Are you a homeowner in Cook County? If so, you’ll need to be aware of the Cook County Property Tax Rates for 2023. These rates are set by the Cook County Assessor’s Office and can vary depending on the property’s location, type, and value.

Homeowners Exemption Cook County Form 2023 – ExemptForm.com – Source www.exemptform.com

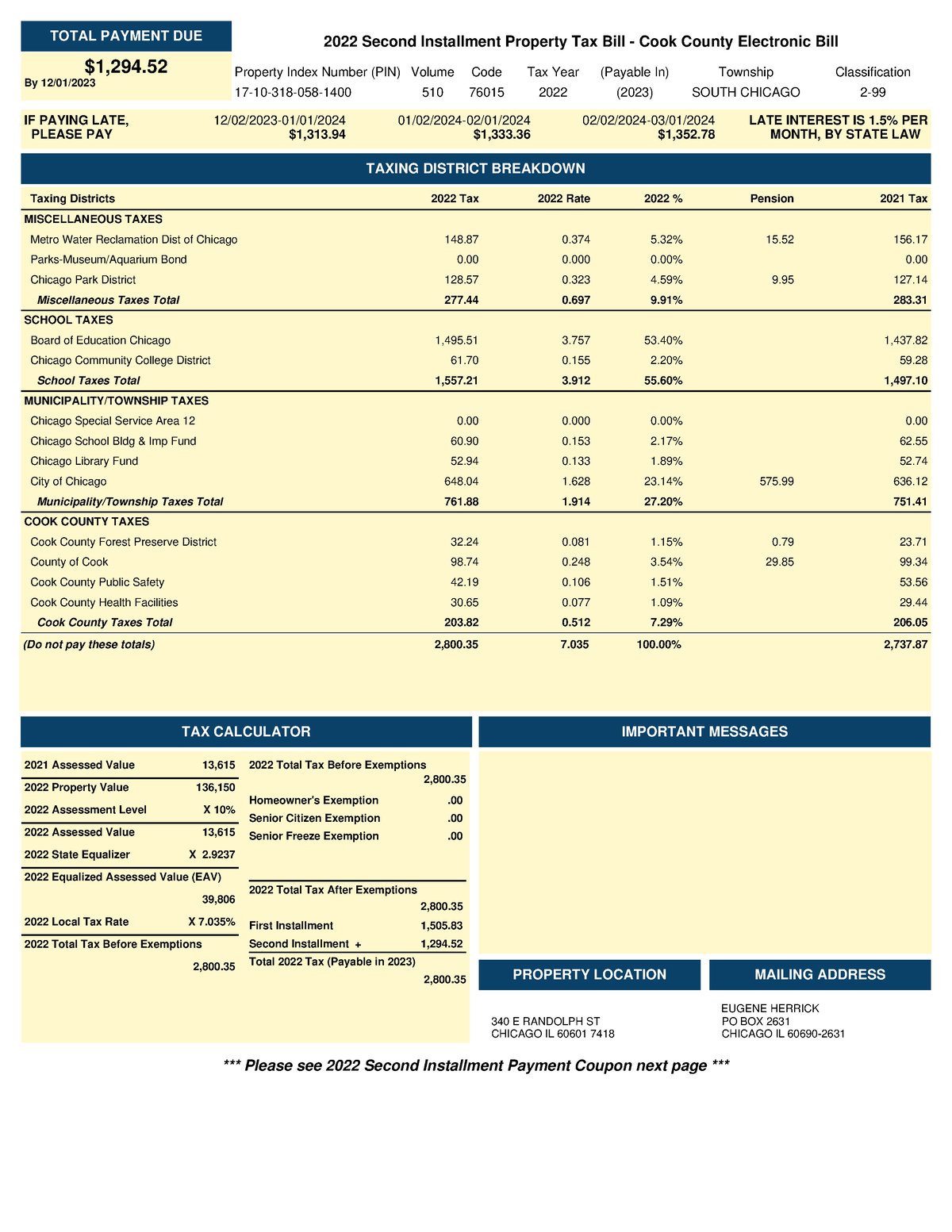

Understanding Your Property Tax Bill

Your property tax bill is made up of several different components. The largest component is the property tax rate. This rate is multiplied by the assessed value of your property to calculate your property tax bill. Other components of your property tax bill may include special assessments, late fees, and interest charges.

