Cook County Equalization Factor: A Comprehensive Guide to Everything You Need to Know

What is the Cook County Equalization Factor?

The Cook County Equalization Factor is a multiplier used to adjust the assessed value of properties in Cook County, Illinois. It is intended to ensure that all properties are assessed at a fair and equitable rate.

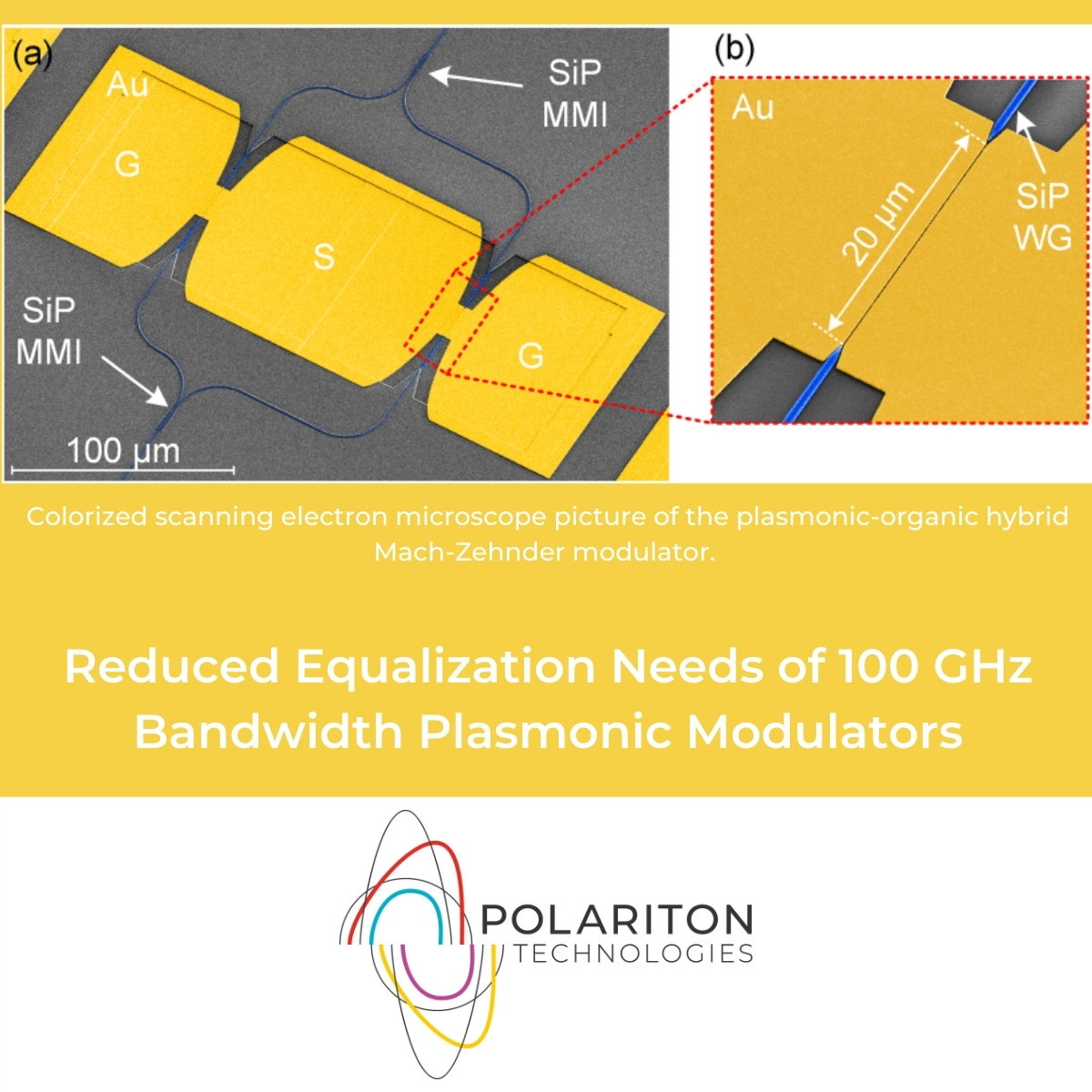

Reduced Equalization Needs of 100 GHz Bandwidth Plasmonic Modulators – Source www.polariton.ch

Why is the Cook County Equalization Factor Important?

The Cook County Equalization Factor is important because it can significantly impact the amount of property taxes that you owe. A higher equalization factor means that your property will be assessed at a higher value, which could lead to higher property taxes.

New members appointed to property value appeals board | The Daily World – Source www.thedailyworld.com

Who Sets the Cook County Equalization Factor?

The Cook County Board of Review sets the Cook County Equalization Factor. The Board of Review is a three-member panel that is appointed by the Cook County Board President.

Equalization – Branch County, Michigan – Source countyofbranch.com

How to Appeal the Cook County Equalization Factor

If you believe that your property has been assessed at an unfair value, you can appeal the Cook County Equalization Factor. To appeal, you must file a petition with the Cook County Board of Review. The petition must be filed within 30 days of the date that you received your property tax bill.

