Cook County homeowners, brace yourselves! The dreaded property tax bill is on its way, and you need to be prepared. Late payments can lead to hefty penalties and even foreclosure, so it’s crucial to understand when your bill is due and how to pay it.

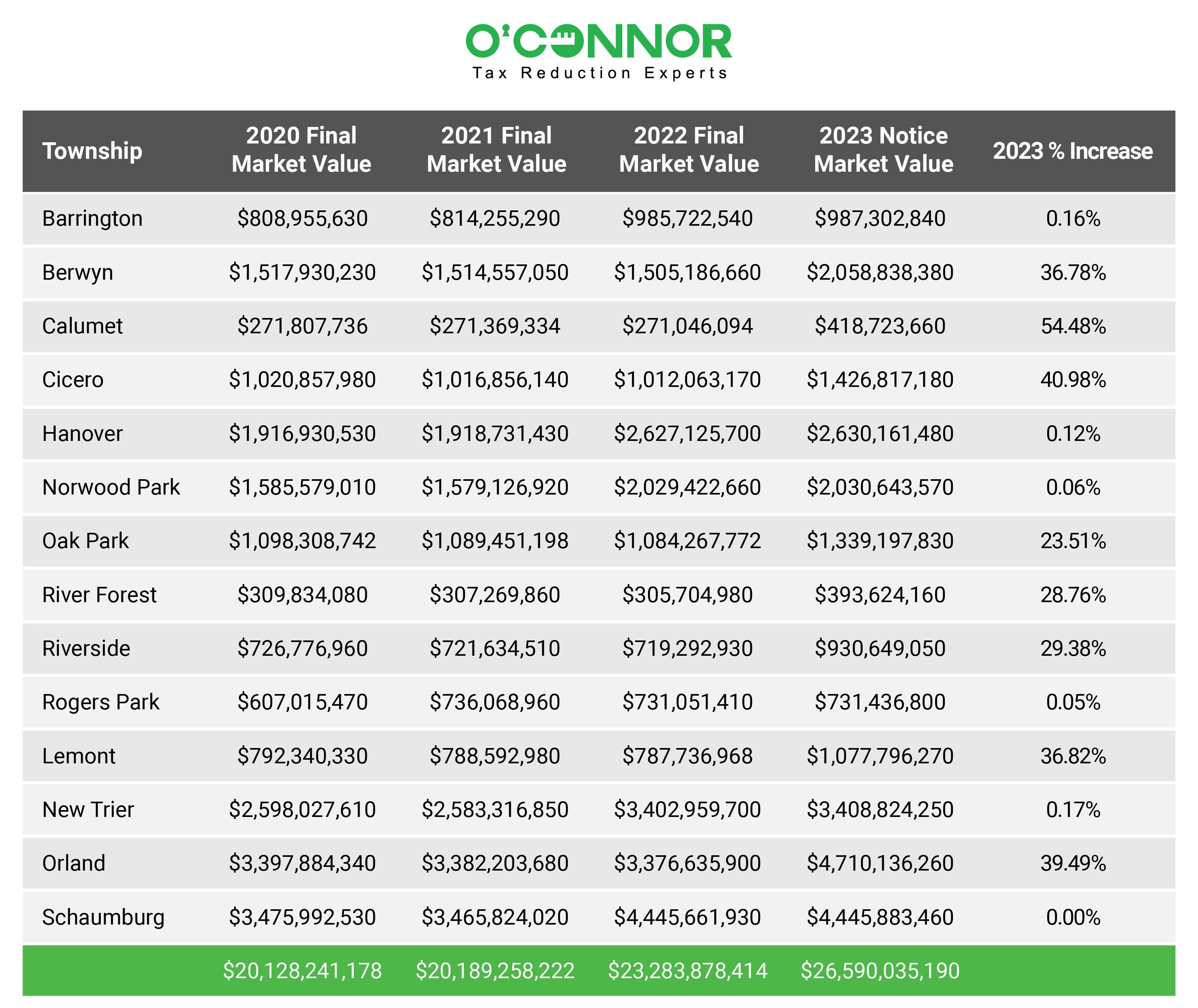

Cook County Tax Appeal: How do I know if my property taxes are going up – Source www.hermosachi.com

Missing a property tax payment can result in a big financial headache. You may incur late fees, penalties, and even have your property sold in a tax sale. To avoid these consequences, it’s essential to know the due dates for your county’s property taxes.