Cook County Property Tax Bill 2022Second Installment – IF PAYING LATE – Source www.studocu.com

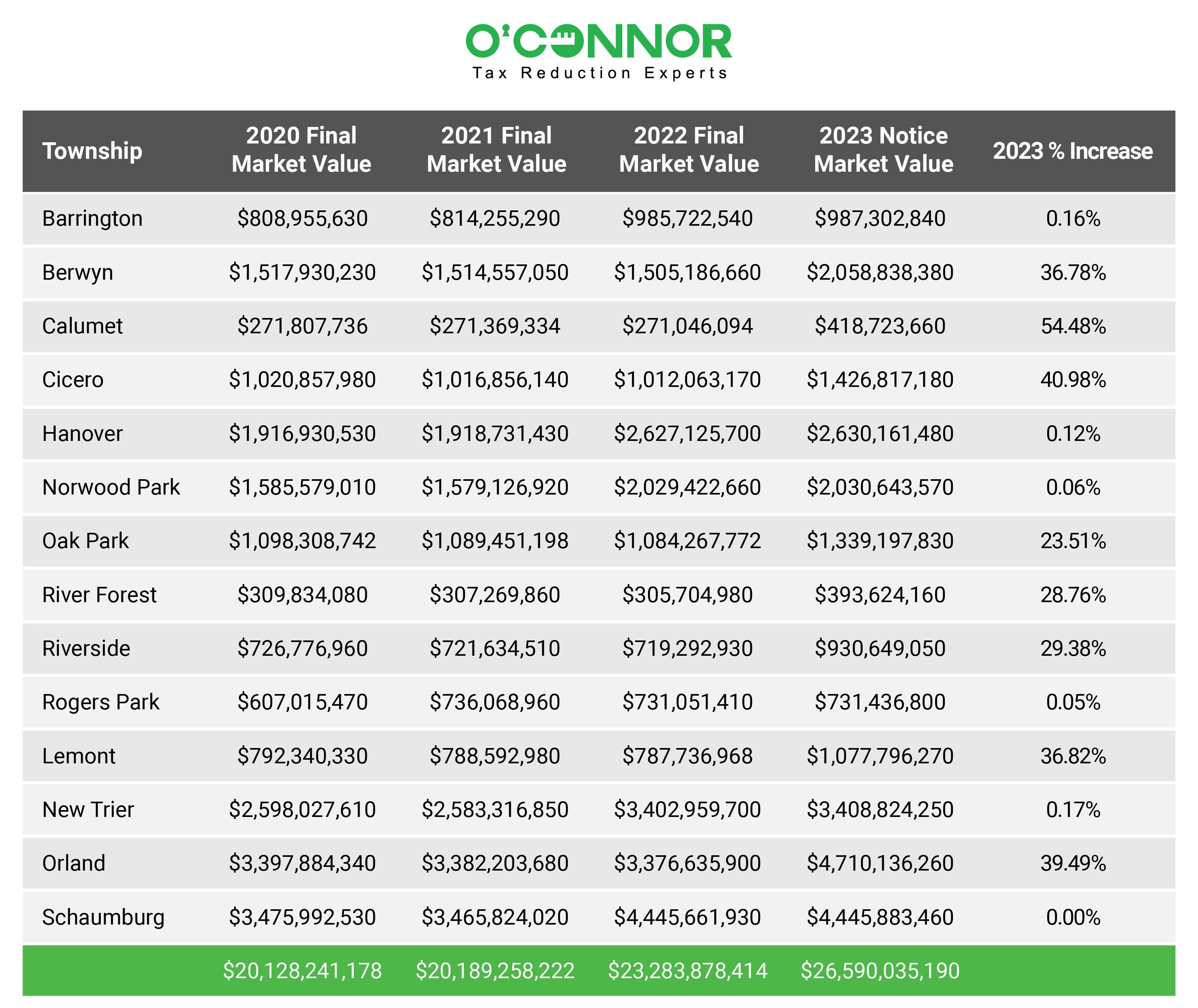

New Rates for 2023

The Cook County Assessor’s Office has released the new property tax rates for 2023. The rates are slightly higher than the rates for 2022. This increase is due to the rising cost of living in Cook County.

Cook County Property Tax Assessment – Source www.cutmytaxes.com

Summary

The Cook County Property Tax Rates for 2023 are now available. The rates are slightly higher than the rates for 2022. This increase is due to the rising cost of living in Cook County. If you have any questions about your property tax bill, you can contact the Cook County Assessor’s Office.