Figure 1 from The lens condition for factor price equalization – Source www.semanticscholar.org

Cook County Equalization Factor

The Cook County Equalization Factor can be a complex and confusing topic. However, it is important to understand how the equalization factor works, as it can significantly impact your property taxes. If you have any questions about the Cook County Equalization Factor, you can contact the Cook County Assessor’s Office for more information.

History of the Cook County Equalization Factor

The Cook County Equalization Factor was first established in 1945. The factor was created in an effort to address the problem of unequal property assessments in Cook County. The equalization factor has been revised several times over the years, and the current factor is 3.0000.

Myths about the Cook County Equalization Factor

There are several myths about the Cook County Equalization Factor. One common myth is that the equalization factor is used to raise property taxes. However, this is not true. The equalization factor is only used to adjust the assessed value of properties. The amount of property taxes that you owe is determined by the tax rate that is set by your local taxing district.

Cook County Equalization Factor 2024 – Kathi Simone – Source melessawarlena.pages.dev

Hidden Secrets of the Cook County Equalization Factor

There are a few hidden secrets about the Cook County Equalization Factor that you should know. One secret is that the equalization factor is not applied to all properties in Cook County. The equalization factor only applies to properties that are located in unincorporated areas of Cook County. This means that if you live in a city or village in Cook County, the equalization factor will not affect your property taxes.

Cook County commissioners urge passage of Residential Tenant Landlord – Source suburbanchicagoland.com

Recommendations for the Cook County Equalization Factor

If you are a homeowner in Cook County, there are a few things that you can do to reduce the impact of the Cook County Equalization Factor on your property taxes. First, you should make sure that your property is assessed at a fair and equitable value. You can do this by contacting the Cook County Assessor’s Office and requesting a review of your property’s assessment.

Cook County Board of Commissioner’s meeting – Source www.boreal.org

Cook County Equalization Factor and Property Taxes

The Cook County Equalization Factor can have a significant impact on your property taxes. A higher equalization factor means that your property will be assessed at a higher value, which could lead to higher property taxes. If you are concerned about the impact of the equalization factor on your property taxes, you should contact the Cook County Assessor’s Office for more information.

Factor price equalization – It also ignores barriers and transportation – Source www.studocu.com

Tips for Appealing the Cook County Equalization Factor

If you believe that your property has been assessed at an unfair value, you can appeal the Cook County Equalization Factor. To appeal, you must file a petition with the Cook County Board of Review. The petition must be filed within 30 days of the date that you received your property tax bill.

Equalization | Berrien County, MI – Source www.berriencounty.org

Fun Facts about the Cook County Equalization Factor

Did you know that the Cook County Equalization Factor is one of the highest in the country? In fact, it is the highest equalization factor in Illinois. This means that properties in Cook County are assessed at a higher value than properties in other counties in Illinois.

Cook County Unconditional Waiver and Release of Mechanic Lien Form – Source www.deeds.com

How to Calculate the Cook County Equalization Factor

The Cook County Equalization Factor is calculated by dividing the total assessed value of all properties in Cook County by the total market value of all properties in Cook County. The resulting number is the equalization factor.

What if the Cook County Equalization Factor is Too High?

If you believe that the Cook County Equalization Factor is too high, you can contact your local taxing district and ask them to lower the tax rate. You can also contact the Cook County Assessor’s Office and request a review of your property’s assessment.

Listicle of Cook County Equalization Factor

Here is a listicle of important things to know about the Cook County Equalization Factor:

- The Cook County Equalization Factor is a multiplier used to adjust the assessed value of properties in Cook County, Illinois.

- The equalization factor is set by the Cook County Board of Review.

- The equalization factor can significantly impact the amount of property taxes that you owe.

- You can appeal the equalization factor if you believe that your property has been assessed at an unfair value.

Questions and Answers about the Cook County Equalization Factor

Here are some frequently asked questions about the Cook County Equalization Factor:

- What is the Cook County Equalization Factor?

- The Cook County Equalization Factor is a multiplier used to adjust the assessed value of properties in Cook County, Illinois.

- Who sets the Cook County Equalization Factor?

- The Cook County Board of Review sets the Cook County Equalization Factor.

- How can I appeal the Cook County Equalization Factor?

- To appeal the Cook County Equalization Factor, you must file a petition with the Cook County Board of Review within 30 days of the date that you received your property tax bill.

- What is the impact of the Cook County Equalization Factor on my property taxes?

- The Cook County Equalization Factor can significantly impact the amount of property taxes that you owe. A higher equalization factor means that your property will be assessed at a higher value, which could lead to higher property taxes.

Conclusion of Cook County Equalization Factor

The Cook County Equalization Factor is a complex and confusing topic. However, it is important to understand how the equalization factor works, as it can significantly impact your property taxes. If you have any questions about the Cook County Equalization Factor, you can contact the Cook County Assessor’s Office for more information.