Top 14 la county property tax payment inquiry 2022 – Source cumeu.com

Cook County Property Tax Bill Due Dates

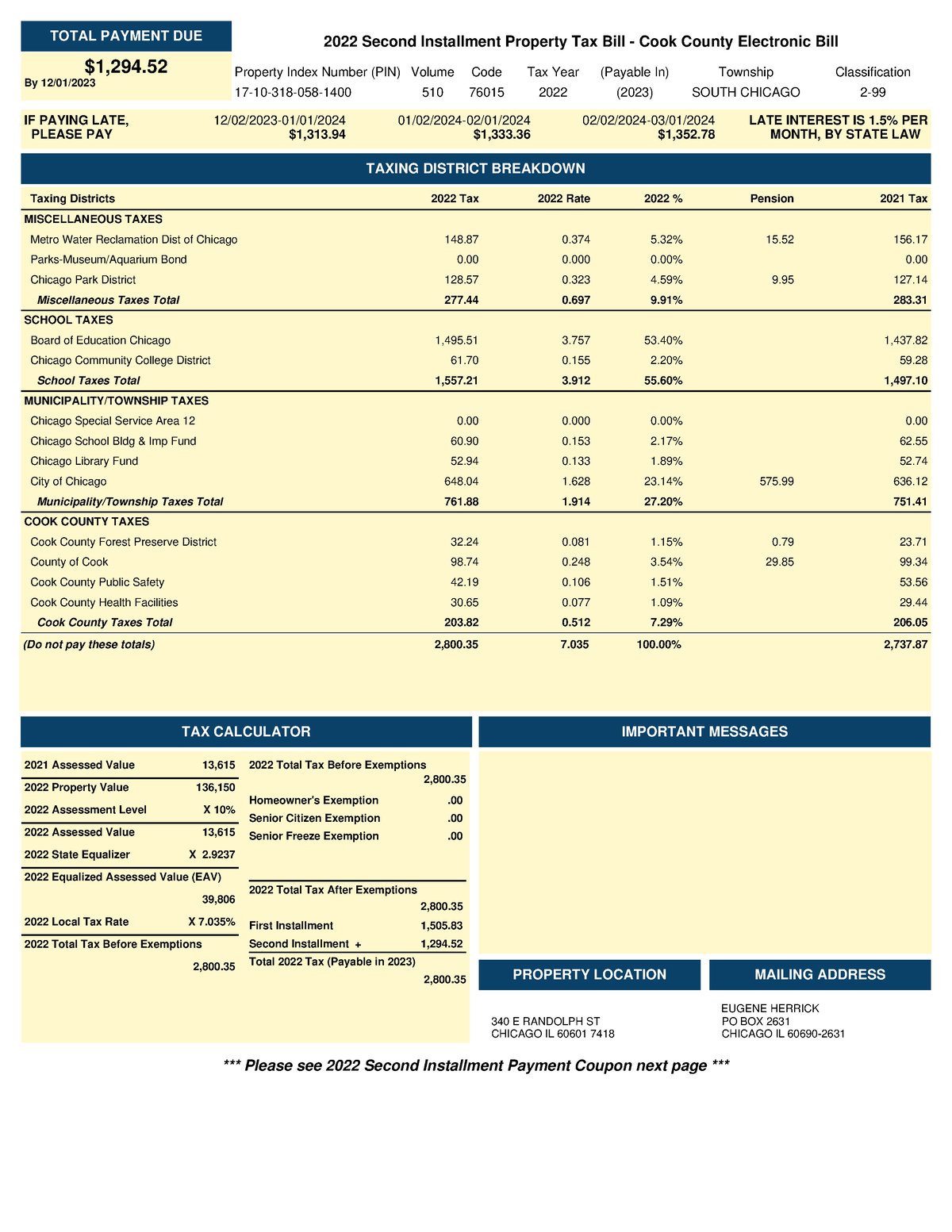

Cook County property tax bills are mailed out in mid-May and are due in two installments. The first installment is due on June 1, and the second installment is due on September 1. If you fail to pay your bill by the due date, you will incur late penalties.

Cook County Property Tax Assessment – Source www.cutmytaxes.com

Personal Experience with Cook County Property Tax Bills

I’ve been a homeowner in Cook County for over ten years, and I’ve learned the hard way that property taxes are not something to be ignored. A few years ago, I missed the June 1st deadline and ended up paying hundreds of dollars in late fees. Since then, I’ve made it a priority to pay my property taxes on time. And remember, if you are struggling to pay your property taxes, the Cook County Treasurer’s Office offers various assistance programs.