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F21990281%2Fmidway_CST_063012_09.jpg)

Cook County property tax revenue rising faster than inflation and wages – Source chicago.suntimes.com

Personal Experience

I’ve been a homeowner in Cook County for over 10 years. I’ve seen the property tax rates increase every year. This year’s increase is the largest I’ve seen. I’m not sure how I’m going to afford my property taxes this year.

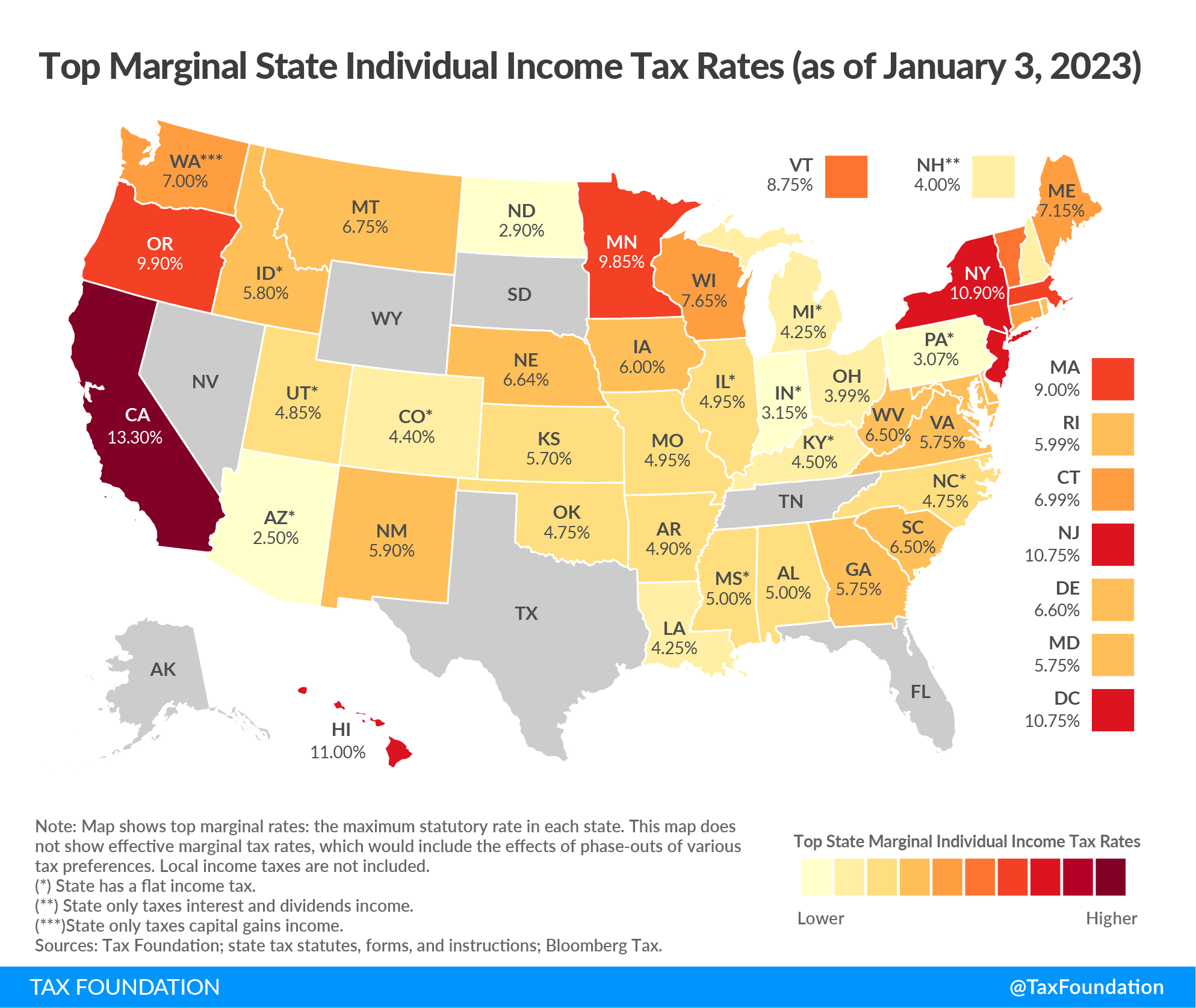

How High Are Property Taxes in Your State? | Tax Foundation – Source taxfoundation.org

I’m not alone in my frustration. Many homeowners in Cook County are struggling to afford their property taxes. The rising cost of living is making it difficult for many people to stay in their homes.

