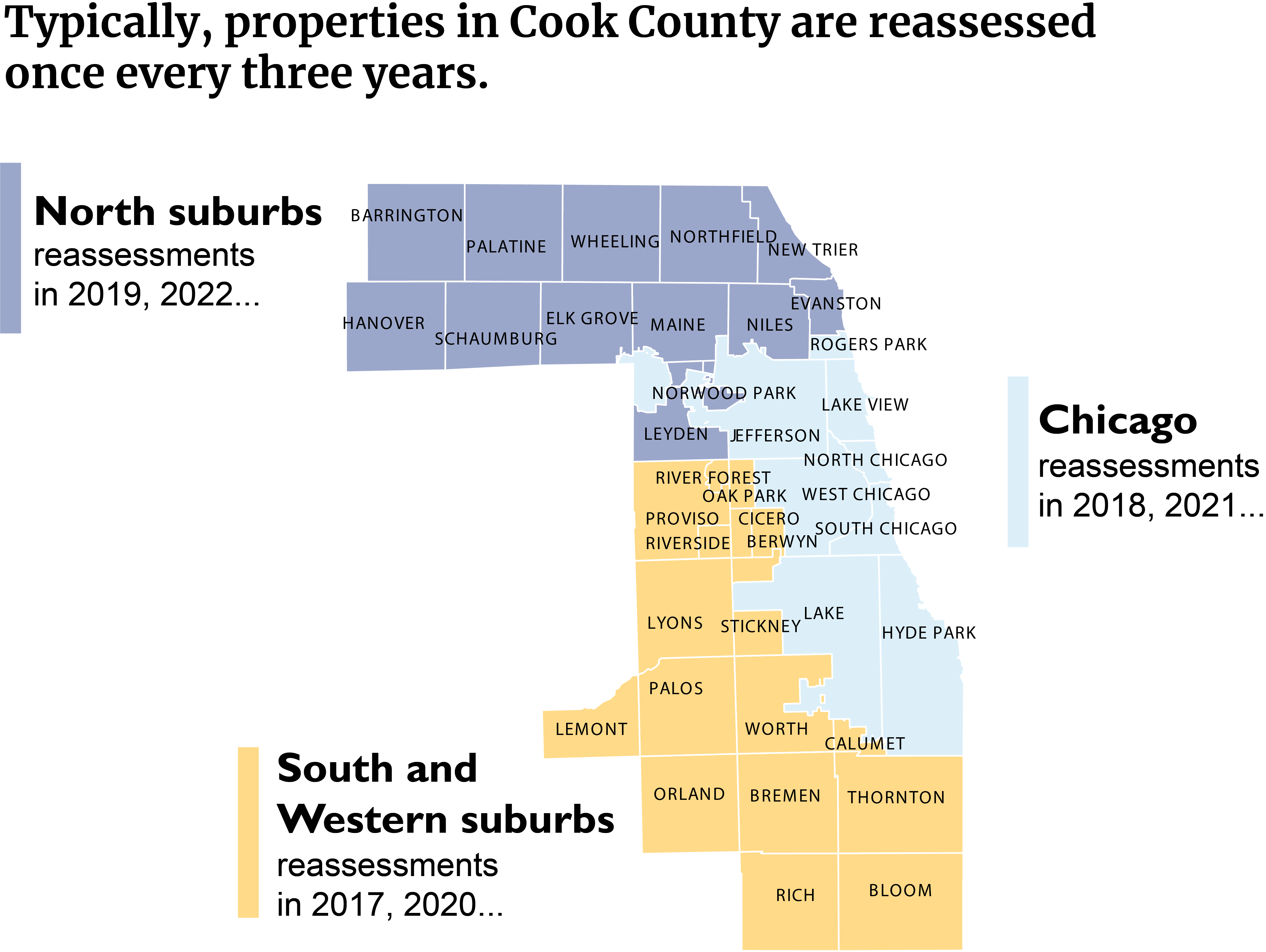

Cook County Tax Appeal: How do I know if my property taxes are going up – Source www.hermosachi.com

The History and Myths of Cook County Property Tax Appeal Champion

The Cook County Property Tax Appeal Champion was founded in 2010 by a group of homeowners who were frustrated with the unfair property tax assessments in Cook County. The Champion has since grown into a statewide organization that has helped thousands of homeowners get their property taxes reduced.

There are a number of myths about the Cook County Property Tax Appeal Champion. One myth is that the Champion only helps wealthy homeowners. This is not true. The Champion helps homeowners of all income levels. Another myth is that the Champion is a government agency. This is also not true. The Champion is a non-profit organization that is funded by donations from individuals and foundations.

Homeowners Exemption Cook County Form 2023 – ExemptForm.com – Source www.exemptform.com

Unveiling the Hidden Secrets of Cook County Property Tax Appeal Champion

The Cook County Property Tax Appeal Champion has a number of secrets that help them get results for their clients. One secret is that the Champion has a team of experienced attorneys who are experts in property tax law. Another secret is that the Champion has a unique database of property tax information that they use to build strong cases for their clients.

If you’re unhappy with your property tax assessment, the Cook County Property Tax Appeal Champion can help. The Champion has a proven track record of success and they can help you get the relief you deserve.