Cook County Property Tax Bill 2022Second Installment – IF PAYING LATE – Source www.studocu.com

History and Myths of Cook County Property Taxes

The history of property taxes in Cook County is a long and winding one. The first property taxes were levied in the early 19th century when Chicago was a small frontier town. As the city grew, so did its need for revenue, and property taxes became an increasingly important source of income.

Homeowners Exemption Cook County Form 2023 – ExemptForm.com – Source www.exemptform.com

Hidden Secrets of Cook County Property Tax Bills

There are a few things you should know about Cook County property tax bills that aren’t always obvious. First, your property taxes are based on the assessed value of your home, not its market value. This means that your taxes could go up even if the value of your home doesn’t. Second, you can appeal your property tax assessment if you believe it is incorrect.

March Property Taxes are due by March 31, 2023 – Poweshiek County, Iowa – Source poweshiekcounty.org

Recommendations for Cook County Property Tax Bills

If you’re a Cook County homeowner, here are a few recommendations to help you manage your property tax bill:

Get Cook County Property Tax Appeals Help Tickets – Powered by Ticket – Source www.ticketfalcon.com

- Pay your property taxes on time to avoid late penalties.

- If you can’t pay your property taxes in full, contact the Cook County Treasurer’s Office to discuss payment options.

- Appeal your property tax assessment if you believe it is incorrect.

- Take advantage of property tax exemptions and deductions that you may be eligible for.

Cook County Property Tax Assessment

Your property’s assessed value is determined by the Cook County Assessor’s Office. The assessor’s office uses a variety of factors to determine your property’s value, including its size, location, and amenities. If you believe your property’s assessed value is incorrect, you can appeal it with the Board of Review.

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F24202004%2Fmerlin_106730316.jpg)

Cook County property tax bills finally posted online after monthslong – Source chicago.suntimes.com

Tips for Paying Cook County Property Taxes

Here are a few tips to help you pay your Cook County property taxes:

Form To Appeal Taxes In Cook County – CountyForms.com – Source www.countyforms.com

- Pay online or by mail. You can pay your property taxes online at the Cook County Treasurer’s Office website or by mail.

- Set up automatic payments. You can set up automatic payments so that your property taxes are paid on time each year.

- Get a property tax loan. If you’re struggling to pay your property taxes, you may be able to get a property tax loan.

- Contact the Cook County Treasurer’s Office. If you have any questions about your property tax bill or payment options, contact the Cook County Treasurer’s Office.

Cook County Property Tax Exemptions

Cook County offers a variety of property tax exemptions for homeowners, including exemptions for senior citizens, veterans, and disabled persons. To qualify for an exemption, you must meet certain eligibility requirements. If you believe you qualify for an exemption, contact the Cook County Assessor’s Office.