Changes to Assessments and Appeals Due to COVID-19 | Cook County – Source prod.cookcountyassessor.com

History and Myths

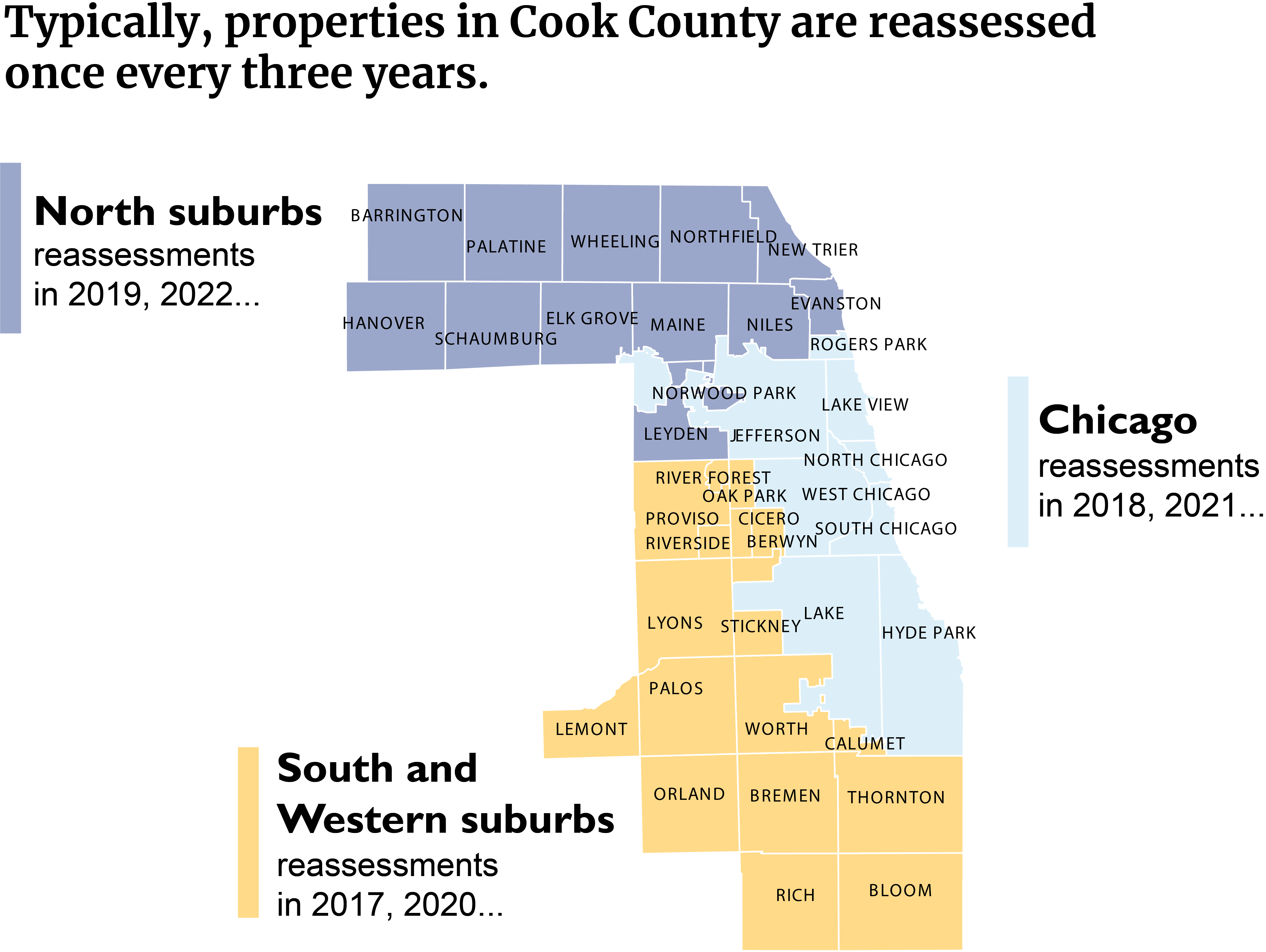

The Cook County property tax system is a complex one. There are many myths and misconceptions about how the system works. One common myth is that the property tax rate is the same for all properties in Cook County. This is not true. The property tax rate can vary depending on the property’s location, type, and value.