Cook County Property Tax Appeal Time 2019 – AssesorAppeal – Dimitrios P – Source www.assessorappeal.com

Recommendations for Cook County Property Tax Appeal Champion

If you’re unhappy with your property tax assessment, the Cook County Property Tax Appeal Champion can help. The Champion provides free legal representation to homeowners who are appealing their assessments. The Champion has a team of experienced attorneys who are dedicated to helping homeowners get the relief they deserve.

Here are a few tips for working with the Cook County Property Tax Appeal Champion:

- Gather all of your documentation. The Champion will need to see your property tax bill, your mortgage statement, and any other relevant documents.

- Be prepared to discuss your case. The Champion will need to know why you believe your assessment is unfair.

- Be patient. The appeals process can take some time. The Champion will work hard to get you the best possible outcome, but it may take some time.

How Do I Get A Plat Of Survey Cook County – Printable Form, Templates – Source projectopenletter.com

Cook County Property Tax Appeal Champion: A Deeper Dive

The Cook County Property Tax Appeal Champion is a valuable resource for homeowners who are unhappy with their property tax assessments. The Champion provides free legal representation to homeowners who are appealing their assessments. The Champion has a team of experienced attorneys who are dedicated to helping homeowners get the relief they deserve.

If you’re unhappy with your property tax assessment, the Cook County Property Tax Appeal Champion can help. Contact the Champion today to learn more about their services.

Form To Appeal Taxes In Cook County – CountyForms.com – Source www.countyforms.com

Cook County Property Tax Appeal Champion: The Legal Process

The Cook County Property Tax Appeal Champion can help you through the legal process of appealing your property tax assessment. The Champion will represent you at all hearings and will work to get you the best possible outcome.

The appeals process can be complex, but the Champion will guide you through each step. The Champion will work hard to get you the relief you deserve.

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F21990281%2Fmidway_CST_063012_09.jpg)

Cook County property tax revenue rising faster than inflation and wages – Source chicago.suntimes.com

Fun Facts About Cook County Property Tax Appeal Champion

Here are a few fun facts about the Cook County Property Tax Appeal Champion:

- The Champion has been featured in the Chicago Tribune, the Chicago Sun-Times, and other major media outlets.

- The Champion has helped homeowners save millions of dollars in property taxes.

- The Champion is a non-profit organization that is funded by donations from individuals and foundations.

Changes to Assessments and Appeals Due to COVID-19 | Cook County – Source prod.cookcountyassessor.com

How to Contact Cook County Property Tax Appeal Champion

If you’re unhappy with your property tax assessment, you can contact the Cook County Property Tax Appeal Champion by phone at (312) 534-6600 or by email at info@cookcountypropertytaxappealchampion.org.

The Champion is located at 111 W. Washington Street, Suite 1400, Chicago, IL 60602.

Cook County judge kicks Trump off Illinois ballot, but appeal expected – Source www.msn.com

What If Cook County Property Tax Appeal Champion Can’t Help Me?

If the Cook County Property Tax Appeal Champion can’t help you, there are a few other options available to you.

You can try filing an appeal on your own. However, this can be a complex and time-consuming process. You may also want to consider hiring a private attorney to represent you.

How to Protest Your Dallas County Property Taxes – Source jillcarpenterhomes.cbintouch.com

Listicle: 5 Benefits of Cook County Property Tax Appeal Champion

Here are 5 benefits of working with the Cook County Property Tax Appeal Champion:

- The Champion provides free legal representation.

- The Champion has a team of experienced attorneys.

- The Champion has a proven track record of success.

- The Champion is a non-profit organization that is funded by donations from individuals and foundations.

- The Champion is committed to helping homeowners get fair property tax assessments.

Questions and Answers About Cook County Property Tax Appeal Champion

Here are some frequently asked questions about the Cook County Property Tax Appeal Champion:

- Q: What is the Cook County Property Tax Appeal Champion?

- A: The Cook County Property Tax Appeal Champion is a non-profit organization that helps homeowners fight for fair property tax assessments.

- Q: Who is eligible for the Cook County Property Tax Appeal Champion?

- A: All homeowners in Cook County are eligible for the Cook County Property Tax Appeal Champion.

- Q: How much does it cost to use the Cook County Property Tax Appeal Champion?

- A: The Cook County Property Tax Appeal Champion provides free legal representation to homeowners who are appealing their assessments.

- Q: How do I contact the Cook County Property Tax Appeal Champion?

- A: You can contact the Cook County Property Tax Appeal Champion by phone at (312) 534-6600 or by email at info@cookcountypropertytaxappealchampion.org.

Conclusion of Cook County Property Tax Appeal Champion: Fighting For Fair Assessments

The Cook County Property Tax Appeal Champion is a valuable resource for homeowners who are unhappy with their property tax assessments. The Champion provides free legal representation to homeowners who are appealing their assessments. The Champion has a team of experienced attorneys who are dedicated to helping homeowners get the relief they deserve.

If you’re unhappy with your property tax assessment, the Cook County Property Tax Appeal Champion can help. Contact the Champion today to learn more about their services.