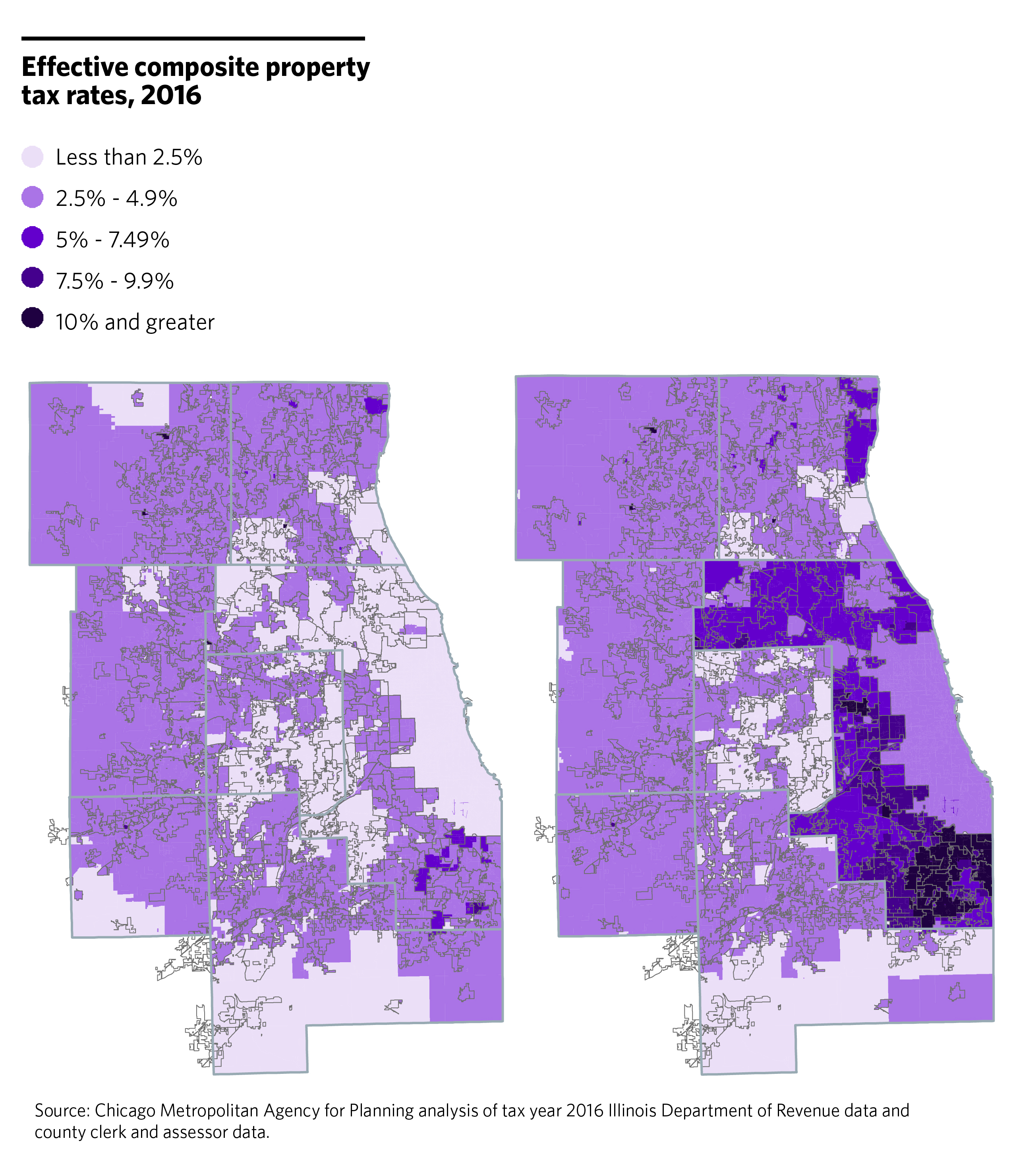

Property Tax Classification – CMAP – Source www.cmap.illinois.gov

Fun Facts About Cook County Property Taxes

Here are a few fun facts about Cook County property taxes:

- Cook County has the highest property taxes in Illinois.

- The average property tax bill in Cook County is over $5,000.

- Property taxes are used to fund a variety of local services, including schools, parks, and libraries.

How to Cook County Property Tax Bill Due Dates

To pay your Cook County property taxes, you can either pay online or by mail. To pay online, visit the Cook County Treasurer’s Office website and click on the “Pay Property Taxes” link. You will need your property tax bill number and your bank account information. To pay by mail, send a check or money order to the address on your property tax bill.

What if Cook County Property Tax Bill Due Dates

If you fail to pay your Cook County property taxes by the due date, you will incur late penalties. The late penalty is 1.5% per month, up to a maximum of 18%. Additionally, your property may be sold in a tax sale if you fail to pay your property taxes for two or more years.

Listicle of Cook County Property Tax Bill Due Dates

Here is a listicle of important dates related to Cook County property taxes:

- May 15: Property tax bills are mailed out.

- June 1: First installment of property taxes is due.

- September 1: Second installment of property taxes is due.

- October 1: Late penalties begin to accrue for unpaid property taxes.

Question and Answer

Here are some frequently asked questions about Cook County property tax bill due dates:

- When are Cook County property tax bills due?

Cook County property tax bills are due in two installments, on June 1 and September 1. - What happens if I miss the property tax due date?

If you miss the property tax due date, you will incur late penalties. The late penalty is 1.5% per month, up to a maximum of 18%. - Can I appeal my property tax assessment?

Yes, you can appeal your property tax assessment if you believe it is incorrect. You must file an appeal with the Board of Review. - How can I get help paying my property taxes?

If you are struggling to pay your property taxes, you can contact the Cook County Treasurer’s Office to discuss payment options.

Conclusion of Cook County Property Tax Bill Due Dates

Cook County property tax bills are a major expense for homeowners, but there are several things you can do to manage your bill and avoid penalties. By understanding the due dates, payment options, and exemptions that are available, you can ensure that your property taxes are paid on time and in full.