Missouri State Income Tax Rate 2024 – Corina Karole – Source corlyqodilia.pages.dev

Another common myth is that the property tax rate is set by the government. This is also not true. The property tax rate is set by the Cook County Assessor’s Office. The Assessor’s Office is an independent body that is not controlled by the government.

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F24202004%2Fmerlin_106730316.jpg)

Cook County property tax bills finally posted online after monthslong – Source chicago.suntimes.com

Hidden Secrets

There are a few hidden secrets about the Cook County property tax system that can help you save money on your property taxes. One secret is that you can appeal your property’s assessed value. If you believe that your property is assessed at too high of a value, you can file an appeal with the Assessor’s Office.

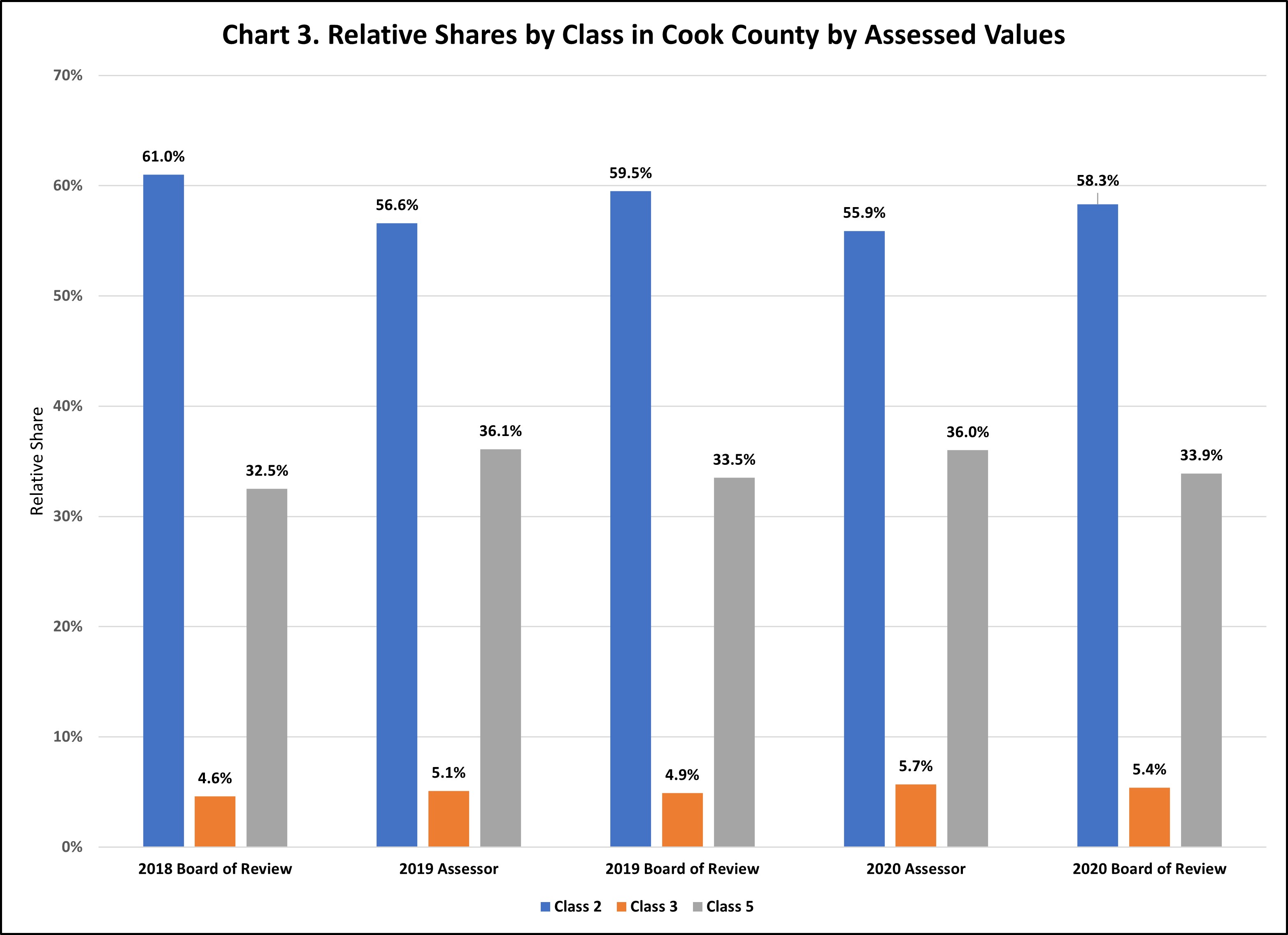

Taxpayers’ Federation of Illinois | Cook County Property Taxation: The – Source www.illinoistax.org

Another secret is that you can get a property tax exemption. There are a number of property tax exemptions available, including exemptions for senior citizens, disabled veterans, and low-income homeowners. If you qualify for an exemption, you can save a significant amount of money on your property taxes.

Cook County Tax Appeal: How do I know if my property taxes are going up – Source www.hermosachi.com

Recommendations

If you’re struggling to afford your property taxes, there are a few things you can do. First, you should contact the Cook County Assessor’s Office to see if you qualify for any exemptions. You can also appeal your property’s assessed value if you believe that it is too high.

If you’re still struggling to afford your property taxes, you may want to consider refinancing your mortgage. Refinancing can lower your interest rate and monthly payments, which can free up some money in your budget to pay for property taxes.

In-Depth Explanation

The Cook County property tax system is a complex one. There are many factors that can affect your property tax bill. These factors include the property’s location, type, value, and exemptions. If you have any questions about your property tax bill, you can contact the Cook County Assessor’s Office.

The Assessor’s Office can provide you with information about your property’s assessed value, exemptions, and payment options. You can also file an appeal with the Assessor’s Office if you believe that your property is assessed at too high of a value.

Tips

Here are a few tips to help you save money on your Cook County property taxes:

- Appeal your property’s assessed value if you believe that it is too high.

- Apply for any exemptions that you may qualify for.

- Refinance your mortgage to lower your interest rate and monthly payments.

- Make extra payments on your property taxes throughout the year.

- Contact the Cook County Assessor’s Office if you have any questions about your property tax bill.

Fun Facts

Here are a few fun facts about the Cook County property tax system:

- The Cook County property tax system is one of the most complex in the United States.

- The average property tax bill in Cook County is over $5,000.

- The Cook County Assessor’s Office is responsible for assessing over 1.8 million properties.

- The Cook County property tax system is constantly changing.

How To

If you’re not sure how to pay your Cook County property taxes, here are a few steps you can follow:

- Gather your property tax bill.

- Choose a payment method.

- Make your payment.

- Keep a record of your payment.

What If

What if you can’t afford to pay your Cook County property taxes? If you’re struggling to afford your property taxes, there are a few things you can do:

- Contact the Cook County Assessor’s Office to see if you qualify for any exemptions.

- Apply for a property tax deferral.

- Refinance your mortgage to lower your interest rate and monthly payments.

- Sell your property.

Listicle

Here is a listicle of the top 10 ways to save money on your Cook County property taxes:

- Appeal your property’s assessed value.

- Apply for any exemptions that you may qualify for.

- Refinance your mortgage to lower your interest rate and monthly payments.

- Make extra payments on your property taxes throughout the year.

- Contact the Cook County Assessor’s Office if you have any questions about your property tax bill.

- Get a property tax loan.

- Sell your property and buy a smaller one.

- Rent out a room in your house.

- Start a business in your home.

- Get a roommate.

Question and Answer

Here are a few questions and answers about the Cook County property tax system:

- What is the property tax rate in Cook County? The property tax rate in Cook County varies depending on the property’s location, type, and value. The average property tax rate in Cook County is over $5,000.

- When are property taxes due in Cook County? Property taxes in Cook County are due in two installments. The first installment is due on March 1st and the second installment is due on September 1st.

- How can I appeal my property’s assessed value? You can appeal your property’s assessed value by filing an appeal with the Cook County Assessor’s Office. The deadline to file an appeal is April 1st.

- What are some exemptions that I may qualify for? There are a number of exemptions available to Cook County homeowners, including exemptions for senior citizens, disabled veterans, and low-income homeowners.

Conclusion of Cook County Property Tax Rates For 2023

The Cook County property tax system is a complex one. There are many factors that can affect your property tax bill. These factors include the property’s location, type, value, and exemptions. If you have any questions about your property tax bill, you can contact the Cook County Assessor’s Office.

The Assessor’s Office can provide you with information about your property’s assessed value, exemptions, and payment options. You can also file an appeal with the Assessor’s Office if you believe that your property is assessed at too high of a value.

If you’re struggling to afford your property taxes, there are a few things you can do. First, you should contact the Cook